How Will Australia Paper And Paperboard Packaging Market Size, Share & Growth Evolve By 2033?

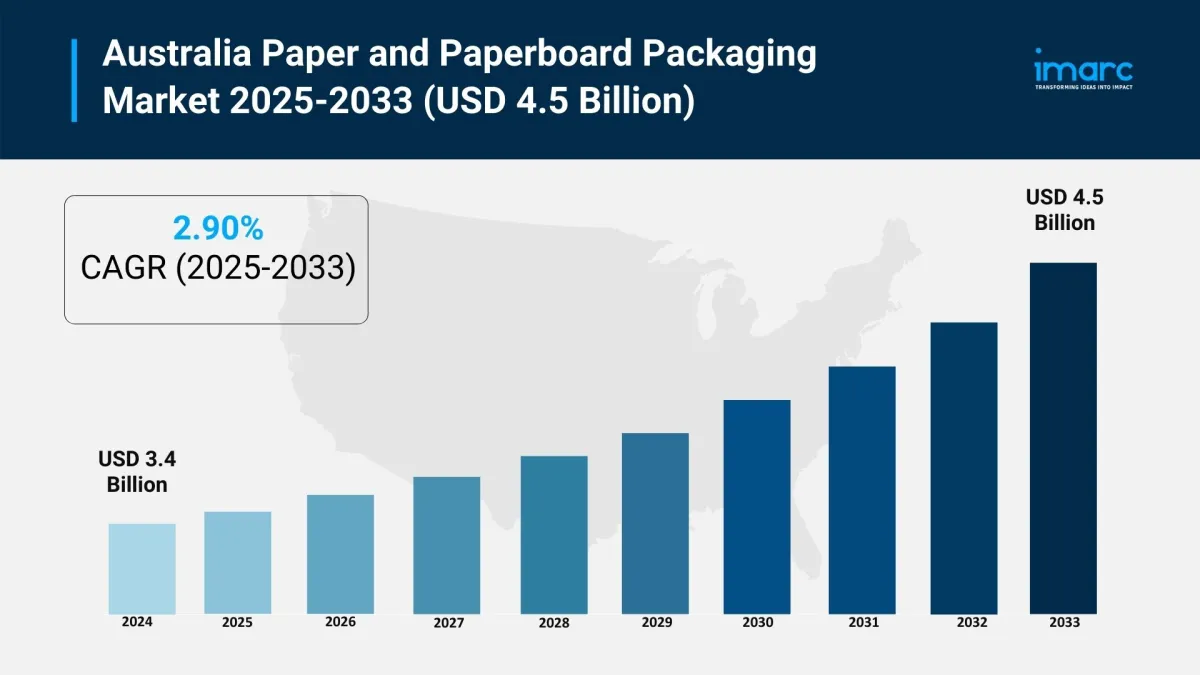

Base Year: 2024

Forecast Years: 2025–2033

Historical Years: 2019–2024

Market Size in 2024: USD 3.4 Billion

Market Forecast in 2033: USD 4.5 Billion

Market Growth Rate (2025–2033): 2.90%

Australia Paper and Paperboard Packaging Market Overview

The Australian paper and paperboard packaging market is experiencing strong growth, driven by rising demand for recyclable and sustainable solutions across sectors including food, beverage, healthcare, personal care, retail, e-commerce, and industry. Increasing environmental awareness and regulatory pressures are accelerating the shift from plastic to paper-based materials. Lightweight, biodegradable, and FSC-certified substrates are becoming standard, with brands adopting innovations such as compostable formats and improved barrier technologies to meet consumer expectations for eco-friendly packaging.

Demand is also rising for personalized, print-ready packaging, as brands seek to enhance shelf appeal and express individuality. Advanced printing technologies support high-impact, color-rich designs that strengthen retail presence. The surge in e-commerce further boosts the market, positioning packaging as a critical element in both logistics and customer experience. Significant investments-like Opal's $140 million corrugated cardboard facility in Wodonga-reflect a broader industry push toward sustainable, high-performance packaging solutions.

Request For Sample Report:

https://www.imarcgroup.com/australia-paper-paperboard-packaging-market/requestsample

How AI Is Transforming Australia Paper and Paperboard Packaging Market

Artificial intelligence is reshaping Australia's paper and paperboard packaging market in 2025 by driving smarter, more sustainable, and cost-efficient production. AI-powered analytics help manufacturers optimize material usage, reduce waste, and improve recycling rates in line with the country's strict sustainability targets. Machine learning algorithms are streamlining supply chain management, predicting demand for eco-friendly packaging solutions, and enabling faster adaptation to e-commerce growth. In product development, AI supports the creation of innovative coatings and barrier technologies that enhance recyclability without compromising durability, while computer vision systems ensure high-quality printing and defect-free packaging at scale. Together, these advancements are accelerating market growth by improving operational efficiency, meeting consumer demand for sustainable solutions, and boosting competitiveness in a fast-evolving industry.

Australia Paper and Paperboard Packaging Market Trends

-

Widespread adoption of recyclable and biodegradable paper packaging, driven by regulatory mandates and consumer choice.

Innovations in lightweight, functional package designs for efficient logistics and enhanced user experience (easy-open, resealable, moisture barriers).

Increasing demand for customizable and high-resolution digital print solutions for branding and retail shelf appeal.

Growth in food delivery, e-commerce, and pharmaceutical packaging requiring robust, multi-functional solutions.

Expansion of sustainable manufacturing, with investments in eco-friendly facilities and processes.

Australia Paper and Paperboard Packaging Market Drivers

-

Environmental awareness and regulatory support encouraging reduction of single-use plastics.

Rising applications in food and beverage, healthcare, personal care, and industrial sectors.

Consumer preference for renewable, compostable, and recyclable packaging options.

Growth in online retail and direct-to-consumer sales boosting customized and protective packaging needs.

Corporate focus on sustainability and circular economy principles.

Challenges and Opportunities

Challenges:

-

Fluctuating raw material costs and supply chain management.

Balancing durability, barrier performance, and recyclability.

Competition from alternative packaging materials and imported products.

Opportunities:

-

Innovation in green technology and circular design for enhanced recyclability.

Expanding into high-growth segments like e-commerce and premium food, cosmetics, and pharma packaging.

Strategic brand differentiation via personalization and advanced printing.

Meeting regulatory sustainability targets to capture eco-conscious consumer segments.

Australia Paper and Paperboard Packaging Market Segmentation

By Type:

-

Folding Cartons

Corrugated Boxes

Others

By End User:

-

Food and Beverage

Healthcare

Personal Care and Household Care

Industrial

Others

By Region:

-

Australia Capital Territory & New South Wales

Victoria & Tasmania

Queensland

Northern Territory & Southern Australia

Western Australia

Australia Paper and Paperboard Packaging Market News (2024–2025)

-

November 2024: Mars MasterFoods launches Australia's first paper-recyclable tomato sauce packs, targeting 190 tonnes less plastic by 2025.

November 2023: Opal opens Wodonga corrugated cardboard manufacturing plant, producing 100,000 tonnes annually with advanced sustainability features.

Packaging law overhaul consultation in September 2024 aiming for compulsory recyclability and toxic chemical bans, driving product innovation.

Key Highlights of the Australia Paper and Paperboard Packaging Market Report

-

Market Performance (2019–2024)

Market Outlook (2025–2033)

Regulatory Environment and Impact

Segment-wise growth tracking: type, end user, region

Innovation trends in design and sustainability

Competitive landscape and strategic profiles of key companies

Analysis of consumer behavior, logistics, and retail impact

Q&A Section

Q1: What drives growth in Australia's paper and paperboard packaging market?

A1: Demand for sustainable packaging, regulatory mandates, innovation in design and printing, and growth across food, retail, e-commerce, and personal care industries.

Q2: What are prominent market trends?

A2: Sustainable, print-personalized packaging, lightweight functional design, eco-friendly innovations, and expansion of e-commerce-based solutions.

Q3: What challenges do industry participants face?

A3: Managing raw material costs, balancing performance versus recyclability, and competing with alternative formats and imported products.

Q4: What are key opportunities ahead?

A4: Green technology innovation, personalized and premium packaging segments, meeting strict regulatory sustainability and recycling goals.

About Us

IMARC Group is a global management consulting firm supporting changemakers worldwide with market research, entry, and expansion strategies.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment