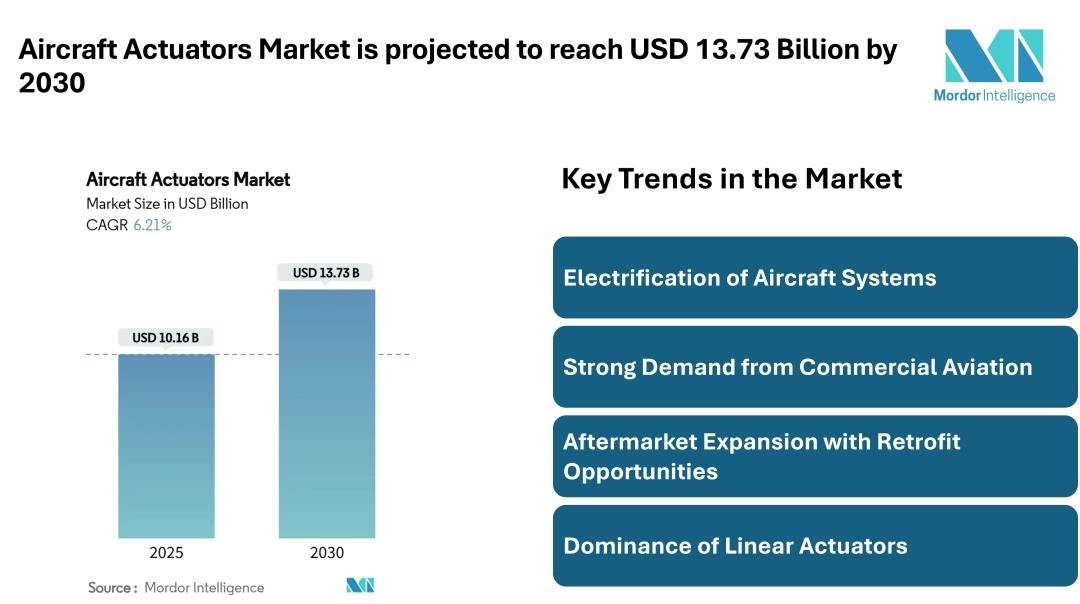

Aircraft Actuators Market To Reach USD 13.73 Billion By 2030, Growing At A CAGR Of 6.21% Mordor Intelligence

"Aircraft Actuators Market"Mordor Intelligence has published a new report on the Aircraft Actuators Market offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

The Aircraft Actuators Market plays a vital role in modern aviation, as actuators are key components that convert energy into motion to control various aircraft functions. They are essential for operating flight-control surfaces such as flaps, ailerons, rudders, and elevators, as well as systems like landing gear, braking, and even cabin seating. With the global aerospace sector expanding, the demand for reliable and efficient actuators continues to rise across commercial, military, and business aviation segments.

Key Market Trends

Electrification of Aircraft Systems: Electrical and electromechanical actuators are steadily replacing traditional hydraulic and pneumatic systems. This shift is linked to the aviation industry's focus on lighter components, reduced maintenance, and improved energy efficiency. More-electric aircraft designs are driving this adoption, with OEMs integrating electric actuators in secondary systems such as landing gear, thrust reversers, and flight surfaces.

Strong Demand from Commercial Aviation: Commercial airlines remain the largest consumers of actuators, with backlogs in single-aisle programs like the Boeing 737 MAX and Airbus A320neo ensuring steady demand. These actuators are essential for flight-control functions such as ailerons, elevators, rudders, and flaps. The market benefits from continuous fleet expansion, rising air passenger traffic, and the replacement of aging aircraft with more efficient models.

Aftermarket Expansion with Retrofit Opportunities: Airlines are increasingly investing in actuator retrofits to extend the operational lifespan of fleets. A key focus is on integrating health-monitoring sensors within actuator systems to enable predictive maintenance. These upgrades help reduce unscheduled downtime, optimize performance, and lower lifecycle costs, making the aftermarket segment an important growth area.

Dominance of Linear Actuators: Linear actuators currently account for the majority of the market share due to their widespread use across primary flight controls, landing gear, and braking systems. Their strength lies in handling high-load applications that are central to safe aircraft operation. While rotary and other types are expanding, linear actuators are expected to remain dominant in the near term due to their reliability and established role.

Market Segmentation

By Type

Linear Actuators – Widely used in flight-control surfaces, landing gear, and braking systems because they can handle heavy loads and provide precise linear motion.

Rotary Actuators – Suitable for applications requiring rotational movement, increasingly important in tilt-rotor aircraft, eVTOLs, and adaptive wing designs.

By System

Hydraulic Actuators – Traditional systems valued for their ability to generate high force, especially in primary flight controls and landing gear.

Electrical/Electromechanical Actuators – Growing segment favored for lighter weight, energy efficiency, and compatibility with more-electric aircraft.

Pneumatic Actuators – Typically used in systems where moderate power and quick response are required, such as cabin doors or auxiliary applications.

Mechanical Actuators – Basic actuators that rely on gears, levers, and other mechanical linkages, often used in secondary or backup applications.

By Application

Flight Control Surfaces – Largest segment, covering ailerons, elevators, rudders, and flaps, where actuators ensure safe and precise control.

Landing Gear and Braking – Critical for retraction, extension, and braking systems, requiring high force and reliability.

Fuel and Thrust Management – Involves actuators for regulating fuel flow, thrust reversers, and engine control systems.

Cabin and Seat Systems – Actuators used in powered seats, adjustable cabin elements, and overhead bins, enhancing passenger comfort.

Environmental and Utility Systems – Include actuators for systems such as air-conditioning, ventilation, and auxiliary functions inside the aircraft.

By End User

Commercial Aircraft – Dominant market segment driven by rising passenger traffic, fleet expansion, and OEM backlogs.

Military Aircraft – Growing demand due to modernization programs, rotorcraft upgrades, and next-generation fighter development.

General Aviation – Includes business jets and light aircraft, where compact and efficient actuators support both performance and comfort.

By Fit

OEM (Original Equipment Manufacturer) – Actuators supplied for newly manufactured aircraft, forming the bulk of initial demand.

Aftermarket – Covers replacement, repair, and retrofit opportunities, driven by fleet maintenance, health-monitoring upgrades, and service life extensions.

By Geography

North America – Largest market, supported by Boeing, Bombardier, and strong US defense spending on fighter jets, helicopters, and UAVs.

Europe – Driven by Airbus production and Eurofighter programs, with a shift toward electrical actuators in more-electric aircraft designs.

Asia-Pacific – Fastest-growing region, led by China's COMAC C919, India's Tejas and AMCA, and expanding airline fleets across Asia.

South America – Growth mainly from Embraer's regional jets in Brazil and steady airline fleet renewals across the region.

Middle East & Africa – Aviation hubs in UAE and Qatar boost demand, while military programs and rising African air travel add opportunities

Major Players

Honeywell International Inc. – A leading aerospace technology company offering a wide range of actuator systems for flight control, landing gear, and cabin operations, with strong expertise in integrating smart monitoring solutions.

Parker-Hannifin Corporation – Specializes in motion and control technologies, including hydraulic and electromechanical actuators, widely used in commercial, military, and business aircraft worldwide.

Moog Inc. – Known for precision motion control products, Moog supplies advanced actuators for flight-control surfaces and military platforms, with a reputation for high reliability in critical aerospace systems.

Safran SA – A global aerospace and defense group providing electrical and hydraulic actuator systems, particularly strong in European markets through partnerships with Airbus and other OEMs.

Collins Aerospace (RTX Corporation) – Offers a broad portfolio of actuation solutions, from primary flight-control actuators to cabin systems, with strong global presence supported by its parent, RTX Corporation.

Conclusion

The Aircraft Actuators Market is set for steady growth, supported by rising aircraft production, expanding retrofit opportunities, and the shift toward electrified systems. Linear actuators remain the dominant segment, but electrical and rotary solutions are gaining traction as airlines and manufacturers embrace more-electric designs and new aircraft concepts. While North America continues to lead in market share, Asia-Pacific stands out as the fastest-growing region, driven by indigenous programs and fleet expansion.

For more information:

Industry Related Reports

Aircraft Seat Actuation Systems Market: The Global Aircraft Seat Actuation Systems Market is analyzed in terms of revenue share and segmented by mechanism (linear and rotary), aircraft type (fixed-wing aircraft and helicopters), and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa). The report provides market size and value forecasts in USD million across all these segments.

Military Actuators Market: The Military Actuators Market is segmented by type (linear and rotary), system (mechanical, hydraulic, electrical, pneumatic), application (land, air, sea), and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa). The report includes five years of historical data along with five-year market forecasts.

Get More Insights:

Aircraft Landing Gear Systems Market: The Aircraft Landing Gear Systems Market is segmented by aircraft type (commercial aviation, military aviation, and general aviation), gear position (nose landing gear and main landing gear), material (high-strength steel alloys, titanium alloys, composites, and others), end user (OEM and aftermarket/MRO), and geography (North America, Europe, Asia-Pacific, and others). Market forecasts are presented in terms of value (USD).

About Mordor Intelligence: Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact: ...

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment