Industrial PC Market Trends 20252033: AI Acceleration, Cybersecurity, And Smart Factory Expansion

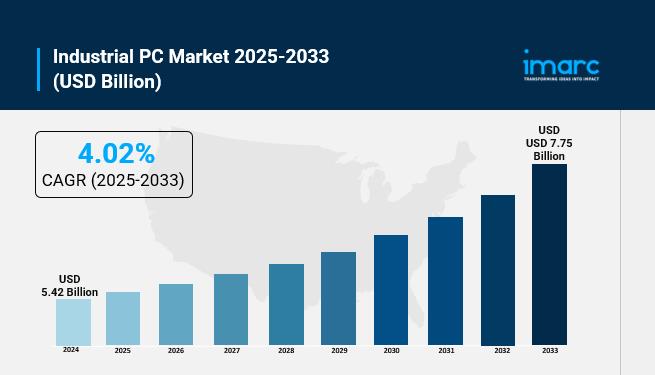

The global industrial PC market was valued at USD 5.42 billion in 2024 and is projected to reach USD 7.75 billion by 2033 , growing at a CAGR of 4.02% during 2025–2033. Growth is driven by the rapid adoption of Industry 4.0 , automation, IoT integration, edge computing, and heightened cybersecurity requirements. Demand for rugged, high-performance IPCs is rising across manufacturing, energy, automotive, and logistics, with applications spanning real-time analytics, HMI operations, predictive maintenance, and AI-powered automation.

Key Stats

-

Market Size (2024): USD 5.42 Billion

Projected Market Size (2033): USD 7.75 Billion

CAGR (2025–2033): 4.02%

Leading Region (2024): Asia-Pacific – 38.3% market share

Top Segment (By Type, 2024): Panel IPCs – 28.6% share

Preferred Display Type (2024): Capacitive – 54% share

Dominant Sales Channel: Direct Sales – 83.4% share

Major End-Use Industry: Automotive – 21.2% share

Key Companies: ABB Ltd, Advantech Co. Ltd, Siemens AG, Rockwell Automation, Schneider Electric SE, Omron Corporation, and others

Growth Drivers

1. Automation, Industry 4.0, and End-Use Demand

The move towards smart manufacturing is driving up the need for industrial PCs. Industries like automotive, electronics, aerospace, and semiconductors are turning to rugged IPCs for tasks such as robotics control, quality assurance, battery and EV testing, and HMI functions. Original Equipment Manufacturers (OEMs) are increasingly opting for panel and box IPCs to enhance operator interfaces and machine-level processing, which supports their replacement and upgrade cycles.

2. IoT, Edge Computing, and AI Acceleration

Industrial PCs are becoming the backbone of IoT and edge deployments. AI-powered IPCs with GPU acceleration are enabling applications like predictive maintenance, computer vision inspection, and decentralized control loops. By processing AI on-site, companies can cut down on latency, reduce bandwidth costs, and minimize downtime.

3. Ruggedization, Cybersecurity, and Regulatory Compliance

Security features like secure boot, encrypted communications, and intrusion detection are now becoming standard practice. Regulatory requirements in sectors such as energy, oil & gas, and aerospace are pushing for certified, rugged IPCs that can withstand extreme temperatures and vibrations, which is increasing their use in mission-critical environments.

AI and Technology Impact

Artificial Intelligence, IoT, and edge computing are transforming the industrial PC landscape . AI-powered IPCs allow real-time decision-making without cloud dependency, enabling faster production cycles, improved quality control, and predictive maintenance . Integration with GPUs enhances processing capacity for deep learning, vision systems, and industrial robotics .

Segmental Analysis

By Type:

-

Panel IPC – Touchscreen, real-time control for factory floors.

Rack Mount IPC – High-density compute for control rooms.

Box IPC – Modular, compact for edge applications.

Embedded IPC – Integrated into machinery for specialized control.

DIN Rail IPC – Slim design for distributed automation.

Others – Mini-PCs, fanless models, and custom designs.

By Display Type:

-

Resistive – Durable, glove-friendly, cost-effective.

Capacitive – Multi-touch, high sensitivity, superior visibility.

Others – Optical bonded, sunlight-readable panels.

By Sales Channel:

-

Direct Sales – Custom solutions, strong after-sales support.

Indirect Sales – Distributor-led reach for SMEs and regional markets.

By End-Use Industry:

Automotive, healthcare, chemical, aerospace & defense, semiconductor & electronics, energy & power, oil & gas, logistics, food & beverage, and packaging.

Regional Insights

-

Asia-Pacific leads with 38.3% market share (2024), fueled by industrialization, automotive and electronics manufacturing, and smart-factory programs in China, Japan, South Korea, and India .

North America benefits from strong automation adoption in manufacturing and energy.

Europe is advancing with Industry 4.0 policies and industrial modernization in Germany, France, and the UK.

Latin America sees growing demand in oil & gas and mining automation.

Middle East & Africa experiences uptake in energy and heavy industrial sectors.

Market Dynamics

Drivers: Industry 4.0, IoT adoption, AI integration, cybersecurity mandates, ruggedization.

Restraints: High initial investment, integration complexity.

Key Trends: AI at the edge, GPU-accelerated IPCs, fanless and mini form factors, and enhanced cybersecurity features.

Leading Companies

ABB Ltd Advantech Co. Ltd American Portwell Technology Inc. (Posiflex Technology, Inc.) Beckhoff Automation GmbH & Co. KG DFI (Diamond Flower Inc) General Electric Co. Kontron S&T AG Omron Corporation Rockwell Automation, Inc. Schneider Electric SE Siemens AG Ricoh (RICOH PFU COMPUTING) C&T Solution Aaeon (subsidiary of Asus) Adlink TechnologyRecent Developments

-

Nov 11, 2024 – Siemens integrates NVIDIA GPUs into IPCs for enhanced AI performance.

Feb 21, 2024 – Emerson launches PACSystems IPC 2010, a compact rugged IPC for OEM and IIoT use.

Dec 2024 – Ricoh forms RICOH PFU COMPUTING to centralize IPC and embedded computing operations.

Aaeon, Adlink, and C&T Solution release new mini, fanless, and semi-rugged IPCs targeting edge analytics and factory automation.

Product diversification trends indicate greater AI and edge optimization in industrial PC designs.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=2842&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No: (+1-201971-6302 )

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment