Alibaba Making China Tech Investible Again

In late January, the sudden arrival of made-in-China artificial intelligence app DeepSeek pulled the rug out from under Wall Street's“Trump trade” party. The surge was driven by bets that US President Donald Trump's policies would send US shares skyward.

Part of the excitement was Trump's enthusiasm for AI, one shared with his benefactor Elon Musk . Trump punctuated the point on January 21, when he stood shoulder-to-shoulder with OpenAI's Sam Altman, Oracle's Larry Ellison and SoftBank's Masayoshi Son at the White House to spotlight a US$500 billion Al infrastructure project.

Days later, it seemed like old hat as DeepSeek's promise caught global markets off guard. Its cost-effective AI model using less advanced chips precipitated a nearly $600 billion selloff in Nvidia's share alone - history's biggest corporate loss in market capitalization.

Now comes Alibaba bursting back onto the global scene with an ambition that's also catching global investors off-guard. It includes a big push into Al, in which Alibaba is investing assertively.

The company that Jack Ma co-founded says it's plowing more than $53 billion into data centers and other AI infrastructure projects. Apple, meanwhile, is incorporating Alibaba's AI offerings in iPhones sold in China.

Yet Alibaba's rally might have legs for an even bigger reason: Xi Jinping's decision to, in the words of economist Stephen Jen,“make Chinese equities investible again,” starting with tech platforms.

Jen, CEO of Eurizon SLJ Asset Management, says that“in many ways, this is a call for a continued bounce-back in a long-depressed and unpopular market. For a change, though, there are now many more reasons to be positive than negative on Chinese equities and China in general.”

Of course, Alibaba's surge hit a speedbump on Tuesday – along with Chinese tech stocks in general – after Trump called for greater scrutiny of foreign companies listed in the US.

But from Jen's perspective, Chinese stocks will remain on roll for reasons including: regulatory easing; signs the property sector is finally bottoming to support better consumer sentiment; the resilience of Chinese bonds and the yuan; a chronic misjudging of China's manufacturing and technological prowess; cheap valuations; and signs the world remains underweight Chinese assets.

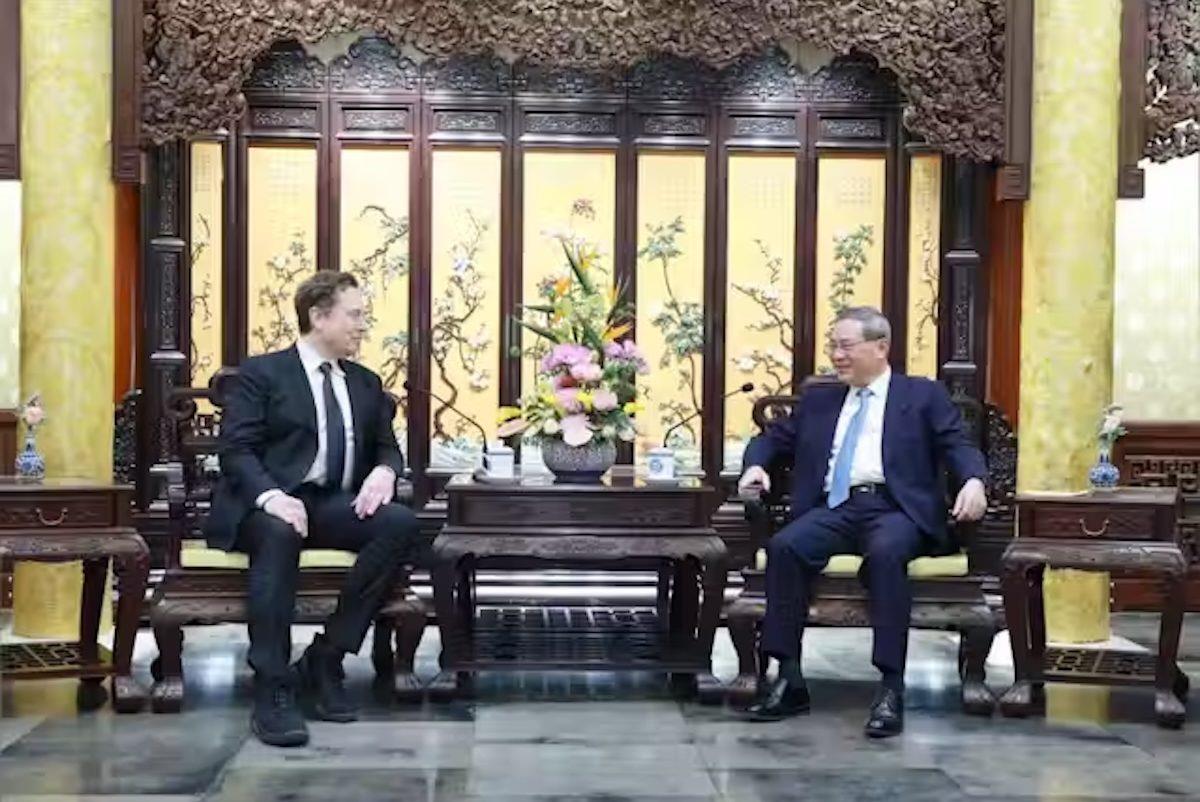

Xi's meeting with Ma and other mainland tech founders last week helped, too. Since late 2020, China's tech scene has been in a state of corporate limbo following Xi's crackdowns beginning with Ma's fintech giant Ant Group.

Ostensibly, Ant's planned $37 billion listing was scrapped after Ma criticized Beijing, suggesting policymakers don't understand technology. In a speech in Shanghai, Ma accused regulators of stifling innovation and banks of having a“pawnshop mentality.”

First, Ant's initial public offering was pulled. At the time, it would've been history's biggest. Next, Xi's financial regulator put under a microscope a who's-who of tech giants: search engine Baidu, ride-hailing giant Didi Global, e-commerce platform JD, food-delivery Meituan and gaming colossus Tencent, among others.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment