Philippines Freight And Logistics Market 2025 Industry Trends, Size, Share, Growth, Demand And Outlook By 2033

| Report Attribute | Key Statistics |

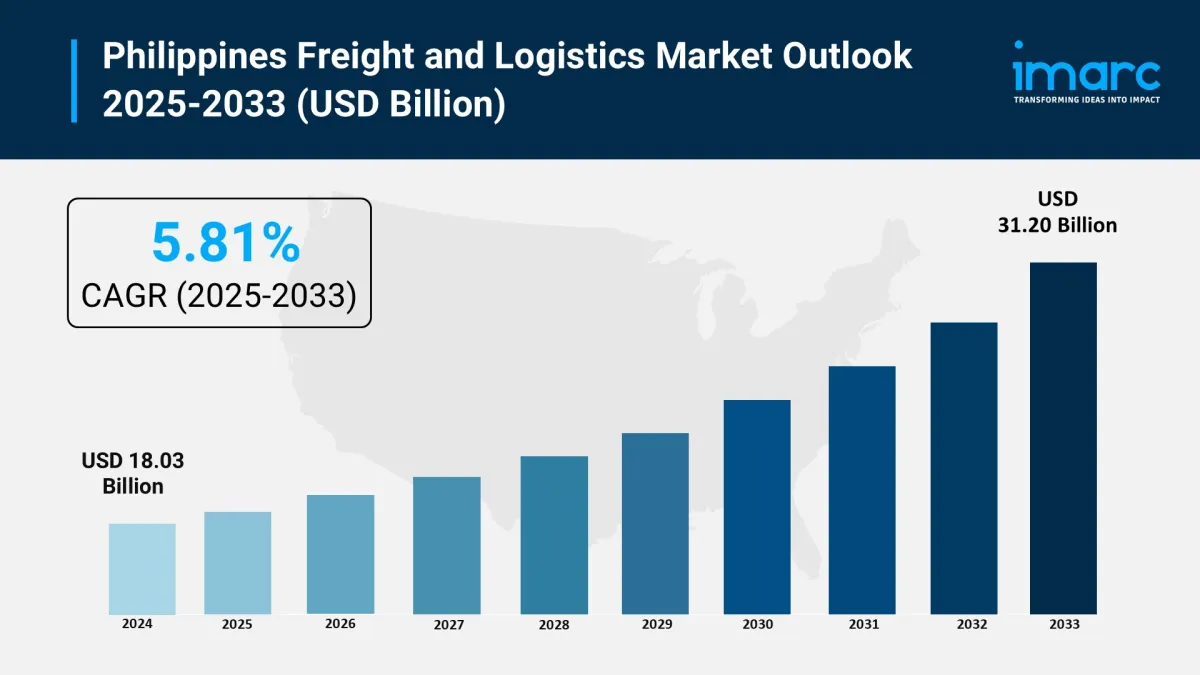

| Base Year | 2024 |

| Forecast Years | 2025-2033 |

| Historical Years | 2019-2024 |

| Market Size in 2024 | USD 18.03 Billion |

| Market Forecast in 2033 | USD 31.20 Billion |

| Market Growth Rate | 5.81% (2025-2033) |

Philippines Freight and Logistics Market Overview:

The freight and logistics market in the Philippines is experiencing strong growth as e-commerce expansion, infrastructure projects, and government initiatives drive demand for efficient logistics solutions. Companies are enhancing distribution strategies and adopting innovative methods to meet the needs of online retail and cross-border trade. Public-private partnerships and the Build Build Build program are improving connectivity, reducing travel times, and attracting foreign investment. There is also heightened demand for cold chain logistics, particularly in food and pharmaceuticals, as consumer preferences shift toward fresh and temperature-sensitive products.

Request For Sample Report: https://www.imarcgroup.com/philippines-freight-logistics-market/requestsample

Philippines Freight and Logistics Market Trends and Drivers:

Logistics providers are incorporating advanced technologies such as fleet management, automation, and port modernization to streamline operations and boost efficiency. The rise of e-commerce is increasing the demand for same-day and last-mile delivery services, prompting investments in distribution centers and partnerships with third-party logistics companies. Cross-border e-commerce is gaining traction, with half of Filipino consumers shopping from international retailers. The market is also seeing growth in temperature-controlled warehousing and advanced cold chain solutions to support the expanding pharmaceutical and agri-food sectors.

Fast urbanization, growing international trade, and the expansion of manufacturing and retail sectors are driving the market. Infrastructure upgrades, including new seaports, airports, and bridges, are improving transportation networks and facilitating smoother supply chain operations. Government policies aimed at trade facilitation and customs streamlining are reducing bottlenecks and aiding delivery times. The rising need for cold chain logistics, driven by increased agricultural exports and pharmaceutical requirements, further supports market growth.

Market Challenges and Opportunities:

The freight and logistics sector in the Philippines faces several structural challenges, including fragmented infrastructure such as congested ports, limited road and rail networks, and outdated facilities. Cumbersome customs procedures and regulatory inefficiencies contribute to delays and higher costs. As an archipelagic nation, transportation across over 7,000 islands further drives up logistics expenses, currently accounting for nearly 27–28% of GDP, the highest in ASEAN.

Despite these hurdles, the industry presents significant opportunities. Growth in e-commerce is fueling demand for efficient last-mile services. Infrastructure investments under government initiatives like“Build, Build, Build,” port and airport upgrades, and public-private partnerships are improving connectivity. The emerging market for cold-chain logistics-especially for perishable goods-and the need for cross-border solutions add further growth potential.

Philippines Freight and Logistics Key Growth Drivers:

-

Rapid expansion of e-commerce and online retail

Infrastructure development and government support

Growth in international trade and exports

Increasing demand for cold chain logistics

Public-private partnerships and foreign investment

Digitalization and adoption of advanced logistics technologies

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/philippines-freight-logistics-market

Philippines Freight and Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on logistics function and end use industry.

By Logistics Function:

-

Courier, Express and Parcel (Destination Type: Domestic, International)

Freight Forwarding (Mode of Transport: Air, Sea and Inland Waterways, Others)

Freight Transport (Mode of Transport: Air, Pipelines, Rail, Road, Sea and Inland Waterways)

Warehousing and Storage (Temperature Control: Non-Temperature Controlled, Temperature Controlled)

Others

By End Use Industry:

-

Agriculture, Fishing and Forestry

Construction

Manufacturing

Oil and Gas

Mining and Quarrying

Wholesale and Retail Trade

Others

By Region:

-

Luzon

Visayas

Mindanao

Competitive Landscape:

-

2GO Group Inc.

LBC Express Holdings Inc.

Air21 (Airfreight 2100 Inc.)

J&T Express Philippines

XDE Logistics Philippines Inc.

Deutsche Post DHL Group

FedEx

UPS

Nippon Yusen (NYK/Yusen Logistics)

PHL Post

Philippines Freight and Logistics Market News:

-

No Freight Rate Increase Amid Infrastructure Repairs (June 2025) – Logistics companies committed to keeping freight rates steady during repairs to the San Juanico Bridge, which connects Samar and Leyte. The Department of Trade and Industry implemented a 60-day price freeze on basic goods in the affected areas.

Fleet Modernization (March 2025) – 2GO Group announced a ₱1.8 billion modernization plan with two new RoRo vessels to improve inter-island cargo services. LBC Express launched an AI-powered route optimization upgrade on its“LBC Connect” platform, cutting metro delivery times by 18%.

Infrastructure Reforms & Digitalization (Ongoing) – The government is pushing infrastructure projects, including the“Build, Build, Build” program, port expansions, and digital customs initiatives like e-invoicing to reduce logistics bottlenecks and enhance operational efficiency.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=28735&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment