Egypt's Top 21 Real Estate Developers Double Sales To EGP 1.4Trn In 2024

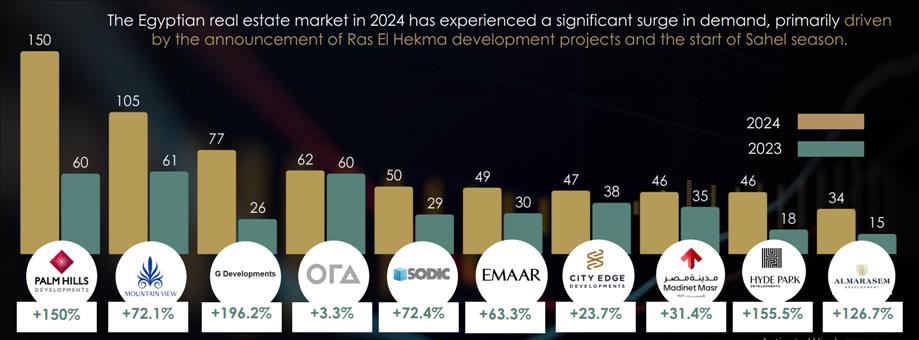

The top 10 developers collectively recorded EGP 1.17trn in sales, marking a 135% increase compared to the previous year. Talaat Moustafa Group (TMG) maintained its position as Egypt's largest real estate developer, achieving EGP 510bn in sales-an impressive 263% jump from EGP 140bn in 2023. Of this total, EGP 447bn came from projects within Egypt. Palm Hills led major developers with EGP 150bn in sales, followed by Mountain View with EGP 105bn. G Developments, formerly New Giza, secured third place with EGP 77bn, while Ora ranked fourth with EGP 61.8bn. Other major players included SODIC, which recorded EGP 50bn in sales, and Emaar, which followed closely with EGP 49bn. City Edge reported sales of EGP 47bn, while Madinet Masr reached EGP 46bn. Hyde Park recorded EGP 45.9bn in total sales, with Saudi-based Al Marasem rounding out the top ten at EGP 34bn.

In the real estate marketing sector, The Address led the market with EGP 128.4bn in sales for 2024. Boldly followed with EGP 79bn, while Nawy secured third place with EGP 65bn. Coldwell Banker ranked fourth with EGP 51.3bn, and Red came in fifth with EGP 21bn in total sales.

As economic fluctuations persist, most real estate developers have begun pricing their units based on the U.S. dollar exchange rate. Some have set their calculations at EGP 80 per dollar, while others have used an exchange rate of EGP 92. This shift reflects the increasing role of currency valuation in property pricing strategies.

Investment-driven transactions surged in 2024, accounting for more than half of all real estate deals. Investors in the Egyptian market were divided into long-term buyers, short-term investors, and speculators aiming for quick profits. At the same time, wealthy Egyptians have been expanding their real estate investments abroad, particularly in the UAE, Greece, and Spain. The relatively comparable prices of luxury properties in these countries, along with the opportunity to secure returns in foreign currency, have fueled this trend.

Meanwhile, regional expansion has become a strategic priority for Egypt's leading developers. While the Saudi market remains a key focus, companies have extended their reach to the UAE, Oman, and Iraq, reflecting a broader strategy to diversify investments and strengthen their presence in regional markets.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment