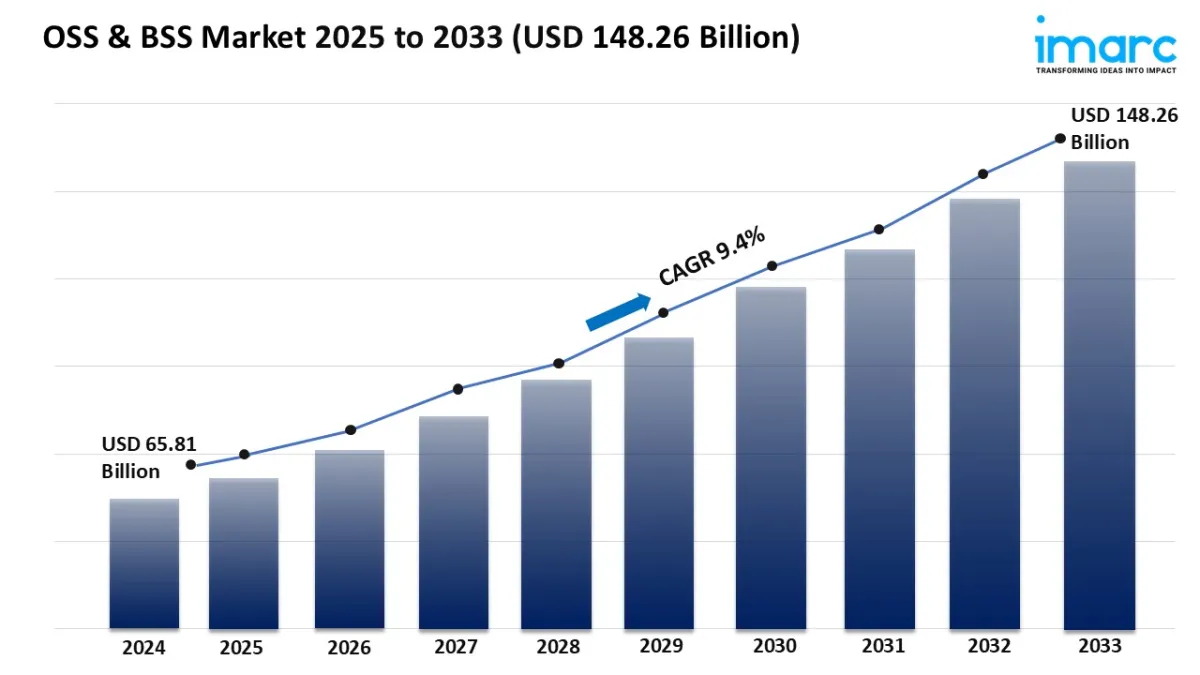

OSS & BSS Market Size To Surpass USD 148.26 Billion By 2033 With A 9.4% CAGR

The OSS & BSS market is experiencing rapid growth, driven by the race to digital transformation, demand for real-time analytics and enhanced customer experience, and government initiatives and cloud adoption. According to IMARC Group's latest research publication, “OSS & BSS Market Size, Share, Trends and Forecast by Component, OSS & BSS Solution Type, Deployment Mode, Organization Size, Industry Vertical, and Region 2025-2033”, the global OSS & BSS market size was valued at USD 65.81 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 148.26 Billion by 2033, exhibiting a CAGR of 9.4% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Claim Your Free“OSS & BSS Market” Insights Sample PDF

Our report includes:

-

Market Dynamics

Market Trends and Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the OSS & BSS Market

-

The Race to Digital Transformation

A major driver in the OSS & BSS space is the global push for digital transformation among telecom and enterprise service providers. As networks get more complex with services spanning 5G, IoT, and cloud, businesses are overhauling aging systems to ensure faster, smarter, and more efficient operations. For instance, more than 60% of deployments now use microservices, enabling over 50% automation and offering 37% quicker problem resolutions with AI-driven solutions. Leading telcos, like Thailand's AIS, are embracing vendors such as Netcracker to streamline billing, revenue tracking, and accelerate launches of new products to market.

-

Demand for Real-Time Analytics and Enhanced Customer Experience

Another major growth factor is the surge in real-time analytics to enable hyper-personalized, seamless customer experiences. Companies recognize that harnessing both structured and unstructured data is vital for optimizing everything from billing to customer support. Modern OSS & BSS solutions leverage AI and big data to power real-time billing, predictive maintenance, and zero-touch provisioning. More than 70% of operators believe their future revenue depends on digital, analytics-driven customer and network management. Investments in tools like Amdocs' Cloud BSS platform show how automation and analytics combine to streamline service deployment and improve customer retention.

-

Government Initiatives and Cloud Adoption

Government-backed digitalization initiatives, especially in countries like India and China, are fast-tracking next-gen OSS & BSS adoption by providing funding, infrastructure, and policy support. These encourage telecom carriers and new market entrants, such as Mobile Virtual Network Operators (MVNOs), to migrate towards cloud-based, cost-effective solutions. With 32% of new OSS & BSS projects now cloud-deployed, operators enjoy scalability and lower upfront investment. Public and private cloud models make advanced OSS & BSS technology accessible, helping even smaller operators deliver competitive, innovative offerings.

Key Trends in the OSS & BSS Market

-

AI-Driven Operations and Automation

There's a clear trend toward integrating artificial intelligence and machine learning in OSS & BSS platforms. These systems now automate service assurance, fault detection, and network optimization, freeing up employees and cutting operational costs. For example, Cerillion's generative AI allows product managers to create catalog configurations and launch new offerings using natural language commands, slashing time-to-market. Across telecom, operators report 60% adoption of zero-touch provisioning-networks that configure and heal themselves with minimal human input.

-

Shift to Cloud-Native and SaaS Models

The move to cloud-native OSS & BSS is revolutionizing how telecom and tech companies work. Cloud-based deployments-including SaaS platforms-now account for a third of new installations, offering rapid deployment, scalability, and cost savings. This not only benefits big carriers but also enables smaller players to compete on customer experience and launch niche offerings without massive upfront investment. Operators have reported reduction in launch cycles from months to weeks thanks to flexible, pay-as-you-go cloud models, driving faster innovation and growth.

-

Expansion Beyond Telco: Cross-Industry Adoption

A striking trend is OSS & BSS technology expanding far beyond telecommunications into sectors like retail, healthcare, and transportation. Retail and e-commerce are adopting telecom-grade billing and real-time catalog management to run loyalty programs, dynamic pricing, and omnichannel experiences-growing at more than 20% in recent years. The flexible, modular nature of today's platforms allows for rapid customization, further fueling use cases in areas like public transit information displays and patient management-all while leveraging the same robust, scalable OSS & BSS systems that underpin global telecom networks.

Leading Companies Operating in the OSS & BSS Industry:

-

Amdocs

Cisco Systems Inc

Comarch SA

Hewlett Packard Enterprise Development LP

Huawei Technologies Co. Ltd

Infosys Limited

Netcracker Technology Corporation (NEC Corporation)

Nokia Corporation

Oracle Corporation

Suntech S.A.

Telefonaktiebolaget LM Ericsson

OSS & BSS Market Report Segmentation:

By Component:

-

Solution

Services

In 2024, the solution segment leads the market with 62.4% share, driven by billing and revenue management systems, with Netcracker Technology recognized for its innovative OSS/BSS solutions.

By OSS & BSS Solution Type:

-

Network Planning and Design

Service Delivery

Service Fulfillment

Service Assurance

Billing and Revenue Management

Network Performance Management

Customer and Product Management

Others

Network planning and design dominate with 19.3% market share in 2024, enabling effective infrastructure planning and peak performance, as highlighted by Netcracker's top vendor position.

By Deployment Mode:

-

On-premises

Cloud-based

The on-premises segment leads with 62.4% market share in 2024, driven by data security and compliance concerns, with Amdocs collaborating with Microsoft to enhance cloud-native solutions.

By Organization Size:

-

Small and Medium-sized Enterprises

Large Enterprises

Large enterprises hold a 62.4% market share in 2024 due to their substantial resources and need for scalable OSS/BSS solutions that manage complex networks effectively.

By Industry Vertical:

-

IT and Telecom

BFSI

Media and Entertainment

Retail and E-Commerce

Others

The IT and telecom sector leads with 61.8% market share in 2024, utilizing OSS/BSS solutions for operational efficiency and customer experience, exemplified by Vivo's automation of its B2B processes.

Regional Insights:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

In 2024, North America dominates the OSS/BSS market with over 35.6% share, driven by advanced technology and a focus on digital transformation, as seen in Etiya's support for Fizz's expansion in Canada.

Research Methodology:

The report employs a comprehensive research methodology , combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability .

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment