Czech Interest Rates Set To Remain Stable, While Upward Risks Build

Czech consumer price growth was confirmed at 2.5% year-on-year in August and 0.1% month-on-month. The monthly CPI gain was mainly driven by price increases in the recreation and culture section due to a 3.9% MoM gain in seasonal prices for packaged holiday services. Prices were higher in the food section, mainly for meat, milk products, and oils, reflecting the continued price gains in the livestock segment of agricultural production. In contrast, prices declined in the transport section, driven by lower oil prices and a stronger koruna against the dollar. Prices of goods fell by 0.2% overall, while prices of services rose by 0.5%. Imputed rents added 0.6% MoM in August, up from a 0.4% increase previously.

In annual terms, food prices continued to have the largest inflationary impact in August. That said, some food items recorded a significant price decline of around 20% compared to last year, such as sugar, olive oil, and potatoes. In contrast, prices of items related to animal production experienced substantial annual gains in double-digit terms, such as for meat, milk products, eggs, and butter. We see the latter as more persistent, while the former is prone to increases once the immediate harvest effect fades out. Price gains in the housing section also contributed significantly to overall inflation, with imputed rents maintaining the annual pace of 4.9% for a third consecutive month. Dynamics in market rents picked up marginally to 5.7% YoY. Meanwhile, electricity prices shed 4.1% YoY, natural gas prices declined by 8.0% YoY, and fuel prices fell by 7.6% annually. Prices of goods rose by 1.1% in aggregate, and prices of services gained 4.7% YoY. Core inflation quickened to 2.8% annually in August, which is an upbeat pace yet in line with expectations from the Czech National Bank.

Wage-price spiral and ETS2 represent risksOverall, we bring to attention the continued monthly gains in imputed rents, despite the annual dynamics having stabilised over recent months. Given that the (expected) slowdown in annual food price dynamics over August and September is driven predominantly by volatile items associated with plant production, which is affected by the ongoing harvest, we see food prices gaining strength over the final quarter of the year. Also, the downward pressure on the overall price level from the sharp drop in fuel prices is expected to gradually diminish over the coming months. We see both headline and core inflation somewhat picking up toward the end of the year.

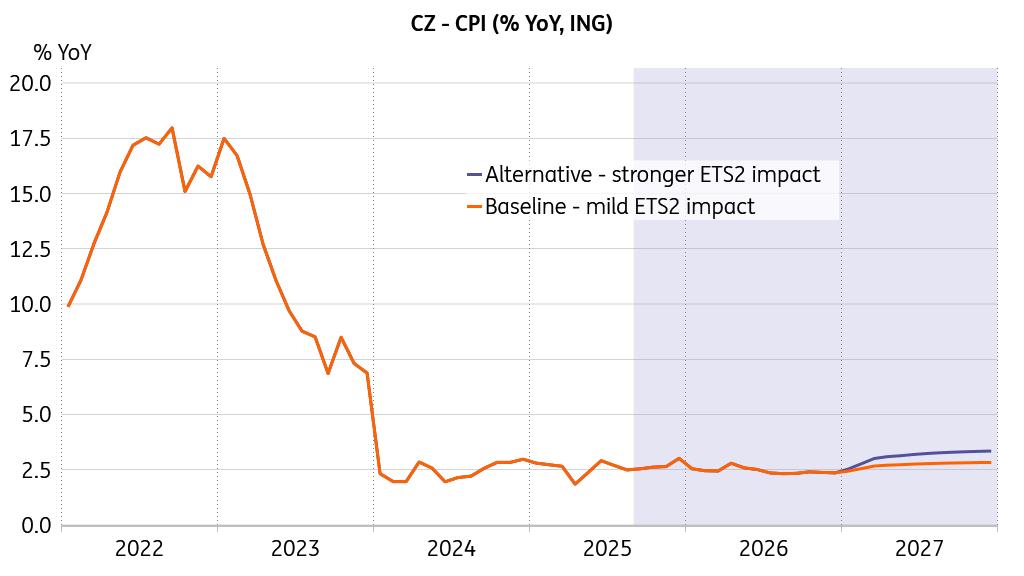

ETS2 will likely affect 2027 inflation

Source: CZSO, ING, Macrobond

Looking ahead, we have incorporated the anticipated impact of the EU Emissions Trading System Phase 2 - set to launch in 2027 - into our baseline forecast. Our best guess, based on the price of allowances reaching the limit level of EUR 57/t CO2 in 2027, is a 0.8ppt impact on headline inflation in the same year, including some unspecified mitigating measures taken by the government. This outcome is captured in our ETS2 alternative scenario. However, we plug in only half of this impact to our baseline inflation scenario for now, given the thick fog of uncertainty surrounding the whole ETS2 implementation.

Although seemingly distant, we believe that the effect will shape thinking about the monetary policy stance already, as the period has already entered the monetary policy horizon. Plug in more upbeat wage growth and a likely re-tightening of the labour market over the coming year, unshattered price growth of services already over an extended period of time shaping inflation expectations, and you may start to consider the classical feedback loop of inflation expectations – wage demands – consumer inflation. We are not there yet, but I see the likelihood of such a chain of events as rising.

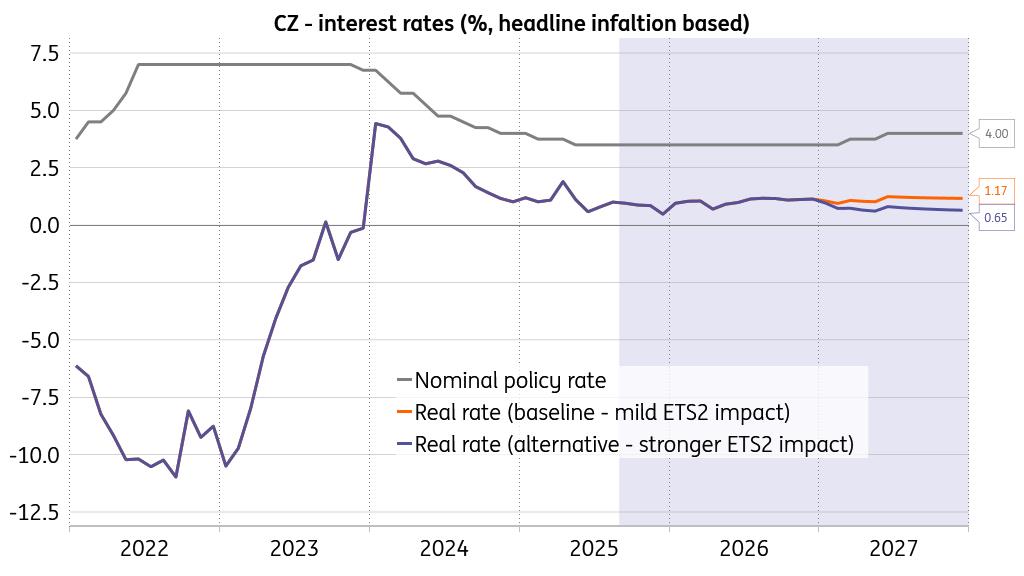

Positive real interest rates are to be safeguardedFrom the policymaker's view, the current monetary policy setup seems to be assessed as only marginally restrictive. Indeed, taking certain perspectives, such as accelerating credit, record high new mortgage levels, the housing market and construction boom, and unshattered price dynamics in the service sector, you might even think that the effects of the monetary policy restrictiveness are no longer tangible in the economy. Well, of course, the inflation in various economic segments would likely be higher with more relaxed monetary policy, so stopping with the cutting cycle at 3.5% base rate is a welcome approach. Nevertheless, the current setup does not seem to generate much of a restriction any longer, nota bene when looking ahead.

Moderate restrictiveness may not be sufficient to break upbeat service price growth

Source: CNB, ING, Macrobond

In a way, just like that, everyone adapted to the presence of positive real interest rates, as the economy moved into genuine expansion territory. We reiterate our hypothesis of growth that is beneficial to future structural adjustments of the economy, fostering a more efficient modus operandi and feeding the productive sectors and investment, i.e., in a universe where real interest rates are positive. Every single thought about a future investment endeavour has simply to pass the gate of a positive real-rate alternative. We believe that in such a setup, the current cyclical rebound of the Czech economy will evolve into a structurally underpinned expansion that lasts longer and stands on stronger foundations. Should the real interest rate flirt with the zero bound or slip back into negative territory, then - when it comes to the vital pursuit of structural reforms - this would signal one thing only: barbarians at the gate.

A strong koruna reflects the growth outperformance vis-à-vis the eurozone, while the dollar has been depreciating against a basket of currencies. The appreciated domestic currency makes all imports cheaper, which is particularly tangible in the subdued annual price dynamics of goods, where tradables hold the lion's share. This helps to keep headline inflation within the tolerance band. However, there is no free lunch, and we believe that the pronounced disinflationary process observed in the goods segment comes at the cost of upbeat pressure on services prices. Households are left with more resources to spend on services, as the bill for goods has become less burdensome on their budgets. Should the situation carry on, it might be a gargantuan task to break the elevated price dynamics in the service sector, indeed. Maintaining a securely positive real interest rate will be a strong ally in the struggle.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Buy Now Pay Later Market Size To Surpass USD 145.5 Billion By 2033 CAGR Of 22.23%

- BTCC Summer Festival 2025 Unites Japan's Web3 Community

- GCL Subsidiary, 2Game Digital, Partners With Kucoin Pay To Accept Secure Crypto Payments In Real Time

- Smart Indoor Gardens Market Growth: Size, Trends, And Forecast 20252033

- Nutritional Bar Market Size To Expand At A CAGR Of 3.5% During 2025-2033

- Pluscapital Advisor Empowers Traders To Master Global Markets Around The Clock

Comments

No comment