India Health And Wellness Market 2025: Size, Share, Growth, Trends, Top Companies And Forecast Report By 2033

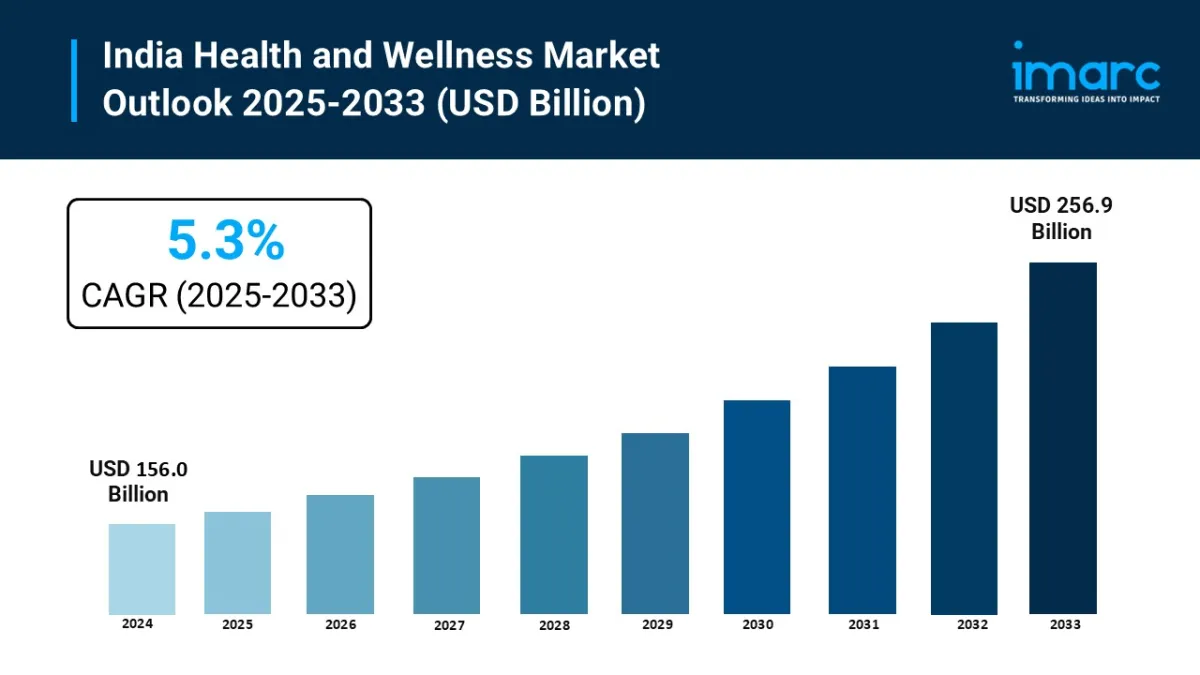

In 2024, the India Health and Wellness Market was valued at USD 156.0 billion . It is forecast to reach approximately USD 256.9 billion by 2033 , growing at a robust CAGR of 5.3% between 2025 and 2033. Key growth drivers include rising consumer awareness of nutrition and fitness, increasing disposable incomes, expanding lifestyle-related disease burden, and robust government initiatives promoting fitness and preventive healthcare.

Key Highlights-

Market Size (2024): USD 156.0 billion

Forecast (2033): USD 256.9 billion

CAGR (2025–2033): 5.3%

Major Growth Contributors:

-

Rising demand for nutritional diets and wellness consumption

Expansion of fitness training centers and naturopathy adoption

Growing use of health-monitoring devices, mobile apps, and wearable tech

Get instant access to a free sample copy and explore in-depth analysis: https://www.imarcgroup.com/india-health-wellness-market/requestsample

How Is AI Transforming the Health and Wellness Market in India?-

Personalized Health Coaching: Apps like HealthifyMe's Ria provide AI-powered virtual nutrition and fitness guidance based on diet and activity data.

Smart Wearables & Predictive Alerts: AI-enabled wearables analyze health metrics to provide insights or warnings about wellness trends.

Tailored Wellness Interventions: Machine learning models recommend customized dietary plans or preventive routines aligned with individual health profiles.

Enhanced Customer Engagement: AI-driven chatbots and interfaces on wellness platforms offer real-time counseling and feedback, elevating user engagement.

-

National Initiatives: Expansion of Ayushman Bharat Health and Wellness Centres (HWCs) under the National Health Mission increases preventive care outreach in both urban and rural settings.

Technology-led Momentum: Growth of fitness tech, mobile wellness apps, and telemedicine platforms is enhancing accessibility.

Sector-specific Demand: Boom in fitness centers, wellness retreats, medical and wellness tourism fuel demand across health sectors.

Awareness & Cost-efficiency: Rising health consciousness among urban consumers shifts preference toward preventive wellness products and services.

Sustainability & Holistic Wellness: Growth in Ayurveda, yoga, organic products, and integrative wellness aligning with environmental and health consciousness.

Corporate Wellness & Telehealth Integration: Employers increasingly adopt holistic wellness programs; telemedicine expands reach through platforms like eSanjeevani.

Breakup by Product Type:

-

Functional Foods and Beverages

Beauty and Personal Care Products

Preventive and Personalized Medicinal Products

Others

Among these, beauty and personal care products currently hold the largest market share

Breakup by Functionality:

-

Nutrition & Weight Management

Heart & Gut Health

Immunity

Bone Health

Skin Health

Others

Skin health currently exhibits a clear dominance in the India health and wellness market share

Regional Insights-

West and Central India lead the wellness market due to higher urban health awareness and strong infrastructure.

North, South, and East India are fast catching up, driven by rising wellness tourism, spiritual retreats, and expanding health infrastructure.

Wellness tourism hotspots such as Ujjain, Rajasthan, Kerala, and Uttarakhand are emerging as centers of holistic wellness.

Discuss Your Needs with Our Analyst – Inquire or Customize Now: https://www.imarcgroup.com/request?type=report&id=5488&flag=C

Latest Developments in the Industry-

Surge in Health Supplements Sector: Influencer marketing and venture capital funding are fueling a boom in advanced supplements, including gummies, gut-health liquids, sleep aids, hormonal products, and vegan options. This rapid evolution enhances consumer choice but raises regulatory and safety concerns.

Wellness Summit in Ujjain: The 2025 Spiritual & Wellness Summit in Ujjain showcased Madhya Pradesh's vision to position itself as a global wellness destination by integrating spirituality with health tourism and infrastructure development.

Rising Demand for Weight-Loss Drugs: Demand for obesity medications like Eli Lilly's Mounjaro and Novo Nordisk's Wegovy has surged, with India poised to become a key market. Generic versions from domestic players like Sun Pharma and Cipla are expected post-patent expiry in 2026-supporting national goals on preventive health and reducing lifestyle disease burden.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Cryptogames Introduces Platform Enhancements Including Affiliate Program Changes

- Cartesian Launches First Outsourced Middle-Back-Office Offering For Digital Asset Funds

- $MBG Token Supply Reduced By 4.86M In First Buyback And Burn By Multibank Group

- Ethereum Based Meme Coin Pepeto Presale Past $6.6 Million As Exchange Demo Launches

- Daytrading Publishes New Study On The Dangers Of AI Tools Used By Traders

- 1Inch Unlocks Access To Tokenized Rwas Via Swap API

Comments

No comment