403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

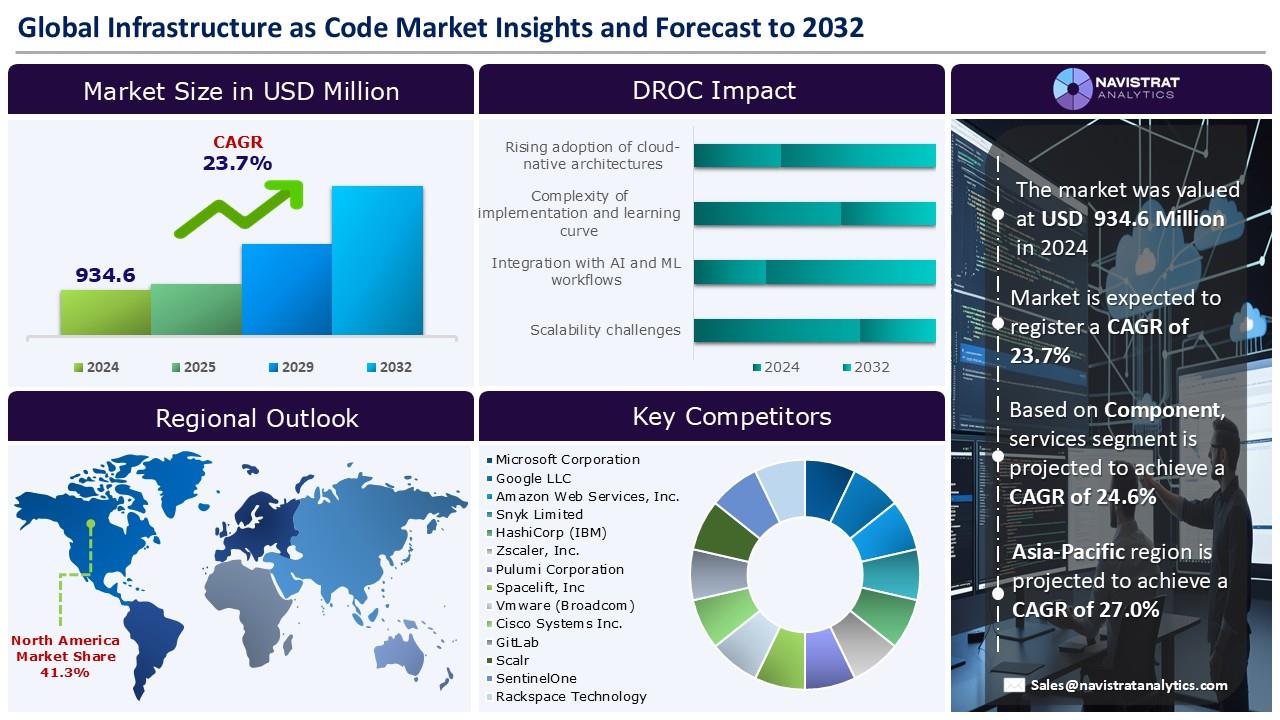

Infrastructure as Code Market Size to Reach USD 4,811.9 Million in 2032

(MENAFN- Navistrat Analytics) July 16, 2025 - The growing adoption of DevOps practices is playing a crucial role in accelerating the revenue growth of the global Infrastructure as Code (IaC) market. Modern organizations are placing greater emphasis on automation, scalability, and operational efficiency within their software development and deployment workflows. As DevOps centers around continuous integration and continuous delivery (CI/CD), it necessitates consistent and repeatable infrastructure provisioning—an area where IaC tools are essential.

In April 2025, StackGen, a leading player in generative infrastructure, partnered with Google Cloud Platform (GCP) to make its cutting-edge platform available through the Google Cloud Marketplace. This strategic collaboration empowers DevOps and Platform Engineering teams to enhance cloud adoption, optimize developer operations, automate GCP migrations, and streamline governance by leveraging StackGen’s advanced Generative Infrastructure capabilities.

However, the complexity of implementation and the steep learning curve are major obstacles hindering the revenue growth of the Infrastructure as Code (IaC) market. Successfully deploying IaC solutions requires advanced knowledge of programming, cloud environments, configuration management tools, and version control systems—skills that can be scarce in organizations with limited technical resources or smaller IT teams. Moreover, shifting from traditional infrastructure management to a fully automated, code-centric approach involves significant changes in workflows, tools, and team competencies.

Want to Know What’s Fueling the Infrastructure as Code Market Growth?

Get Exclusive Report Insights Here:

Segments Market Overview and Growth Insights:

Based on type, the infrastructure as code market is segmented into Imperative IaC and Declarative IaC.

The declarative Infrastructure as Code (IaC) segment held the largest market share in 2024, driven by its ability to streamline infrastructure management by enabling users to define the desired end-state of systems rather than outlining each implementation step. This methodology enhances operational efficiency, minimizes configuration errors, and ensures greater system consistency. It is particularly favored by enterprises embracing DevOps practices, cloud-native architectures, and multi-cloud environments.

The shift toward declarative models has been propelled by tools such as Terraform and AWS CloudFormation. These tools allow users to specify infrastructure outcomes through configuration files, automating the underlying processes required to achieve those outcomes. Terraform introduced the concept of state files for effective resource tracking and scalability, while CloudFormation leveraged JSON and YAML templates for declarative management of AWS resources. Both platforms have successfully addressed the limitations of traditional imperative approaches.

Regional Market Overview And Growth Insights:

Market in North America accounted for largest revenue share in 2024 due to the strong focus on digital transformation, cloud integration, and automation in the region, particularly in the U.S. and Canada. According to a recent survey nearly 40% of U.S. employees utilize some form of automated management in their workplaces, with 34% receiving automated schedule assignments and 32.4% having tasks distributed through automated systems. As organizations across North America increasingly emphasize scalability, operational efficiency, and cost optimization, Infrastructure as Code (IaC) solutions have become critical for automating and managing complex infrastructure deployments.

Competitive Landscape and Key Competitors:

The Infrastructure as Code market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the market report are:

o Microsoft Corporation

o Google LLC

o Amazon Web Services, Inc.

o Snyk Limited

o HashiCorp (IBM)

o Zscaler, Inc.

o Pulumi Corporation

o Spacelift, Inc

o Vmware (Broadcom)

o Cisco Systems Inc.

o GitLab

o Scalr

o SentinelOne

o Rackspace Technology

Buy Your Exclusive Copy Now:

Major Strategic Developments By Leading Competitors:

System Initiative: On September 25, 2024, System Initiative unveiled its revolutionary DevOps automation technology—an intuitive, robust, and collaborative solution that redefines and extends beyond conventional Infrastructure as Code practices. This cutting-edge SaaS platform sets the stage for significant innovation across the enterprise technology landscape. Now available to DevOps engineers worldwide, it offers a generous free tier, transparent usage-based pricing, and active support from a diverse open-source community.

Volumez: On July 10, 2024, Volumez—a next-generation provider of cloud-aware data infrastructure—announced the successful completion of its USD 40 million Series A funding round. The round was led by Koch Disruptive Technologies (KDT), with participation from new investors including Samsung Venture Investment Corporation and J-Ventures, as well as ongoing support from existing backers Pitango First and Viola Ventures.

Unlock the Key to Transforming Your Business Strategy with Our Infrastructure as Code Market Insights –

• Download the report summary:

• Request customization:

Navistrat Analytics has segmented global infrastructure as code market on the basis of component, type, infrastructure, deployment, end-use and region:

• Component Outlook (Revenue, USD Million; 2022-2032)

o Tools

o Services

• Type Outlook (Revenue, USD Million; 2022-2032)

o Imperative IaC

o Declarative IaC

• Infrastructure Outlook (Revenue, USD Million; 2022-2032)

o Mutable IaC

o Immutable IaC

• Deployment Outlook (Revenue, USD Million; 2022-2032)

o Cloud

o On-Premises

• End-Use Outlook (Revenue, USD Million; 2022-2032)

o IT & Telecommunication

o Banking, Financial Services, and Insurance (BFSI)

o Healthcare

o Retail

o Government

o Manufacturing

o Energy and Utilities

o Others

• Regional Outlook (Revenue, USD Million; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

Get a preview of the complete research study:

In April 2025, StackGen, a leading player in generative infrastructure, partnered with Google Cloud Platform (GCP) to make its cutting-edge platform available through the Google Cloud Marketplace. This strategic collaboration empowers DevOps and Platform Engineering teams to enhance cloud adoption, optimize developer operations, automate GCP migrations, and streamline governance by leveraging StackGen’s advanced Generative Infrastructure capabilities.

However, the complexity of implementation and the steep learning curve are major obstacles hindering the revenue growth of the Infrastructure as Code (IaC) market. Successfully deploying IaC solutions requires advanced knowledge of programming, cloud environments, configuration management tools, and version control systems—skills that can be scarce in organizations with limited technical resources or smaller IT teams. Moreover, shifting from traditional infrastructure management to a fully automated, code-centric approach involves significant changes in workflows, tools, and team competencies.

Want to Know What’s Fueling the Infrastructure as Code Market Growth?

Get Exclusive Report Insights Here:

Segments Market Overview and Growth Insights:

Based on type, the infrastructure as code market is segmented into Imperative IaC and Declarative IaC.

The declarative Infrastructure as Code (IaC) segment held the largest market share in 2024, driven by its ability to streamline infrastructure management by enabling users to define the desired end-state of systems rather than outlining each implementation step. This methodology enhances operational efficiency, minimizes configuration errors, and ensures greater system consistency. It is particularly favored by enterprises embracing DevOps practices, cloud-native architectures, and multi-cloud environments.

The shift toward declarative models has been propelled by tools such as Terraform and AWS CloudFormation. These tools allow users to specify infrastructure outcomes through configuration files, automating the underlying processes required to achieve those outcomes. Terraform introduced the concept of state files for effective resource tracking and scalability, while CloudFormation leveraged JSON and YAML templates for declarative management of AWS resources. Both platforms have successfully addressed the limitations of traditional imperative approaches.

Regional Market Overview And Growth Insights:

Market in North America accounted for largest revenue share in 2024 due to the strong focus on digital transformation, cloud integration, and automation in the region, particularly in the U.S. and Canada. According to a recent survey nearly 40% of U.S. employees utilize some form of automated management in their workplaces, with 34% receiving automated schedule assignments and 32.4% having tasks distributed through automated systems. As organizations across North America increasingly emphasize scalability, operational efficiency, and cost optimization, Infrastructure as Code (IaC) solutions have become critical for automating and managing complex infrastructure deployments.

Competitive Landscape and Key Competitors:

The Infrastructure as Code market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the market report are:

o Microsoft Corporation

o Google LLC

o Amazon Web Services, Inc.

o Snyk Limited

o HashiCorp (IBM)

o Zscaler, Inc.

o Pulumi Corporation

o Spacelift, Inc

o Vmware (Broadcom)

o Cisco Systems Inc.

o GitLab

o Scalr

o SentinelOne

o Rackspace Technology

Buy Your Exclusive Copy Now:

Major Strategic Developments By Leading Competitors:

System Initiative: On September 25, 2024, System Initiative unveiled its revolutionary DevOps automation technology—an intuitive, robust, and collaborative solution that redefines and extends beyond conventional Infrastructure as Code practices. This cutting-edge SaaS platform sets the stage for significant innovation across the enterprise technology landscape. Now available to DevOps engineers worldwide, it offers a generous free tier, transparent usage-based pricing, and active support from a diverse open-source community.

Volumez: On July 10, 2024, Volumez—a next-generation provider of cloud-aware data infrastructure—announced the successful completion of its USD 40 million Series A funding round. The round was led by Koch Disruptive Technologies (KDT), with participation from new investors including Samsung Venture Investment Corporation and J-Ventures, as well as ongoing support from existing backers Pitango First and Viola Ventures.

Unlock the Key to Transforming Your Business Strategy with Our Infrastructure as Code Market Insights –

• Download the report summary:

• Request customization:

Navistrat Analytics has segmented global infrastructure as code market on the basis of component, type, infrastructure, deployment, end-use and region:

• Component Outlook (Revenue, USD Million; 2022-2032)

o Tools

o Services

• Type Outlook (Revenue, USD Million; 2022-2032)

o Imperative IaC

o Declarative IaC

• Infrastructure Outlook (Revenue, USD Million; 2022-2032)

o Mutable IaC

o Immutable IaC

• Deployment Outlook (Revenue, USD Million; 2022-2032)

o Cloud

o On-Premises

• End-Use Outlook (Revenue, USD Million; 2022-2032)

o IT & Telecommunication

o Banking, Financial Services, and Insurance (BFSI)

o Healthcare

o Retail

o Government

o Manufacturing

o Energy and Utilities

o Others

• Regional Outlook (Revenue, USD Million; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

Get a preview of the complete research study:

Navistrat Analytics

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment