What Opportunities Lie Ahead For The Latin America Digital Banking Market By 2033?

Download a sample copy of the report: https://www.imarcgroup.com/latin-america-digital-banking-market/requestsample

Key Highlights

-

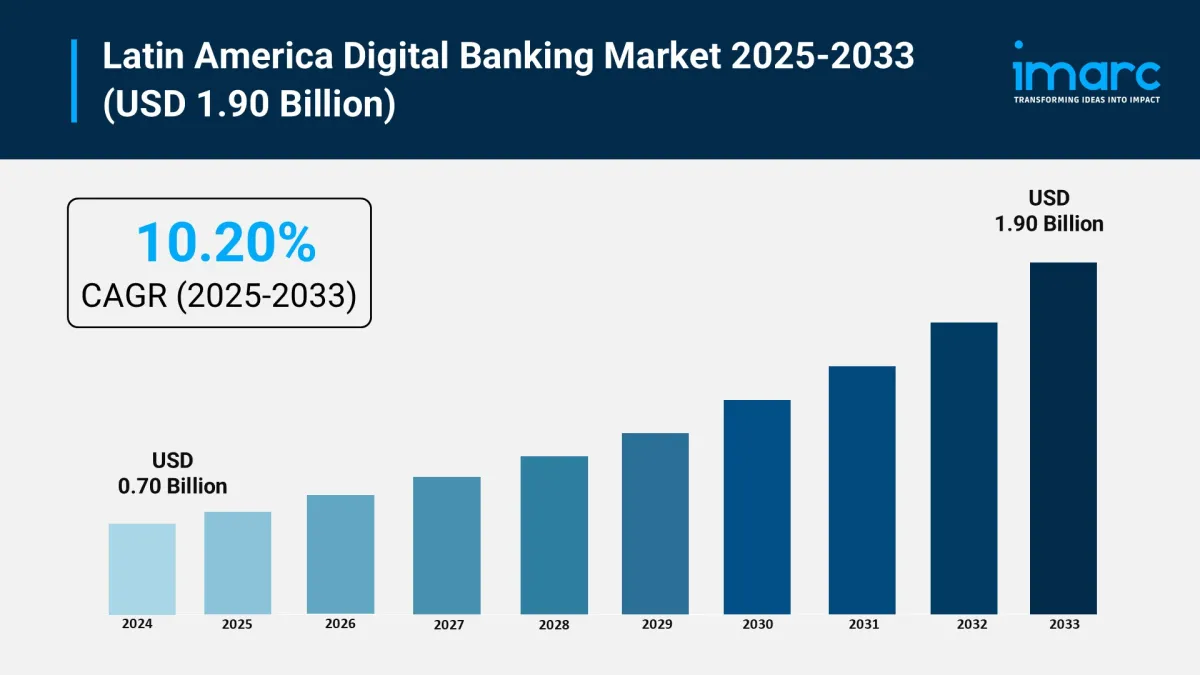

Market size (2024): USD 0.70 billion

Forecast (2033): USD 1.90 billion

CAGR (2025–2033): 10.20%

Smartphone penetration >80% and 4G/5G roll-outs enabling 24/7 mobile banking access

Strategic partnerships between fintech's and incumbents are accelerating digital onboarding for 150 m+ unbanked/under-banked consumers

How Is AI Transforming the Digital Banking Market in Latin America?

AI-enabled platforms are being embedded into digital banking stacks to deliver:

-

Real-time credit scoring and micro-loan approvals using alternative data (phone top-ups, e-commerce history).

Predictive cash-flow insights and AI budgeting nudges to improve financial wellness.

Fraud-prevention engines leveraging biometric KYC and behavioral analytics to cut account-takeover fraud by 35%.

Voice and chatbot assistants offering 24/7 support in Spanish and Portuguese.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=30194&flag=C

Key Market Trends and Drivers

-

Smartphone & Internet Surge: Affordable devices and expanding fiber/5G networks are democratizing access across urban and rural regions

Fintech Start-Up Wave: Customer-centric UX, zero-fee accounts, and instant P2P payments winning Gen-Z and gig-economy users

Regulatory Push: Brazil's PIX, Mexico's Cobro Digital, and open-banking mandates creating cashless ecosystems

Financial Inclusion: Digital wallets and micro-savings products onboarding first-time bank customers at scale

Cross-Border Integration: Mercosur and Pacific Alliance harmonizing payment rails for seamless remittances and e-commerce

Latin America Digital Banking Market Segmentation:

Analysis by Services:

-

Non-Transactional Activities

-

Information Security

Risk Management

Financial Planning

Stock Advisory

-

Cash Deposits and Withdrawals

Fund Transfers

Auto-Debit/Auto-Credit Services

Loans

Analysis by Deployment Type:

-

On-premises

On cloud

Analysis by Technology:

-

Internet Banking

Digital Payments

Mobile Banking

Analysis by Industries:

-

Media and Entertainment

Manufacturing

Retail

Banking

Healthcare

Regional Analysis:

-

Brazil

Mexico

Argentina

Colombia

Chile

Peru

Others

Latin America Digital Banking Market News:

-

In April 2025, Nubank surpassed 100 million LatAm customers and launched an AI-powered“NuFuturo” micro-investment platform with fractional U.S. & LatAm ETFs

Mexico's central bank (Banxico) rolled out an AI-based fraud-detection layer for SPEI (July 2025), reducing real-time payment fraud rates by 42 % within the first quarter of deployment

Colombia's government announced a USD 200 million Digital Financial Inclusion Fund (August 2025) to subsidize AI-driven rural banking agents, targeting 5 million new digital accounts by 2027

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment