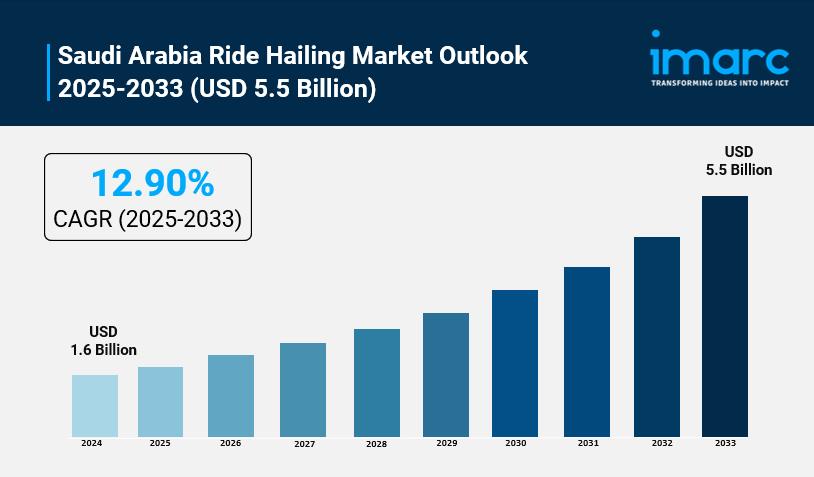

Saudi Arabia Ride Hailing Market Records USD 1.6 Billion In 2024 With Projected 12.90% CAGR Growth

Key Highlights

-

Market size (2024): USD 1.6 Billion

Forecast (2033): USD 5.5 Billion

CAGR (2025–2033): 12.90%

The market is seeing increased digital integration, the adoption of electric vehicles, and a rise in female drivers, driven by Vision 2030 initiatives.

Rapid urbanization, high smartphone penetration, government support, and evolving consumer preferences for convenient and flexible transportation are key drivers.

The economy vehicle type and intracity travel segments dominate the market, with Riyadh accounting for the largest share of trips.

How Is AI Transforming the Ride Hailing Market in Saudi Arabia?

-

Smarter Ride Matching : AI optimizes ride-hailing with algorithms that cut wait times, handling 80.5 million trips via apps, boosting efficiency across Saudi cities.

Female Driver Growth : Vision 2030's reforms empower women, with thousands joining as drivers, enhancing inclusivity and safety in apps like Careem and Wsslini.

Eco-Friendly Fleets : Ride-hailing firms adopt AI to manage electric vehicles, aligning with Saudi's goal of 1-2 million EVs, reducing urban emissions.

Cashless Convenience : AI-driven digital payments, backed by 70% non-cash transactions, streamline rides, aligning with Vision 2030's push for a digital economy.

Job Creation Surge : AI platforms enabled 332,100 Saudi drivers to earn SAR 2.3 billion, supporting Vision 2030's aim to lower unemployment.

Grab a sample PDF of this report : https://www.imarcgroup.com/saudi-arabia-ride-hailing-market/requestsample

Saudi Arabia Ride Hailing Market Trends and Drivers

-

Digitalization Boost : High smartphone penetration and 5G expansion drive seamless ride-hailing app adoption.

Vision 2030 Support : Government reforms promote smart mobility, enhancing ride-hailing infrastructure and regulations.

Female Driver Surge : Post-2018 ban lift, women drivers increase, offering gender-specific services.

Sustainability Focus : Ride-hailing platforms adopt electric vehicles, aligning with Vision 2030's green goals.

Urban Demand Growth : Rapid urbanization and tourism boost demand for convenient ride-hailing solutions.

Saudi Arabia Ride Hailing Industry Segmentation:

The report has segmented the market into the following categories:

Vehicle Type Insights:

-

Two-Wheeler

Passenger Car

Booking Type Insights:

-

Online

Offline

End-Use Insights:

-

Personal

Commercial

Regional Insights:

-

Northern and Central Region

Western Region

Eastern Region

Southern Region

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=33284&flag=E

Recent News and Developments in Saudi Arabia Ride Hailing Market

-

May 2025: Saudi Arabia's Transport General Authority signed a strategic partnership with Uber Technologies to introduce autonomous vehicle (AV) services in the Kingdom. This initiative aligns with the National Transport and Logistics Strategy and Vision 2030, aiming to deploy AVs in urban centers and giga-project zones like NEOM, Riyadh, and Diriyah. The rollout will begin with AVs accompanied by onboard drivers for safety, reflecting a cautious approach to innovation integration.

January 2025: The Saudi Arabia ride-hailing services market reached a size of USD 1.35 billion in 2024, driven by increased smartphone adoption (33.55 million users in 2024) and supportive government regulations implemented in February 2024. These regulations include enhanced service quality requirements and operational efficiency improvements, which foster competition, safety, and investor confidence. There is also a rising trend toward flexible and sustainable transport options, including carpooling and electric vehicles, reflecting growing environmental awareness.

August 2025: Ride-hailing apps in Saudi Arabia completed over 32 million trips in the second quarter of 2025, marking a significant 104% increase from the same period last year. This surge highlights rapid consumer adoption and expanding demand for ride-hailing services across the Kingdom.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment