Mexico's Ongoing Rate Reducing Mission Presents Opportunity

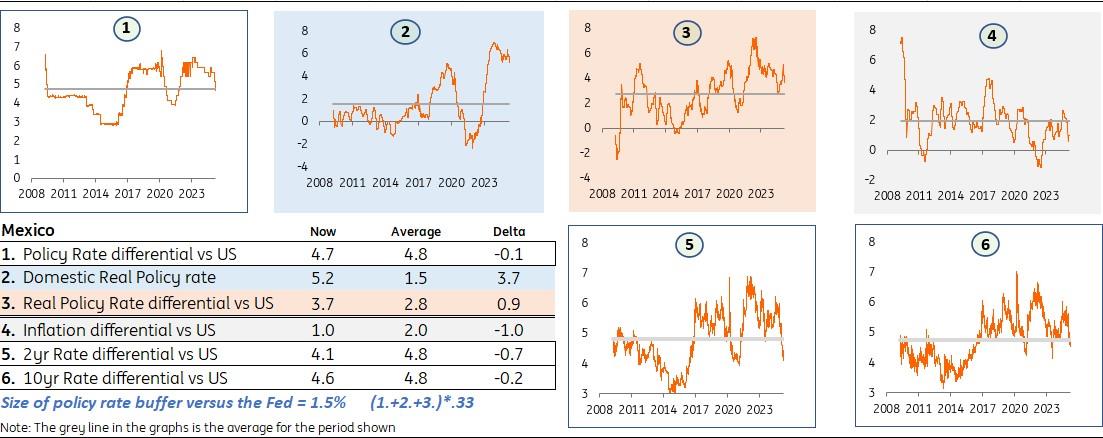

The Bank of Mexico (Banxico) has cut, and our models show room for more cuts ahead. Our calculation of the interest rate buffer versus neutrality is now 1.5%. This is based off an equally weighted combination of the nominal rate differential versus the Fed funds rate, the real rate differential versus the US and the Mexican real policy rate. The buffer widens when the Fed funds rate falls, Mexican inflation falls or US inflation rises. Of late, the Fed has not changed rates and US inflation has not shown much change, but Mexican inflation has managed to dip below the 4% ceiling in recent months. That dip in Mexican inflation has managed to offset the last 50bp rate cut, making room for delivery of the latest 50bp cut.

Ahead, there are two key factors that can facilitate further rate cuts. The first is the aforementioned interest rate buffer. This is something that Banxico can choose to eat into. The constraint is Banxico's tendency to prefer to have a decent buffer, which acts as a protective factor for the Mexican peso (peso). In turn, appetite for cuts is premised on a degree of confidence that the peso can "take the cut". Lately the peso has shown the type of resilience that Banxico likes to see. The second factor is an expectation for the Federal Reserve to cut rates. Some 75bp of cuts are discounted, but starting later in 2025. We think from September. That helps, but ideally needs to be sooner.

That leaves Banxico with just the "ease into the buffer" rationale for cuts in the next few meetings. And as they cut, that buffer shrinks, unless offset by lower Mexican inflation. This could argue for a slowing in cuts, to say 25bp. Or even a stalling should the peso start to feel the heat from the tariff talk out of the US. However, Banxico seems confident that it can repeat the 50bp cutting sequence ahead, citing an approach to the 3% inflation target. Achieving that would absolutely help. Lower Mexican inflation directly helps to sustain the buffer versus the US, facilitating cuts. We think two more 50bp cuts, and then its gets a bit more dicey. After that, for more, the Fed needs to cut and/or Mexician inflation needs to head to 3%.

To assess forward capacity for Banxico to cut, we start with the base to be set by the Federal Reserve. This is around 3.6% (75bp of cuts to come). Based off the average spread to the funds rate in the past decade and a half, that would imply a target of 8% for the Banxico policy rate. While that seems high versus the average Banxico rate of 6% in the past decade and a half, remember that the average Fed funds rate was 1.2% over the same period. If 3% inflation is actually delivered, then the case for getting below 8% builds, while maintaining an interest rate safety buffer of no lower than 1%. We settle on a target of 7.75% for Banxico. The market is closer to 7% now, post Banxico.

Here's how we calculate the interest rate buffer versus neutralityAnd we also show how Mexico market rates have been doing versus SOFR

Source: Macrobond, ING estimates An analysis of market rates, and the lock-in opportunities

The current swap curve has a bottoming formation in the area of 8%, extending then to 8.5% in the 10yr (graph 2 below). The forwards discount a dip below 8% on the front end, and we tend to agree, settling on a 7.75% bottom. To get lower than this we'd likely need the US to go into a recessionary tendency, to drive the funds rate even lower than currently discounted. Without that, there will be resistance to the 10yr making a material move lower from here. Any expectation of getting to say 8% would require a bigger rate cutting tendency, to help pull the front end lower and maintain some semblance of a curve.

Beyond that, we have two states for the medium-term Banxico rate. The first is an averaging tendency at around 8% (the neutral rate). The second is a move lower in that neutral rate to 7.5% in the longer term, reflecting a tendency for the credit perception of Mexico to improve over time. Note, however, that these are average tendencies (graph 3 below). What we don't have are anticipated spikes above and below, mostly as these cannot be anticipated with accuracy. Potential spikes to the upside are of particular concern for both asset managers and liability managers. The carry calculations we make for fixed rate payers don't have such spikes in the price, so the identified carry costs are super conservative.

For fixed rate payers set today, 3yr and 5yr carry are positive in impact, and maintain that positivity in cumulative terms even as Banxico cuts to 7.75% (during which there is a dip into negative carry on the per annum calculations). For the 10yr payer, there is impact positive carry, but that morphs to negative carry thereafter, on a theory that in the medium term the 3mth rate trends in the 8% area. This results in a consistent negative carry outcomes over time, and growing cumulative negative carry. While this may look off-putting, it does not factor in the whole point of locking in – protection against market rate spikes. Should such spikes occur (and they tend to happen), the carry can quickly swing positive.

Mexico interest rate environment and the prognosis aheadBelow we set fixed rate payers, and calculate carry based off our outlook for floating rates

Source: Macrobond, ING estimates Mexico in terms of spread to the US, in cross currency circumstancesSpreads to SOFR are now much tighter than they've been. Previous wides have been around 550bp (2024) and before that 650bp (2021), while now we are in sub 450bp territory. For liability managers looking to swap peso liabilities into USD, the interest rate saving is now 4.3% in the 5yr, and the breakeven FX rate to the peso is 25.4.

There is a game of risk/reward here. On swapping peso liabilities to dollars there is an interest rate saving, and currently the peso looks reasonably stable. Our FX team has it trending to the 22 area. The risk here is it could be worse for the peso should a tariff war with the US become a real thing. For now we're downsizing that risk, reflecting the view the Mexico remains a viable and tolerable friend-shoring candidate.

On the other side, where the swap is from dollar liabilities to the peso, then the advantage is a much lower increase in interest rate costs relative to recent history. The average spread in the past 15 years is around 4.75%, and in the past 5 years it's been in the 5.25% area. Whereas now, its in the 4.3% area. Also, this strategy acts as a peso hedge, in the sense that it benefits should the peso weaken dramatically (in fact, the weaker the better).

Mexico versus SOFR and the spreads environmentWe show spreads (incl. basis) and the FX forward breakeven profile

Source: Macrobond, ING estimatesBottom line, Mexican market rates have been much lower historically. But that history includes periods where the Fed funds rate has effectively been at zero (GFC / pandemic). Mexican market rates currently have an 8% handle (extending to 8.5%). We view 7.75% as a viable target for Banxico. To get lower, we'd need to see a much deeper rate cutting tendency out of the US.

Post Banxico, the market has deepened its discount for the official rate down to 7%. Not impossible, but would require Banxico to get comfortable with a narrowing in its interest rate cushion to the US to 0.5% (currently 1.5%), where that cushion refers to deviation versus the neutral spread to the US.

Improved Mexican fundamentals can help, but the largest obstacle remains the issue of US tariff policy. While we are not painting this as hugely negative for Mexico (as a friend-shoring option), it's also cannot be construed as a positive impulse.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment