Exploring USDT On Lightning: Benefits, Drawbacks, And Untold Insights

USDT on Lightning: the Good, the Bad, and the Unknown

Many are familiar with the oft-quoted phrase,“May you live in interesting times ,” sometimes described as a curse in light of its complex implications. It carries a weighty influence, appealing to those with a penchant for the profound. However, have you ever pondered the other side of this narrative?

As indicated in the Anglo-Saxon Chronicle , there were lengthy periods in history-nearly two hundred years-marked by stagnation. To borrow from Vivian Mercier's famous critique of Waiting for Godot, it's“a play in which nothing happens, twice.” If it's an option between mundane silence or chaotic dynamism, I'd embrace the latter every time.

We find ourselves in precisely such dynamic times now. Tether , known for its stablecoin USDT , is about to integrate with the Lightning Network . Recent discussions have highlighted the function of Lightning as the universal language within the Bitcoin economy and its role as a formidable medium of exchange (and trust us; it genuinely is-check our report).

These concepts are now intersecting. By functioning as a common framework, Lightning facilitates Bitcoin 's interaction with various complementary technologies, including USDT. This integration is poised to propel Bitcoin into previously unimagined applications, markets, and challenges that the Lightning ecosystem has yet to navigate.

If given the choice, I'd prefer to leap into the unknown rather than luxuriate on the couch. The excitement lies in discovery. (Image: pxhere )

Embracing the unknown is often more exciting than passive alternatives, for true discovery lies in uncharted territories. (Image: pxhere )

The advent of USDT on Lightning signifies a journey into uncharted possibilities. It's crucial to consider the implications of this development for both USDT and Lightning-addressing opportunities, risks, and unanswered questions.

Taproot Assets 101Initially, Lightning was designed to enhance Bitcoin 's transaction capacity, focusing solely on Bitcoin transfers. However, the introduction of Taproot Assets paves the way for fungible assets like stablecoins to traverse the Lightning network as hashed metadata, leveraging the same underlying technology used for Bitcoin transactions.

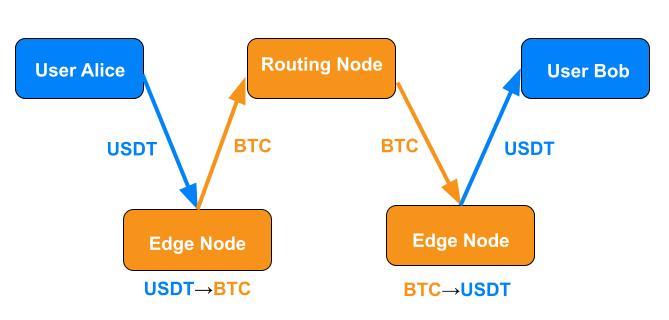

For those with a grasp on how Lightning operates, the mechanism is quite straightforward. The recipient generates an invoice that queries edge nodes (nodes linking users to the broader network) for exchange rates between Bitcoin and the specified asset-USDT, in this case. After the user agrees to an edge node's rate, they create an invoice for the transaction and forward it to the payer. The payer then sends the asset to the edge node on their side, which translates everything into a standard Bitcoin payment, routing it through the network as usual. The edge node on the receiving end then converts the payment back into USDT and transfers it to the intended recipient.

Taproot Assets utilizes the versatility of Lightning, facilitating the transfer of diverse asset types using Bitcoin as the universal medium of exchange. The benefit of all nodes collaborating under Lightning is that routing nodes only recognize Bitcoin during transit, streamlining the process. Excellent!

Yet there is more complexity than just technical intricacies. USDT represents a significant medium of exchange, with tens of billions of USDT traded daily across millions of transactions. Its daily trading volume rivals that of prominent currencies like the Brazilian real and the Indian rupee. Therefore, the integration of Lightning with USDT brings monumental implications for both assets.

The Good ... for BitcoinUp to now, much of the focus on Bitcoin adoption in commerce has hinged on“orange pilling” as many individuals as possible, thereby enlarging the circular economy incrementally. This method may have approached its maximum potential . Despite significant growth over the past fifteen years, the circle remains limited, and we must shift our thinking toward larger masses.

With USDT and BTC now inherently compatible on Lightning, the circle has expanded its reach. Users can choose to transact in either BTC or USDT independently; both the payer and the recipient can decide their asset of choice without reliance on each other's preferences. A customer can pay in BTC while a merchant accepts USDT, or vice versa, or they may both opt for the same currency. The specifics are irrelevant. The native nature of both assets within Lightning facilitates seamless interchangeability, granting everyone the option to harness Bitcoin 's intrinsic advantages as a user-driven medium of exchange or USDT's price stability derived from US monetary policies and Tether's liquidity.

Lightning is poised to attract millions of new users and substantial financial resources to Bitcoin . This transition signifies qualitative enhancements to Bitcoin 's utility and promises a quantitative surge for Lightning. Many new users may not even realize they are utilizing Lightning due to its role as the common language of the Bitcoin economy . However, the old-school Lightning users understand that this is the culmination of our efforts.

While a circle is beautiful, one with multiple tangents extending outward is truly captivating. (Image: Todd Quackenbush)

Furthermore, as we pointed out regarding how Lightning could streamline access for American users of USDT, this integration will additionally simplify their use of Lightning. U.S. tax regulations categorize BTC as an equity , creating potential tax complexities for each transaction. Nevertheless, if U.S. users can utilize Lightning with a non-capital gains asset, they can enjoy many of Lightning's advantages without the accompanying regulatory burdens.

...for TetherTether typically launches USDT on established blockchains with proven market adoption, showing no interest in developing its own . Currently, USDT can be found on platforms such as Algorand, Celo, Cosmos, Ethereum , EOS, Liquid Network, Solana , Tezos, Ton, and Tron-all proof-of-stake (PoS) blockchains (except Liquid, which operates via federation) and as a result, inherently more centralized compared to Bitcoin .

Each of these blockchains presents unique advantages and disadvantages. Ethereum boasts relative decentralization for a PoS network but is often criticized for its exorbitant transaction fees . In contrast, Tron offers lower costs. Consequently, a recent estimate indicates that approximately seven times more monthly active retail USDT users prefer Tron over Ethereum and generate eight times more retail volume on the Tron network. However, Tron is frequently criticized for its centralization , creating a vulnerability in its capacity. A significant disruption to Tron could result in a loss of around half of Tether's total capacity across all networks, which would be substantial. Integrating USDT transactions through the more decentralized Lightning Network enables Tether to reduce that reliance on cheaper, centralized blockchains.

Additionally, implementing USDT on Lightning could significantly enhance its usability within the United States market. Exchanges in the U.S. often restrict USDT transactions to specific blockchains; for instance, Coinbase states ,“Coinbase only supports USDT on the Ethereum blockchain (ERC-20). Do not send USDT on any other blockchain to Coinbase .” With Lightning, exchanges such as Binance , Coinbase , and Kraken (which already support Lightning) could provide a decentralized option for USDT transactions.

The BadThe current U.S. administration has proposed onshoring the entire stablecoin industry, indicating that regulating stablecoins is their“top priority .” This means they will closely monitor every movement in the sector. Given that stablecoins like USDT are pegged to the dollar, those who control the dollar-and benefit from it-will also seek control over stablecoins.

Regulators often believe they can enhance freedom through regulation, an instinct that stems from their nature. However, as USDT's functionality increases on Lightning, both USDT and Lightning will likely attract heightened attention from regulators. It's hard to forecast how much scrutiny will develop and to what extent they will intervene, but it's safe to say that regulation tends to produce friction.

A particular area likely to draw regulatory interest is the edge nodes. Many conventional centralized exchanges adhere to KYC/AML regulations across various jurisdictions. If edge nodes begin automatically exchanging USDT and BTC and routing payments, they may resemble conventional exchanges in the eyes of regulators, who typically frown upon decentralization .

While Lightning undeniably offers numerous benefits to both users and USDT, it may not universally serve as the ideal solution for every transaction involving USDT. Participants within the Lightning Network anticipate low fees, and so too do USDT users who engage with centralized blockchains and custodial exchanges. Nonetheless, the integration of a second asset into Lightning introduces financial considerations that all parties-routing nodes, users, and especially edge nodes-must address.

Firstly, edge nodes will undertake the usual functions of LSPs-ensuring users are connected to the network with sufficient channels and liquidity to facilitate payments-additionally to converting between assets. This conversion process is a valuable service warranting compensation and carries inherent risks (discussed below).

Secondly, incorporating USDT is expected to significantly heighten transaction volume, necessitating that LSPs and routing nodes maintain greater liquidity on the network to accommodate increased payment flow. Unlike custodial exchanges, which merely update their internal records, genuine liquidity management is imperative. The economics of liquidity allocation will apply in heightened measure.

Will Lightning manage to compete with centralized exchanges like Tron for USDT transactions? The resolution will likely mirror responses to most inquiries regarding technology's alignment with specific use cases, as each technology has strengths and weaknesses catering to particular applications. Ultimately, market dynamics will dictate the solutions that thrive. Since the technology wasn't specifically designed for this use case, establishing appropriate pricing will entail a process of experimentation over time.

Free Call Options? Uh oh.Edge nodes face an intriguing risk known as the“free-call-option problem ,” which warrants dedicated discussion. This risk is novel and arises whenever multiple assets coexist within a single Lightning payment.

Lightning transactions must finalize within a predetermined timeframe to settle; otherwise, the invoice automatically cancels. This timeframe is incorporated within the“T” of HTLCs , or hashed time-locked contracts.

When edge nodes submit their exchange rates for a USDT

BTC transaction, they base their bids on factors such as current liquidity levels and prevailing market prices. Users have a window during which they can either accept the edge node's bid and complete the payment or wait until the rate shifts favorably before releasing their preimage to finalize the deal. Should the rate decline, the user can simply opt not to release the preimage. In this scenario, the edge node may need to initiate a channel closure to reclaim their funds, which is a slow and potentially costly endeavor. Conversely, if the rate improves, the edge node is left vulnerable to covering the loss. This creates a scenario where, heads, the user risks nothing; tails, the edge node bears the consequence.

Transactions that involve any combination of assets on Lightning effectively grant users a call option . Traditional financial entities mitigate the inherent risk of selling call options by factoring this risk into the pricing. These options can become quite costly for unprepared edge nodes. Kilian and Michael at Boltz first brought attention to this issue and astutely elucidated it for the benefit of the ecosystem. One alternative would be for edge nodes to incorporate the costs of these call options into their pricing, akin to traditional financial institutions. Intertemporal arbitrage may prove rewarding if handled expertly.

Moreover, edge nodes also grapple with user-related concerns. If a routing node fails to relay the preimage-whether intentionally or due to a malfunction-the edge node could still be held accountable. While reputation systems might exist for routing nodes to improve decision-making, implementing a similar system for end users may prove unrealistic due to the constant influx of new participants within the network.

The free-call option dilemma has not posed a significant challenge for Lightning until now, as the network has predominantly engaged with a single currency: Bitcoin . Should this issue escalate, one could envision the emergence of multiple parallel, single-currency Lightning Networks-one dedicated to Bitcoin , another for USDT, and potentially others. Should Bitcoin be excluded from this ecosystem, we could forfeit the advantages of Bitcoin interactivity, possibly leading to regrets concerning the integration of USDT into Lightning.

We're in It for the Interesting TimesBitcoin is inherently revolutionary, designed to disrupt the flawed fiat system-a goal that has always underpinned its existence. Our engagement is driven by the desire for profound change. We recognize that the path of evolution and disruption is rarely smooth.

Nonetheless, change is fundamentally positive. Progress is a welcomed form of change in society. The integration of USDT within Lightning symbolizes opportunity and advancement for users, this payment technology, and Bitcoin at large.

However, like all transformations, this one requires meticulous planning, robust preparation, astute instincts, and agile responses. Navigating uncharted waters demands the right tools and skills. For those involved in Lightning liquidity provisioning, new obstacles will arise, but they may also yield significant benefits.

Tether stands to gain a cost-effective, decentralized distribution network along with improved access to the essential U.S. market. Concurrently, Lightning is set to experience an influx of liquidity and users. Bitcoin will achieve seamless interoperability with USDT. This convergence explains the enthusiasm surrounding these developments.

However, we must remain vigilant as regulators keep a watchful eye. Edge nodes will provide essential conversion services only if they remain profitable, avoiding loss. Therefore, it is crucial to approach this evolution by engaging in thorough reflection, detailed design, rigorous coding, market preparation, and maintaining our primary focus on the vision of achieving a universal Bitcoin economy.

This is a guest post by Roy Sheinfeld. The views expressed are solely his and do not necessarily reflect the views of BTC Inc or Bitcoin Magazine.

This post USDT on Lightning: the Good, the Bad, and the Unknown first appeared on Bitcoin Magazine and is written by Roy Sheinfeld .

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk.

Don't invest unless you're prepared to lose all the money you invest.

This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment