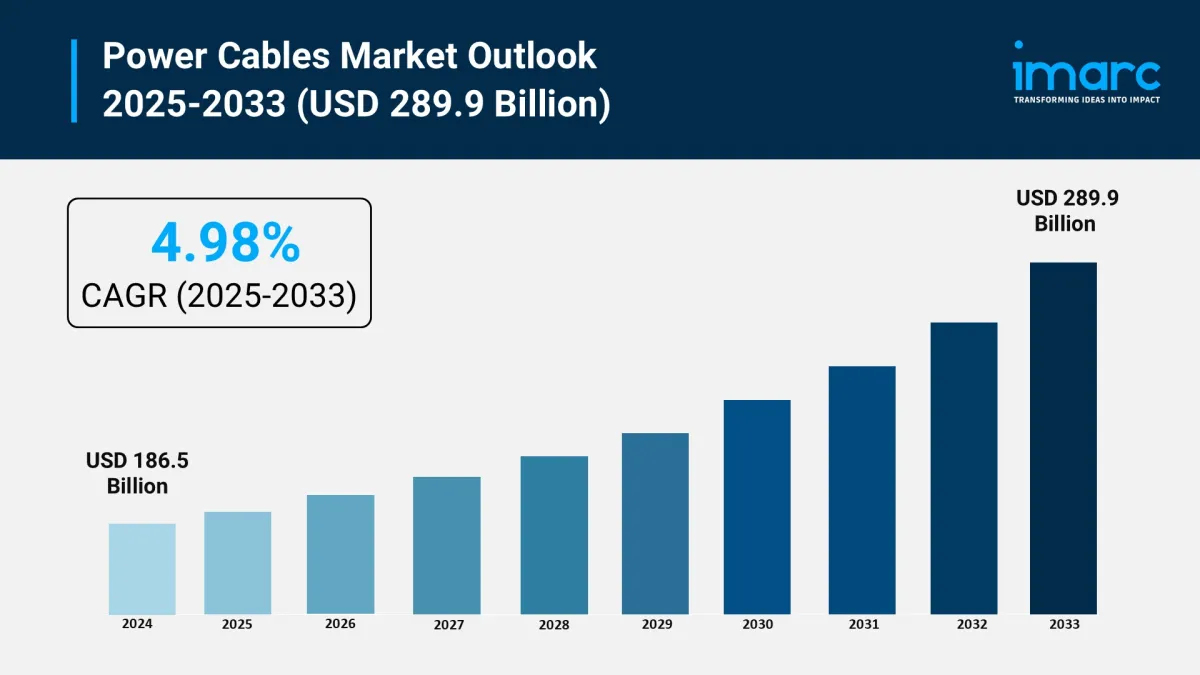

Power Cables Market Size To Reach USD 289.9 Billion, Globally By 2033 At 4.98% CAGR

The power cables market is experiencing rapid growth, driven by surge in renewable energy adoption, rapid urbanization and infrastructure development, and advancements in smart grid technology. According to IMARC Group's latest research publication, “Power Cables Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, The global power cables market size reached USD 186.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 289.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.98% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Claim Your Free“Power Cables Market” Analysis Sample Report Here

Our report includes:

-

Market Dynamics

Market Trends And Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Power Cables Market

-

Surge in Renewable Energy Adoption:

One big driver pushing the power cables industry forward is the massive shift toward renewable energy sources like solar, wind, and offshore wind farms. Governments worldwide are rolling out schemes to hit green energy targets, cutting back on fossil fuels to tackle global warming and protect the environment. For instance, initiatives in countries like China, India, and the U.S. are pouring investments into renewables, which ramps up the need for specialized cables to connect these projects to the grid efficiently. Take Nexans SA-they just inked a two-year deal with MHI Vestas to supply Windlink cable kits for onshore wind turbines across multiple regions, showing how companies are jumping on this bandwagon. Stats wise, the utilities segment leads the market because of new setups for storing and transmitting renewable power, while low voltage cables hold a 43.5% share thanks to their role in residential solar setups. This isn't just about going green; it's creating reliable power networks that handle fluctuating energy from renewables without major losses. Overall, this factor is fueling demand as more nations aim for 100% electrification through clean sources, boosting cable manufacturers who innovate for durability in harsh conditions like offshore setups.

-

Rapid Urbanization and Infrastructure Development:

Urbanization is exploding globally, with folks flocking to cities, which means a ton more buildings, factories, and transport systems-all hungry for electricity. This is supercharging the power cables market as governments and companies invest heavily in infrastructure to keep up. In Asia Pacific, which grabs a 36.22% market share valued at USD 60.96 billion, rapid urban migration in places like India and China is driving huge construction booms, from homes to industrial parks. Government schemes for smart cities and rural electrification are key here, pushing for underground cables to cut down on accidents and power leaks compared to old overhead lines. Company-wise, Prysmian Group's acquisition of Encore Wire Corporation is a prime example, aimed at speeding up electrification in North America. The building and construction segment is growing fast, fueled by economic development, while industrial expansion in oil, gas, mining, and automotive sectors adds to the cable demand for various voltages. It's not just about quantity; these projects need reliable cables to support everything from pharmaceuticals to small-scale manufacturing, ensuring steady power flow in bustling urban areas. This growth factor ties directly into rising energy consumption, making cables essential for modern infrastructure.

-

Advancements in Smart Grid Technology:

The upgrade to smart grids is a game-changer for the power cables industry, as it replaces outdated systems with smarter, more efficient ones that monitor and optimize power in real time. This shift is driven by the need for better grid reliability, especially with rising electricity demands from industries and homes. Governments in Europe and the U.S. are backing this with regulations and funding for energy efficiency, like initiatives to interconnect grids and boost EV adoption. For example, the energy and power segment holds the largest revenue share, thanks to high-voltage cables reducing transmission losses. Company news highlights include Nexans' acquisition of Reka Cables to innovate in production, and TenneT awarding a contract to Jan De Nul Group for high-voltage cables in offshore wind farms. In regions like North America, investments in replacing overhead with underground lines are cutting unmapped usage and enhancing safety. The medium voltage segment dominates due to its wide use in distribution networks, while Asia Pacific's economic expansion adds fuel with urbanization projects. Essentially, smart grids integrate renewables seamlessly, demanding advanced cables that support IoT monitoring and reduce failures-it's all about building resilient power systems for the future.

Key Trends in the Power Cables Market

-

Rise of Superconducting and Advanced Materials:

A cool trend shaking up the global power cables market is the push toward superconducting materials and advanced tech like electron beam cross-linking, which amps up cable performance big time. These superconductors cut transmission losses dramatically and pack more power into slimmer designs, slashing manufacturing costs. For real-world use, think of them in high-demand spots like urban grids or renewable setups, where they handle massive loads without overheating. A concrete example is their deployment in offshore wind farms, connecting turbines to the mainland with minimal energy waste. Numerical insights show the low voltage segment as the biggest, driven by construction and automotive needs, while utilities remain the top end-use for these innovations. Companies like Prysmian Group are leading the charge, offering solutions that boost conductivity using high-purity copper or aluminum. This trend also ties into durability-cross-linking insulation like XLPE at 120°C makes cables tougher against UV and temperature swings, perfect for solar farms. It's making cables smarter and more efficient, helping grids integrate renewables smoothly while keeping things compact and cost-effective for big projects.

-

Shift to Eco-Friendly and Sustainable Cables:

Sustainability is becoming a must in the power cables world, with a big focus on eco-friendly materials like recyclable, low-smoke halogen-free options that cut environmental impact. This trend is all about meeting tough regulations and going green, using stuff like fire-resistant wires to minimize fire risks in buildings or industries. Real-world applications include data centers and smart cities, where companies opt for these to lower carbon footprints-Finolex Cables launched eco-safe FinoGreen wires, expected to make up 5% of their business. Numerical wise, aluminum cables are popular for their lightweight and corrosion resistance, holding strong in overhead transmission with a high conductivity-to-weight ratio. Prysmian Group and Nexans S.A. are innovating with green production, supplying cables for offshore wind and utilities that align with global standards. This isn't just hype; it's practical for harsh environments, like LSZH materials in residential setups reducing smoke in fires. Overall, it's driving the market toward longer-lasting, planet-friendly cables that support electrification without harming the earth, appealing to buyers who prioritize compliance and efficiency.

-

Expansion of HVDC and Smart Cable Technologies:

High-voltage direct current (HVDC) and smart cables are exploding in popularity, transforming how power gets transmitted over long distances with way less loss. HVDC is ideal for linking far-off renewable sources like solar farms to urban grids, ensuring stable energy flow. A solid example is their use in submarine cables for offshore wind projects, where they handle megawatt-scale power efficiently. Smart cables add IoT monitoring for real-time tweaks, boosting grid reliability-think utilities using them to cut failures and optimize flow in industrial automation. Numerical insights highlight the copper segment at USD 12.43 billion, favored for its durability in underground apps, while high voltage grows fast for transmission lines. Companies like Nexans provide these for EV charging and data centers, reducing energy waste in critical systems. In practice, this trend supports industrial electrification, powering automated factories or electric transport. It's making cables more intelligent, with features like enhanced insulation for extreme weather, helping the market adapt to renewables and smart grids while keeping operations smooth and reliable.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=1849&flag=E

Leading Companies Operating in the Global Power Cables Industry:

-

Prysmian S.p.A

Belden Inc.

Encore Wire Corporation

Finolex Cables Ltd.

Fujikura Ltd.

Furukawa Electric Co., Ltd.

HENGTONG GROUP CO., LTD.

KEI Industries Limited

LS Cable & System Ltd.

Leoni AG

Nexans

NKT A/S

Southwire Company, LLC

Sumitomo Electric Industries, Ltd.

TPC Wire & Cable Corp.

Power Cables Market Report Segmentation:

By Installation:

-

Overhead

Underground

Submarine Cables

Overhead represents the largest segment, which can be attributed to the rising need for cost-effective power transmission solutions.

By Voltage:

-

High

Medium

Low

Low holds the biggest market share as it is suitable for smaller-scale projects.

By End-Use Sector:

-

Power

Oil & Gas

Chemical

Manufacturing

Metals & Mining

Infrastructure

Transportation

Others

Power accounts for the largest market share due to the increasing demand for electricity.

By Material:

-

Copper

Aluminum

Aluminum exhibits a clear dominance in the market on account of its recyclable nature.

Regional Insights:

-

North America: (United States, Canada)

Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America: (Brazil, Mexico, Others)

Middle East and Africa

Asia Pacific enjoys a leading position in the power cables market, which can be accredited to rapid urbanization.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment