Blue Star Reports High Grade Surface Samples From The Auma Prospect

Auma Highlights

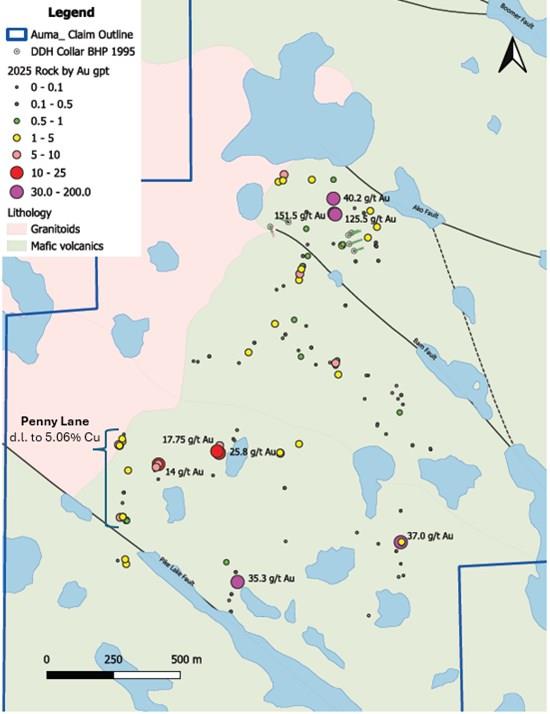

- Two samples grading over 100 grams per tonne gold (151 & 125 g/t Au) extended the high grade 'Zone 3' an additional 35 metres to the south, for a total strike length of 130 metres which remains untested by drilling A total of 133 samples were collected: 33% (44 samples) returned grades over 1 g/t Au, 14% (18) over 5 g/t One prospect dubbed "Penny Lane" returned high copper values in addition to high gold values in quartz veining; one sample (H504682) returned grades of 7.64 g/t Au and 4.2% Cu Groundwork confirmed quartz veining with anomalous gold is distributed across the Auma property, with high-grade samples (35.3 g/t Au) as far away as 1.4 km from the original showing SkyTEM survey: 89-line kilometres of modern EM and magnetics data completed over the property

"The expanded Auma prospect is a very encouraging addition to our exploration target pipeline," said Grant Ewing, CEO of Blue Star. "The high-grade gold grabs at surface, along with visible gold and numerous untested geophysical anomalies, suggest that we may be on the verge of something significant. Furthermore, the proximity to the proposed road, just 15 kilometres to the east, improves the accessibility of this project and positions it well for future development. We are looking forward to advancing this target as part of our 2026 drill program, where we plan to test its full potential."

Plate 1: Typical Vein with Strong Gold Values (left), Penny Lane Anomalous Copper Sample (centre, right).

To view an enhanced version of this graphic, please visit:

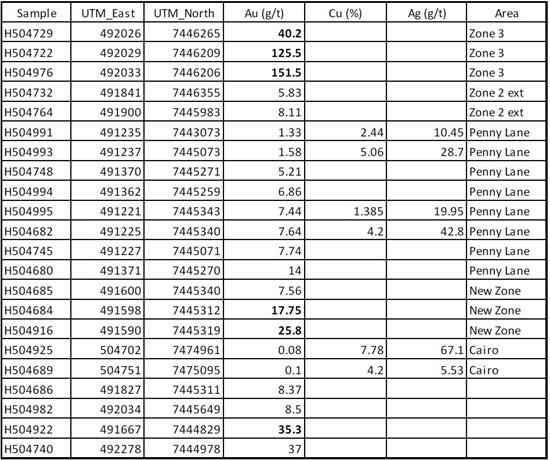

Table 1: 2025 Samples Grading Over 5 g/t Gold and Significant Copper/Silver.

To view an enhanced version of this graphic, please visit:

Discussion of the Auma Field Program

During the 2025 season, Blue Star undertook targeted prospecting, mapping and pXRF lithogeochemical chip sampling across the Auma property. The areas focused on were defined by compiled data for the prospect that included mapped vein trends, magnetic anomalies, MaxMin conductive plate surface traces and historical DIGHEM picks.

Anomalous gold is distributed throughout the Auma property, with high-grade samples collected as far away as 1.4 km from the original showings (Figure 2). Gold is associated with gossanous, sulphide bearing quartz veining within the abundant gossans across the property. The gossans are caused by disseminated pyrrhotite (+/- pyrite) within the mafic volcanic host rocks. Biotite alteration and silicification associated with the disseminated sulphides occur as an alteration halo around veining. Large gossanous quartz blocks were commonly found in frost boils. Pyrrhotite, pyrite and chalcopyrite often occurred within the veining, or at vein selvages.

Several different types of quartz and associated sulphides were noted as described below:

- Dark grey to white glassy quartz, sometimes with disseminated pyrrhotite, pyrite and variable amounts of chalcopyrite throughout Vuggy white quartz with coarse pyrite agglomerates when fresh; pyrite is commonly weathered-out leaving rusty staining and large vugs White to orange to pink sugary quartz and carbonate, and bands of pyrrhotite Vein selvages, more closely associated with the dark grey quartz are often characterized by massive tabular to flaky pyrrhotite +/- stringers of chalcopyrite

The pyrrhotite found in alteration halos, selvages and the veins themselves is likely the cause of magnetic and electromagnetic anomalies noted in the historical ground magnetic and MaxMin surveys.

In one distinct area, located 1.2 km southwest of the original gold showing, chalcopyrite was identified within white quartz veining. This area, now called the Penny Lane prospect returned strong copper and gold values with elevated silver content (see Table 1). A second area, located 300 metres along strike to the south, also returned anomalous copper values associated with both massive sulphides in mafic volcanic host rocks and quartz veining (Figure 2).

In addition to groundwork, Blue Star contracted SkyTEM to fly a heliborne electromagnetic & magnetic survey over the Auma claim block. The survey consisted of 89-line kilometres covering 614 hectares. The results for this survey are pending.

Next Steps

The 2025 field season was very successful at expanding the extent of known high-grade gold veining across the Auma property and identifying new areas of anomalous gold and copper mineralisation. The lithogeochemical chip sampling results combined with our knowledge of the Ulu stratigraphy and the new magnetics survey data will be used to generate a revised geological map and targeting model for the Auma prospect. Based on the historical work Auma was drill ready in 2025, and the additional field work and data compilation has led to more compelling drill targets across the property. Auma is expected to be a key component of a robust 2026 exploration drill program.

Sampling, Assaying & QA/QC

Blue Star field programs collect a variety of samples; prospecting rock samples are selective by nature, channel samples are saw cut samples from outcrop intended to be representative of the exposed mineralisation, and drill core samples are sawn in half with one half retained as core record and the other half submitted for analysis.

Blue Star samples are delivered under chain of custody to ALS Geochemistry in Yellowknife, NT for sample preparation which are then forwarded to ALS Canada Inc. in North Vancouver, BC for final analysis. Samples are prepared using code PREP-31 (crushing and pulverising) and analysed using codes Au-AA26 (50-gram fire assay with atomic absorption finish) and ME-MS61 (48 element four acid digestion with ICP-MS finish). Samples returning > 10 g/t Au are reanalysed under code Au-GRA22 (50-gram fire assay with gravimetric finish). Over limits for non-gold elements are ore grade four acid digestion with ICP-AES finish. The work is being conducted using industry standard procedures, including a quality assurance and quality control("QA/QC") program consisting of the insertion of certified standards, blanks and duplicates into the sample stream.

Qualified Person

Darren Lindsay, P. Geo. and Vice President Exploration for Blue Star, is a Qualified Person under National Instrument 43-101 ("NI 43-101") and has reviewed and approved the technical information contained in this news release.

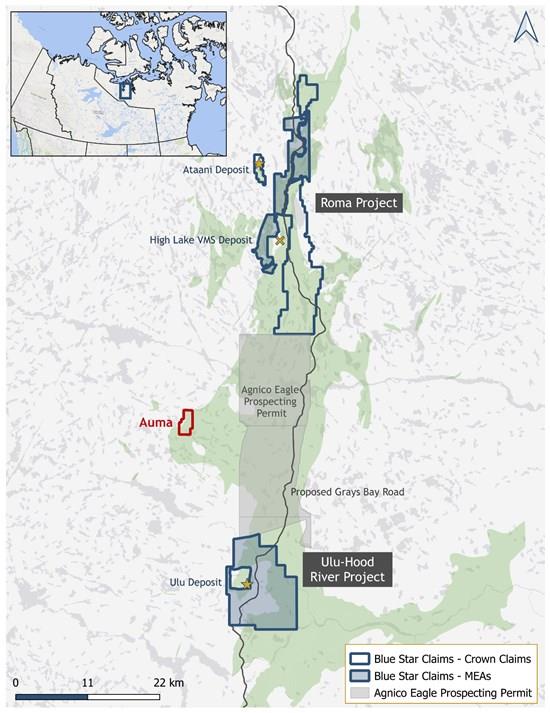

Figure 1: Location Map of Blue Star Projects and Landholdings.

To view an enhanced version of this graphic, please visit:

Figure 2: 2025 Sample Locations with Gold Grades on the Auma Property.

To view an enhanced version of this graphic, please visit:

About Blue Star Gold Corp.

Blue Star is a mineral exploration and development company focused in Nunavut, Canada. Blue Star's landholdings total 300 square kilometres of highly prospective and underexplored mineral properties in the High Lake Greenstone Belt. The Company owns the Ulu Gold Project, comprised of the Ulu Mining Lease and Hood River Property, and the Roma Project. A significant high-grade gold resource exists at the Flood Zone deposit (Ulu Mining Lease), and numerous high-potential exploration targets (gold and critical minerals) occur throughout the Company's extensive landholdings, providing Blue Star with excellent resource growth potential. The site of the future deep-water port at Grays Bay is 40 - 100 km to the north of the properties, and the proposed route corridor for the all-weather Grays Bay Road passes close by the Roma and Ulu Gold Projects.

Blue Star is listed on the TSX Venture Exchange under the symbol: BAU, the U.S. OTCQB Venture Market under the symbol: BAUFF, and on the Frankfurt Exchange under the symbol: 5WP0. For information on the Company and its projects, please visit our website: .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Buy Now Pay Later Market Size To Surpass USD 145.5 Billion By 2033 CAGR Of 22.23%

- BTCC Summer Festival 2025 Unites Japan's Web3 Community

- GCL Subsidiary, 2Game Digital, Partners With Kucoin Pay To Accept Secure Crypto Payments In Real Time

- Smart Indoor Gardens Market Growth: Size, Trends, And Forecast 20252033

- Nutritional Bar Market Size To Expand At A CAGR Of 3.5% During 2025-2033

- Pluscapital Advisor Empowers Traders To Master Global Markets Around The Clock

Comments

No comment