Is Bitcoin's Bull Market Making A Comeback? Discover The Signs!

Is Bitcoin's Bull Market Truly Back?

After a significant selloff that saw Bitcoin prices plummet from over $100,000 to below $80,000, the recent price surge is prompting traders to consider whether Bitcoin 's bullish momentum has genuinely returned or if this is just a temporary recovery before further market declines.

Is Bitcoin at a Local Bottom or Just Experiencing a Pause?The recent downturn in Bitcoin was substantial enough to shake investor confidence, yet not so severe as to disrupt the overall macro trend. Current prices appear to have established a local bottom within the $76K to $77K range, with various dependable indicators beginning to affirm these lows and suggest potential upward movement.

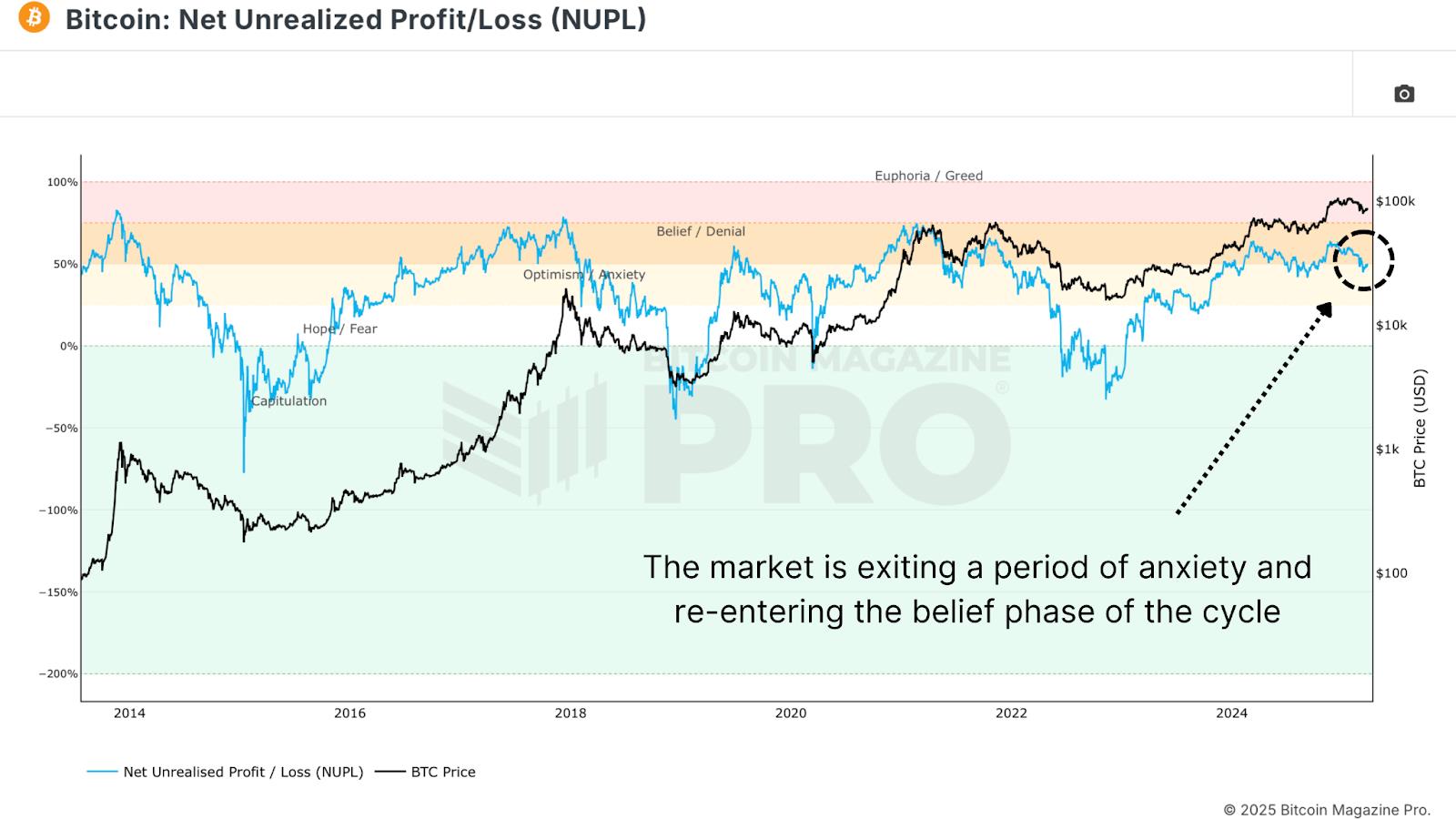

One of the most dependable sentiment indicators in Bitcoin cycles is the Net Unrealized Profit and Loss (NUPL) . As the price experienced a downturn, NUPL dipped into the“Anxiety” zone. However, following the latest rebound, NUPL has returned to the“Belief” territory-an essential shift in sentiment historically linked to macro higher lows.

Figure 1: The NUPL indicates a bullish rebound in sentiment. View Live Chart

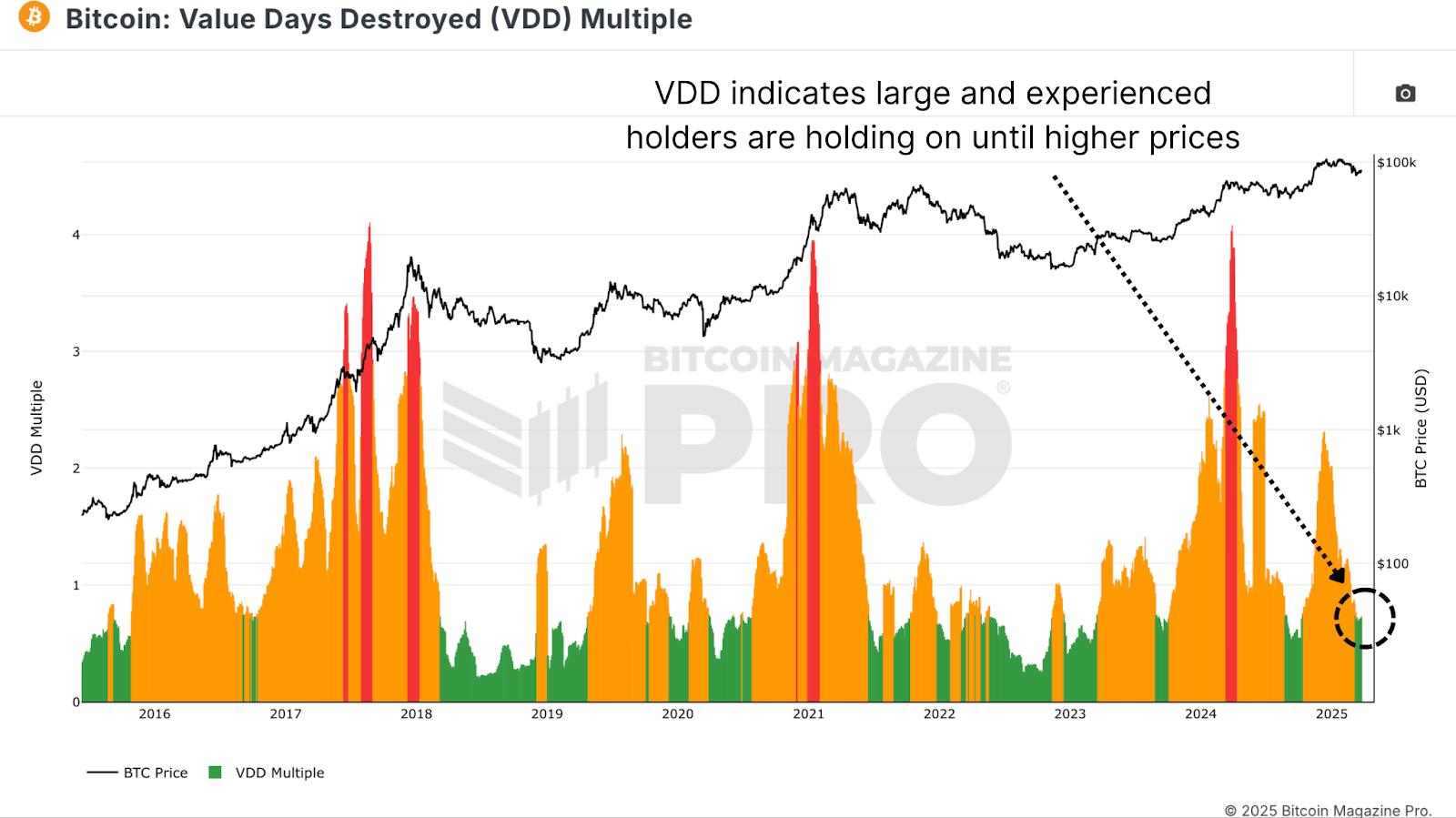

The Value Days Destroyed (VDD) Multiple measures Bitcoin transactions based on the age of coins and the size of transactions, comparing this data against prior yearly averages. Current metrics have reset to low levels, indicating that large, older coins are being retained rather than moved. This serves as a strong sign of conviction from savvy investors. Similar behaviors were observed prior to significant price rallies during the bull cycles of 2016/17 and 2020/21.

Figure 2: The largest and most experienced Bitcoin holders have stopped selling. View Live Chart Long-Term Holders Support Bitcoin's Bull Market

Currently, we are witnessing a rise in the Long-Term Holder Supply . Following profit-taking actions above the $100,000 mark, long-term investors are now returning to accumulate at lower price levels. Historically, such accumulation phases have laid the groundwork for supply constraints and subsequent explosive price movements.

Figure 3: Long-Term Holder Bitcoin supply is rapidly increasing. View Live Chart Hash Ribbons Indicate a Bull Market Signal

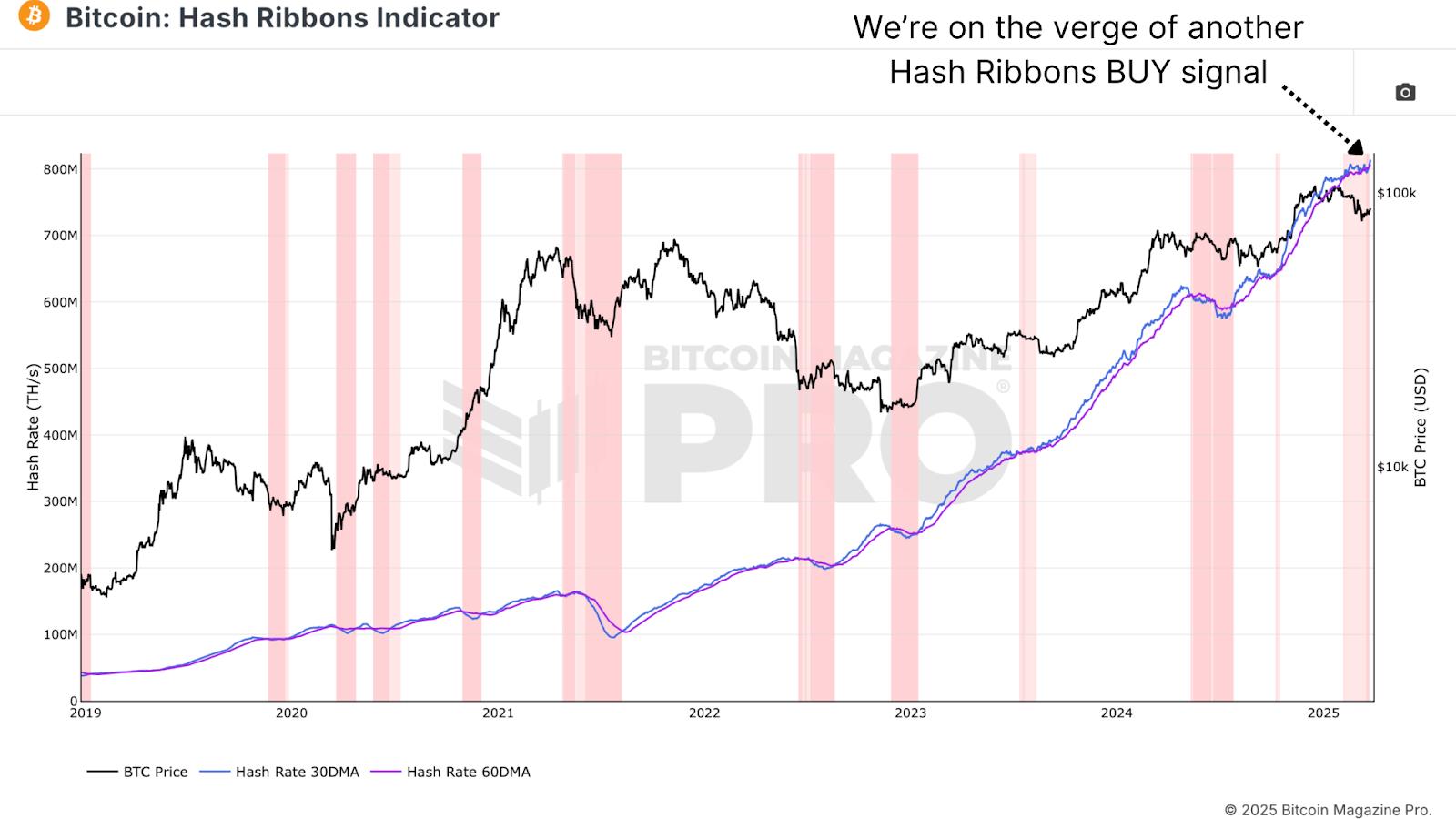

The Hash Ribbons Indicator has recently experienced a bullish crossover, where the short-term hash rate surpasses the longer-term average. Historically, this indication has coincided with market bottoms and trend reversals. Since miners typically mirror profitability expectations, this crossover implies that they are anticipating higher prices in the near future.

Figure 4: Bitcoin miners are becoming bullish once again. View Live Chart Bitcoin's Bull Market Linked to Stock Performance

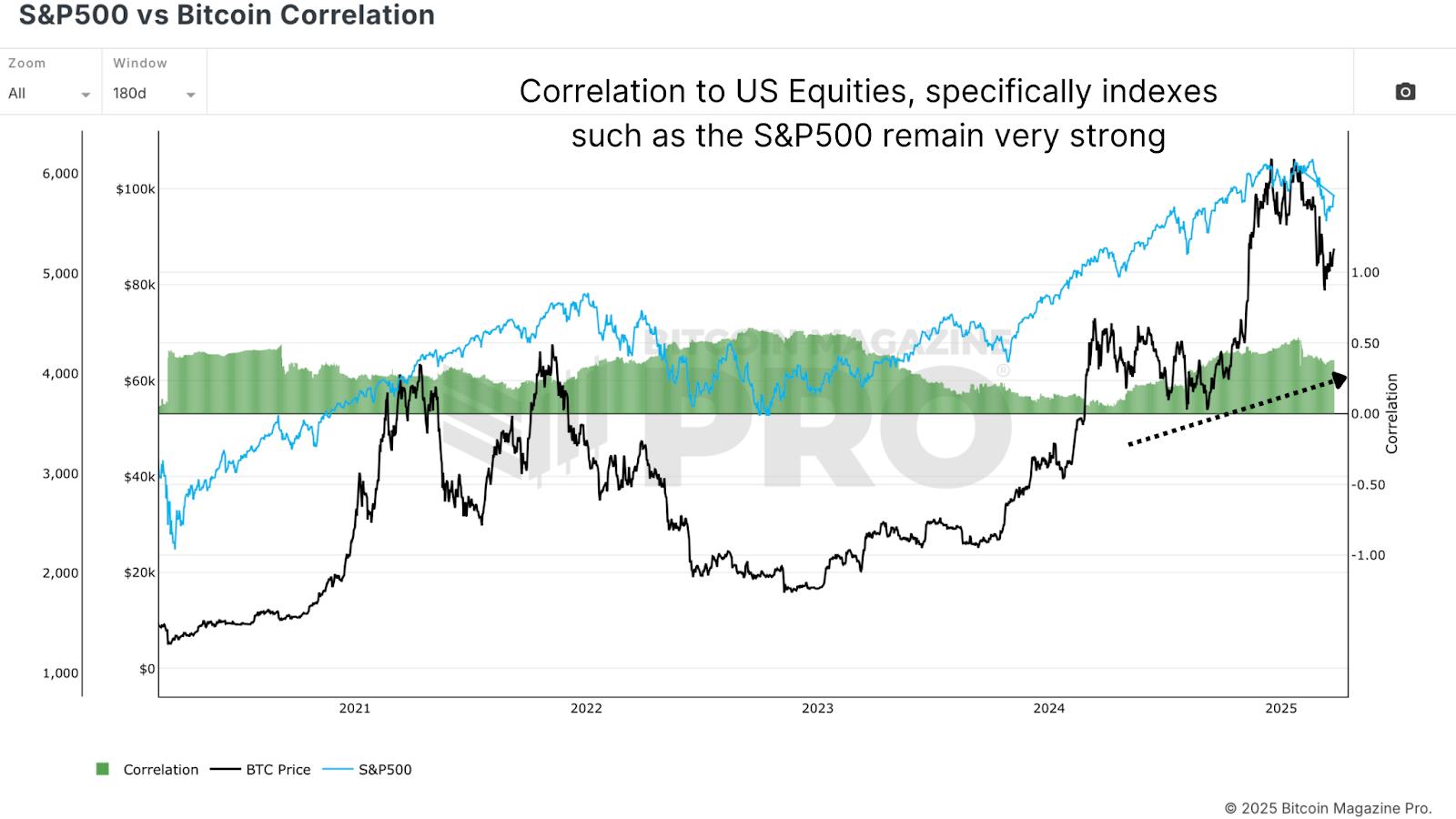

Despite the positive indicators within the blockchain data, Bitcoin remains significantly influenced by macroeconomic factors and the stock markets, especially the S&P 500 . As long as this correlation persists, Bitcoin will continue to be affected by global monetary policies, risk appetite, and liquidity flows. While expectations of interest rate reductions have contributed to a rebound in risk assets, any sudden market reversal could introduce volatility for Bitcoin .

Figure 5: BTC remains highly correlated to US Equities. View Live Chart Future Outlook for Bitcoin's Bull Market

From an analytical standpoint, Bitcoin seems well-prepared for a continued bullish phase. On-chain analysis reveals a strong narrative supporting the resilience of the Bitcoin bull market. The recent shift in the Net Unrealized Profit and Loss (NUPL) from“Anxiety” during the downturn to“Belief” following the price recovery is often indicative of macro higher lows. In conjunction with this, the Value Days Destroyed (VDD) Multiple has dropped to levels reflecting the conviction among long-term holders, mirroring patterns observed before significant price surges in previous bull cycles.

Additionally, the recent bullish crossover of the Hash Ribbons Indicator points to an increasing confidence among miners regarding Bitcoin 's profitability, a historically reliable signal of potential trend reversals. This accumulation phase may suggest that the Bitcoin bull market is on the verge of a supply squeeze, akin to movements observed in past market performances. Collectively, these data points highlight resilience, as long-term holders capitalize on the latest price dip. However, this momentum is contingent not only on these metrics but also on external macroeconomic influences.

Nevertheless, the current macro landscape necessitates a watchful approach, as Bitcoin 's bull market does not exist in isolation. Bull markets require time to gather steam, frequently depending on consistent accumulation and favorable conditions to secure the next upward movement. Although the local support around $76K to $77K appears robust, the road ahead may not be characterized by swift upward movement or extreme euphoria. Bitcoin 's correlation with the S&P 500 and prevailing global liquidity trends suggests that shifts in monetary policy or changing risk sentiment could lead to renewed volatility.

For instance, even though expectations of interest rate cuts have provided support to risk assets, a sudden shift-potentially driven by inflationary pressures or geopolitical tensions-could challenge Bitcoin 's stability. As a result, while on-chain indicators suggest a robust framework, the forthcoming phase of Bitcoin 's bull market will likely evolve gradually. Traders hoping for a swift return to six-figure prices must exercise patience as the market seeks to establish a solid foundation.

If you're looking for more in-depth analysis and real-time data, consider visiting Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Always conduct your own research before making investment decisions.

This post Is Bitcoin's Bull Market Truly Back? first appeared on Bitcoin Magazine and is authored by Matt Crosby .

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk.

Don't invest unless you're prepared to lose all the money you invest.

This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment