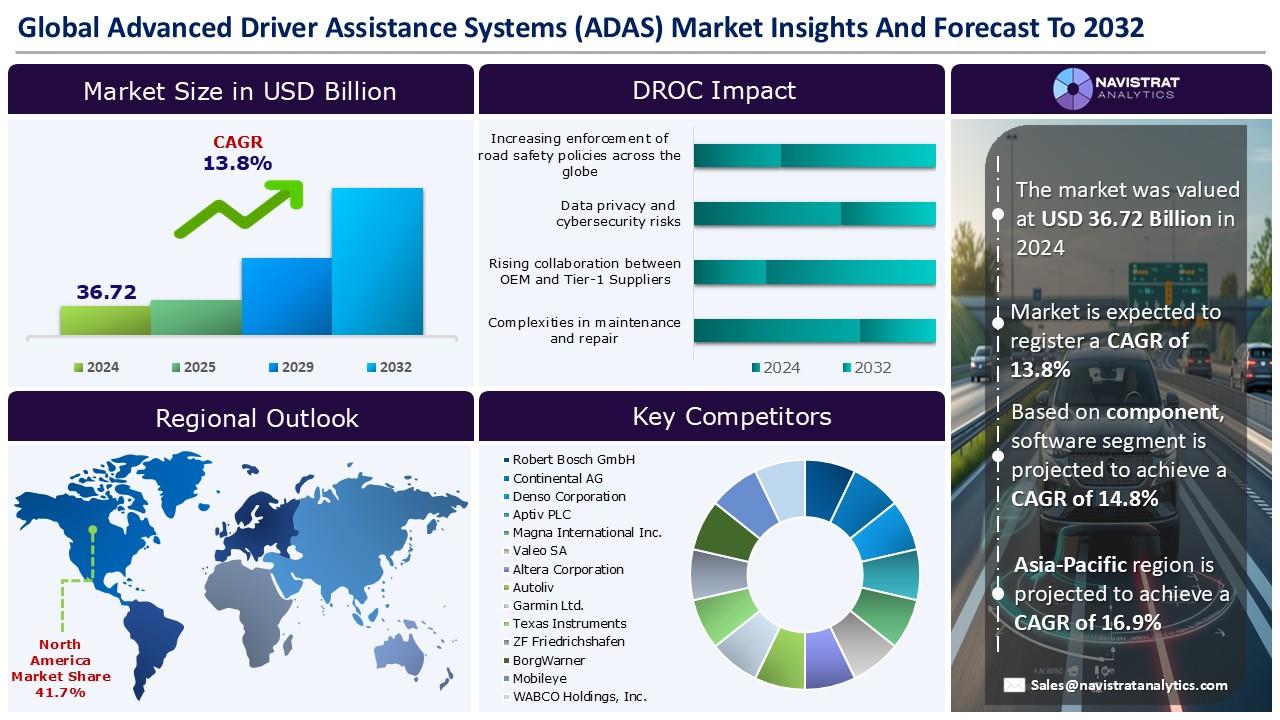

Advanced Driver Assistance Systems (ADAS) Market Size to Reach USD 101.97 Billion in 2032

(MENAFN- Navistrat Analytics) September 10, 2025 - The rapid expansion of electric and autonomous vehicles is a major driver of revenue growth in the Advanced Driver Assistance Systems (ADAS) market. The International Energy Agency (IEA) reported that nearly 14 million new electric cars were registered globally in 2023, bringing the total number of electric vehicles on the road to 40 million.

This reflects an increase of 3.5 million units compared to 2022, equating to a 35% year-over-year growth. Electric vehicles accounted for around 18% of all car sales in 2023, up from 14% the year before. Increasingly, EVs are incorporating ADAS technologies to improve safety and enhance the driving experience, aligning with consumer demand for advanced and sustainable mobility solutions. Additionally, government incentives and infrastructure support in countries such as India, China, the United States, and the U.K. are further fueling the growth of the ADAS market.

However, data privacy and cybersecurity concerns present a major challenge for the Advanced Driver Assistance Systems (ADAS) market. These systems depend extensively on the real-time collection, processing, and exchange of data between in-vehicle components and external networks, making them susceptible to cyberattacks and data breaches. Risks related to unauthorized access to sensitive information, such as vehicle location, driving behavior, and control systems, have triggered regulatory oversight and raised consumer concerns. Consequently, manufacturers are facing higher compliance costs to meet evolving security and privacy standards.

Want to Know What’s Fueling the Advanced Driver Assistance Systems (ADAS) Market Growth? Get Exclusive Report Insights Here:

Segments market overview and growth Insights

Based on the component, the Advanced Driver Assistance Systems (ADAS) market is segmented into hardware, and software.

The hardware segment accounted for the largest market share in 2024 due to the increasing incorporation of safety and automation features in next-generation vehicles. Rising demand for key hardware components—such as radar sensors, LiDAR, ultrasonic sensors, cameras, and Electronic Control Units (ECUs)- is fueled by strict safety regulations, growing consumer interest in advanced driver assistance features, and the ongoing shift toward higher levels of vehicle autonomy.

In September 2024, Arbe Robotics Ltd, a leading provider of perception radar technology, announced that its Tier 1 partner, HiRain Technologies, is accelerating the development of an ADAS system for a Chinese automaker. The system will integrate both radar and camera technologies using Arbe’s radar chipset.

Regional market overview and growth insights

North America held the largest revenue share in 2024, driven by a combination of regulatory requirements, high consumer awareness, and rapid technological innovation, particularly in the U.S. and Canada. Strict safety mandates from agencies like the National Highway Traffic Safety Administration (NHTSA) are pushing automakers to equip new vehicle models with ADAS features such as automatic emergency braking, lane departure warning, and blind spot detection.

In December 2024, the NHTSA expanded its program to include four critical ADAS technologies: Pedestrian Automatic Emergency Braking (PAEB), Lane Keeping Assist (LKA), Blind Spot Warning (BSW), and Blind Spot Intervention (BSI). These updated testing standards aim to enhance vehicle performance in preventing accidents and better reflect real-world driving scenarios.

Competitive Landscape and Key Competitors

The Advanced Driver Assistance Systems (ADAS) market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the Advanced Driver Assistance Systems (ADAS) market report are:

o Robert Bosch GmbH

o Continental AG

o Denso Corporation

o Aptiv PLC

o Magna International Inc.

o Valeo SA

o Altera Corporation

o Autoliv

o Garmin Ltd.

o Texas Instruments

o ZF Friedrichshafen

o BorgWarner

o Mobileye

o WABCO Holdings, Inc.

Major strategic developments by leading competitors

Texas Instruments: On April 15, 2025, Texas Instruments introduced a new lineup of automotive lidar, clock, and radar chips designed to improve vehicle safety by enabling advanced autonomous features across a wider range of vehicles. A key innovation in the launch is the LMH13000, the industry's first integrated high-speed lidar laser driver, which delivers ultra-fast rise times to facilitate faster real-time decision-making.

Elitek Vehicle Services: On February 18, 2025, Elitek Vehicle Services, a subsidiary of LKQ, announced the release of its advanced ADAS MAP (Advanced Driver Assistance Systems Mapping) solution. Created in partnership with OPUS IVS, a global leader in intelligent vehicle support, this innovative software tool is designed to help repair shops accurately and efficiently diagnose, calibrate, and service ADAS components in today’s vehicles.

Navistrat Analytics has segmented global Advanced Driver Assistance Systems (ADAS) market on the basis of component, function, vehicle type, level of automation, sales channel and region:

• Component (Revenue, USD Billion; 2022-2032)

o Hardware

a. Sensors

b. Electronic Control Units (ECUs)

c. Actuators

d. Display Panels

e. Others

o Software

a. Embedded Software

b. AI/ML Algorithms

c. Mapping & Navigation Software

d. Others

• Function Outlook (Revenue, USD Billion; 2022-2032)

o Adaptive Cruise Control (ACC)

o Automatic Emergency Braking (AEB)

o Lane Departure Warning (LDW)

o Lane Keeping Assist System (LKAS)

o Blind Spot Detection (BSD)

o Traffic Sign Recognition (TSR)

o Driver Monitoring Systems (DMS)

o Forward Collision Warning (FCW)

o Night Vision Systems (NVS)

o Park Assist / Automated Parking System

o Others

• Vehicle Type Outlook (Revenue, USD Billion; 2022-2032)

o Passenger Vehicles

o Commercial Vehicles

a. Light Commercial Vehicles (LCVs)

b. Heavy Commercial Vehicles (HCVs)

• Level of Automation (Revenue, USD Billion; 2022-2032)

o Level 1 (Driver Assistance)

o Level 2 (Partial Automation)

o Level 3 (Conditional Automation)

o Level 4 (High Automation)

o Level 5 (Full Automation)

• Sales Channel (Revenue, USD Billion; 2022-2032)

o Original Equipment Manufacturer (OEMs)

o Aftermarket

• Regional Outlook (Revenue, USD Billion, Volume, Square Feet; 2019–2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. Saudi Arabia

b. UAE

c. South Africa

d. Turkey

e. Rest of MEA

Get a preview of the complete research study on our website.

© Navistrat Analytics.

This reflects an increase of 3.5 million units compared to 2022, equating to a 35% year-over-year growth. Electric vehicles accounted for around 18% of all car sales in 2023, up from 14% the year before. Increasingly, EVs are incorporating ADAS technologies to improve safety and enhance the driving experience, aligning with consumer demand for advanced and sustainable mobility solutions. Additionally, government incentives and infrastructure support in countries such as India, China, the United States, and the U.K. are further fueling the growth of the ADAS market.

However, data privacy and cybersecurity concerns present a major challenge for the Advanced Driver Assistance Systems (ADAS) market. These systems depend extensively on the real-time collection, processing, and exchange of data between in-vehicle components and external networks, making them susceptible to cyberattacks and data breaches. Risks related to unauthorized access to sensitive information, such as vehicle location, driving behavior, and control systems, have triggered regulatory oversight and raised consumer concerns. Consequently, manufacturers are facing higher compliance costs to meet evolving security and privacy standards.

Want to Know What’s Fueling the Advanced Driver Assistance Systems (ADAS) Market Growth? Get Exclusive Report Insights Here:

Segments market overview and growth Insights

Based on the component, the Advanced Driver Assistance Systems (ADAS) market is segmented into hardware, and software.

The hardware segment accounted for the largest market share in 2024 due to the increasing incorporation of safety and automation features in next-generation vehicles. Rising demand for key hardware components—such as radar sensors, LiDAR, ultrasonic sensors, cameras, and Electronic Control Units (ECUs)- is fueled by strict safety regulations, growing consumer interest in advanced driver assistance features, and the ongoing shift toward higher levels of vehicle autonomy.

In September 2024, Arbe Robotics Ltd, a leading provider of perception radar technology, announced that its Tier 1 partner, HiRain Technologies, is accelerating the development of an ADAS system for a Chinese automaker. The system will integrate both radar and camera technologies using Arbe’s radar chipset.

Regional market overview and growth insights

North America held the largest revenue share in 2024, driven by a combination of regulatory requirements, high consumer awareness, and rapid technological innovation, particularly in the U.S. and Canada. Strict safety mandates from agencies like the National Highway Traffic Safety Administration (NHTSA) are pushing automakers to equip new vehicle models with ADAS features such as automatic emergency braking, lane departure warning, and blind spot detection.

In December 2024, the NHTSA expanded its program to include four critical ADAS technologies: Pedestrian Automatic Emergency Braking (PAEB), Lane Keeping Assist (LKA), Blind Spot Warning (BSW), and Blind Spot Intervention (BSI). These updated testing standards aim to enhance vehicle performance in preventing accidents and better reflect real-world driving scenarios.

Competitive Landscape and Key Competitors

The Advanced Driver Assistance Systems (ADAS) market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the Advanced Driver Assistance Systems (ADAS) market report are:

o Robert Bosch GmbH

o Continental AG

o Denso Corporation

o Aptiv PLC

o Magna International Inc.

o Valeo SA

o Altera Corporation

o Autoliv

o Garmin Ltd.

o Texas Instruments

o ZF Friedrichshafen

o BorgWarner

o Mobileye

o WABCO Holdings, Inc.

Major strategic developments by leading competitors

Texas Instruments: On April 15, 2025, Texas Instruments introduced a new lineup of automotive lidar, clock, and radar chips designed to improve vehicle safety by enabling advanced autonomous features across a wider range of vehicles. A key innovation in the launch is the LMH13000, the industry's first integrated high-speed lidar laser driver, which delivers ultra-fast rise times to facilitate faster real-time decision-making.

Elitek Vehicle Services: On February 18, 2025, Elitek Vehicle Services, a subsidiary of LKQ, announced the release of its advanced ADAS MAP (Advanced Driver Assistance Systems Mapping) solution. Created in partnership with OPUS IVS, a global leader in intelligent vehicle support, this innovative software tool is designed to help repair shops accurately and efficiently diagnose, calibrate, and service ADAS components in today’s vehicles.

Navistrat Analytics has segmented global Advanced Driver Assistance Systems (ADAS) market on the basis of component, function, vehicle type, level of automation, sales channel and region:

• Component (Revenue, USD Billion; 2022-2032)

o Hardware

a. Sensors

b. Electronic Control Units (ECUs)

c. Actuators

d. Display Panels

e. Others

o Software

a. Embedded Software

b. AI/ML Algorithms

c. Mapping & Navigation Software

d. Others

• Function Outlook (Revenue, USD Billion; 2022-2032)

o Adaptive Cruise Control (ACC)

o Automatic Emergency Braking (AEB)

o Lane Departure Warning (LDW)

o Lane Keeping Assist System (LKAS)

o Blind Spot Detection (BSD)

o Traffic Sign Recognition (TSR)

o Driver Monitoring Systems (DMS)

o Forward Collision Warning (FCW)

o Night Vision Systems (NVS)

o Park Assist / Automated Parking System

o Others

• Vehicle Type Outlook (Revenue, USD Billion; 2022-2032)

o Passenger Vehicles

o Commercial Vehicles

a. Light Commercial Vehicles (LCVs)

b. Heavy Commercial Vehicles (HCVs)

• Level of Automation (Revenue, USD Billion; 2022-2032)

o Level 1 (Driver Assistance)

o Level 2 (Partial Automation)

o Level 3 (Conditional Automation)

o Level 4 (High Automation)

o Level 5 (Full Automation)

• Sales Channel (Revenue, USD Billion; 2022-2032)

o Original Equipment Manufacturer (OEMs)

o Aftermarket

• Regional Outlook (Revenue, USD Billion, Volume, Square Feet; 2019–2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. Saudi Arabia

b. UAE

c. South Africa

d. Turkey

e. Rest of MEA

Get a preview of the complete research study on our website.

© Navistrat Analytics.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Buy Now Pay Later Market Size To Surpass USD 145.5 Billion By 2033 CAGR Of 22.23%

- BTCC Summer Festival 2025 Unites Japan's Web3 Community

- GCL Subsidiary, 2Game Digital, Partners With Kucoin Pay To Accept Secure Crypto Payments In Real Time

- Smart Indoor Gardens Market Growth: Size, Trends, And Forecast 20252033

- Nutritional Bar Market Size To Expand At A CAGR Of 3.5% During 2025-2033

- Pluscapital Advisor Empowers Traders To Master Global Markets Around The Clock

Comments

No comment