Indonesia Generic Drug Market Size, Share, Growth, Trends, Outlook, Research Report 2025-2033

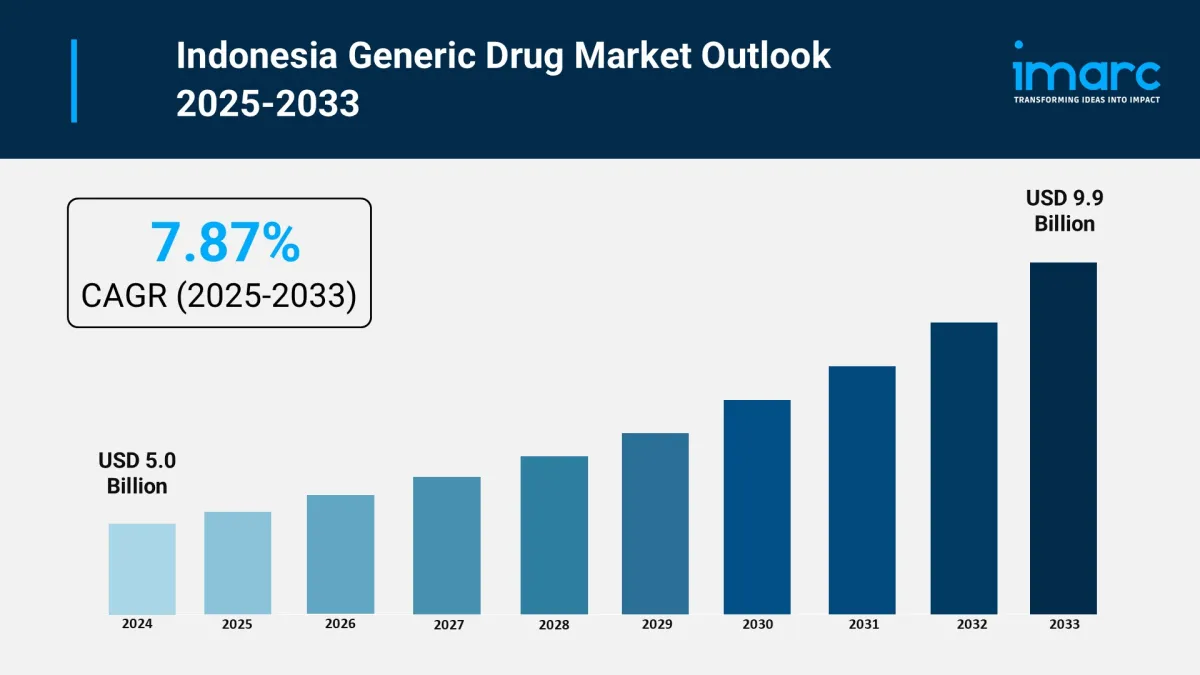

The Indonesia generic drug market size reached USD 5.0 Billion in 2024 . Looking forward, IMARC Group expects the market to reach USD 9.9 Billion by 2033 , exhibiting a CAGR of 7.87% during 2025–2033 . Market growth is driven by government initiatives to improve healthcare access, the expansion of Indonesia's National Health Insurance (JKN) program, and increasing demand for cost-effective treatments. The rise in chronic diseases, along with growing awareness of affordable alternatives to branded drugs, further supports market expansion.

For an in-depth analysis, you can refer free sample copy of the report: https://www.imarcgroup.com/indonesia-generic-drug-market/requestsample

Key Highlights

-

Market Size (2024): USD 5.0 Billion

Forecast (2033): USD 9.9 Billion

CAGR (2025–2033): 7.87%

Growth Drivers: Expansion of universal healthcare coverage, affordability of generic medicines, and rising chronic disease prevalence.

Key Trends: Increasing penetration of biosimilars, investment in local manufacturing facilities, and digital distribution through e-pharmacies.

Key Companies: Kalbe Farma, Kimia Farma, Dexa Medica, Sanbe Farma, Indo Farma, and multinational players with generic portfolios in Indonesia.

How Is AI Transforming the Generic Drug Market in Indonesia?

-

Drug Discovery & Development: AI-driven simulations speeding up formulation research for generics.

Regulatory Compliance: AI tools improving pharmacovigilance and documentation for faster approvals.

Supply Chain Optimization: Machine learning enhancing demand forecasting and distribution efficiency.

E-Pharmacy Integration: AI-powered platforms personalizing patient engagement and improving medicine adherence.

Key Market Trends and Drivers

-

Government Support: JKN program driving demand for affordable medicines.

Patent Expirations: Expiry of branded drugs creating opportunities for generics.

Local Manufacturing: Investments in domestic pharmaceutical plants reducing import dependence.

Digital Health Expansion: Growth of telemedicine and e-pharmacies boosting generic drug accessibility.

Rising Chronic Diseases: Increasing prevalence of diabetes, cardiovascular diseases, and oncology cases.

Ask Analyst For Customization: https://www.imarcgroup.com/request?type=report&id=17019&flag=C

Market Segmentation

The report has segmented the market into the following categories:

Therapy Area Insights:

-

Central Nervous System

Cardiovascular

Dermatology

Genitourinary/Hormonal

Respiratory

Rheumatology

Diabetes

Oncology

Others

Drug Delivery Insights:

-

Oral

Injectables

Dermal/Topical

Inhalers

Distribution Channel Insights:

-

Retail Pharmacies

Hospital Pharmacies

Regional Insights:

-

Java

Sumatra

Kalimantan

Sulawesi

Others

Latest Developments in the Industry

-

February 2025: Kalbe Farma announced expansion of its generic drug portfolio in oncology and cardiovascular segments.

April 2025: Dexa Medica partnered with a local hospital network to improve distribution of affordable generics in rural areas.

June 2025: Kimia Farma launched AI-enabled e-pharmacy services to streamline generic drug prescriptions and home delivery.

Ongoing Trend: Government pushing local manufacturers to produce more biosimilars for chronic disease treatment.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment