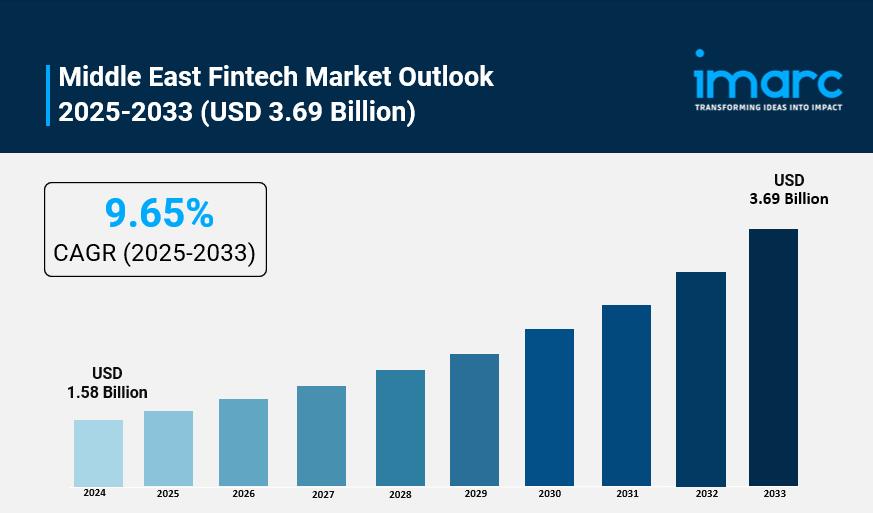

Middle East Fintech Market Size To Surpass USD 3.69 Billion By 2033 With A 9.65% CAGR

Key Highlights

-

Market size (2024): USD 1.58 Billion

Forecast (2033): USD 3.69 Billion

CAGR (2025–2033): 9.65%

Rapid digital payment adoption, BNPL growth, and blockchain integration are transforming the Middle East fintech landscape.

Government initiatives, high smartphone penetration, and unbanked population demand drive fintech expansion across the region.

Digital payments dominate, accounting for over 70% of the market, fueled by e-commerce and cashless economy goals.

How Is AI Transforming the Fintech Market in Middle East?

-

Boosting Investments: Fintech startups like Alaan snagged $48 million to grow AI tools in Saudi Arabia, making expense tracking smoother and helping businesses cut costs effectively.

Government Partnerships: UAE's central bank teamed up with Presight in a joint venture to weave AI into financial systems, enhancing security and efficiency for the whole market.

Digital Banking Advances: Jeel and zypl.ai joined forces to roll out AI-powered banking in Saudi, delivering personalized services that fit local users' needs perfectly.

AI Leadership Moves: Mashreq bank brought on a new head of AI to drive innovative features, like smarter customer interactions, reshaping UAE's fintech landscape.

Smart Investment Tools: BridgeWise launched SignalWise for AI-driven alerts, giving Middle East investors real-time insights to make better decisions with solid data.

Grab a sample PDF of this report : https://www.imarcgroup.com/middle-east-fintech-market/requestsample

Middle East Fintech Market Trends and Drivers

-

Government Support and Regulation: Supportive policies, regulatory sandboxes, and national visions are fostering innovation.

High Mobile and Internet Penetration: Widespread smartphone use drives demand for mobile-first financial solutions.

Youthful, Digital-Savvy Population: A large young demographic is a key driver for digital financial service adoption.

Increased Demand for Digital Payments: Consumers and businesses are embracing cashless transactions and e-wallets.

Financial Inclusion Initiatives: Fintech is bridging the gap for the unbanked and underserved population.

Middle East Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Deployment Mode:

-

On-premises

Cloud-based

Analysis by Technology:

-

Application Programming Interface

Artificial Intelligence

Blockchain

Robotic Process Automation

Data Analytics

Others

Analysis by Application:

-

Payment and Fund Transfer

Loans

Insurance and Personal Finance

Wealth Management

Others

Analysis by End User:

-

Banking

Insurance

Securities

Others

Analysis by Country:

-

Saudi Arabia

Turkey

Israel

United Arab Emirates

Iran

Iraq

Qatar

Kuwait

Oman

Jordan

Bahrain

Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=19909&flag=E

Recent News and Developments in Saudi Arabia Construction Equipment Rental Market

-

June 2024 : Saudi Arabia's construction equipment rental market saw a surge in demand for telematics-enabled machinery, with over 40% of new rentals featuring GPS and IoT-based fleet management systems to optimize fuel efficiency and maintenance schedules.

August 2024 : The adoption of electric and hybrid construction equipment in rental fleets increased by 30%, driven by new sustainability regulations and cost savings from lower fuel consumption and reduced carbon emissions.

October 2024 : AI-powered predictive maintenance tools were integrated into 25% of major rental providers' operations, reducing equipment downtime by up to 20% through real-time diagnostics and automated service alerts.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment