How The US Sanctioned Itself In Ukraine

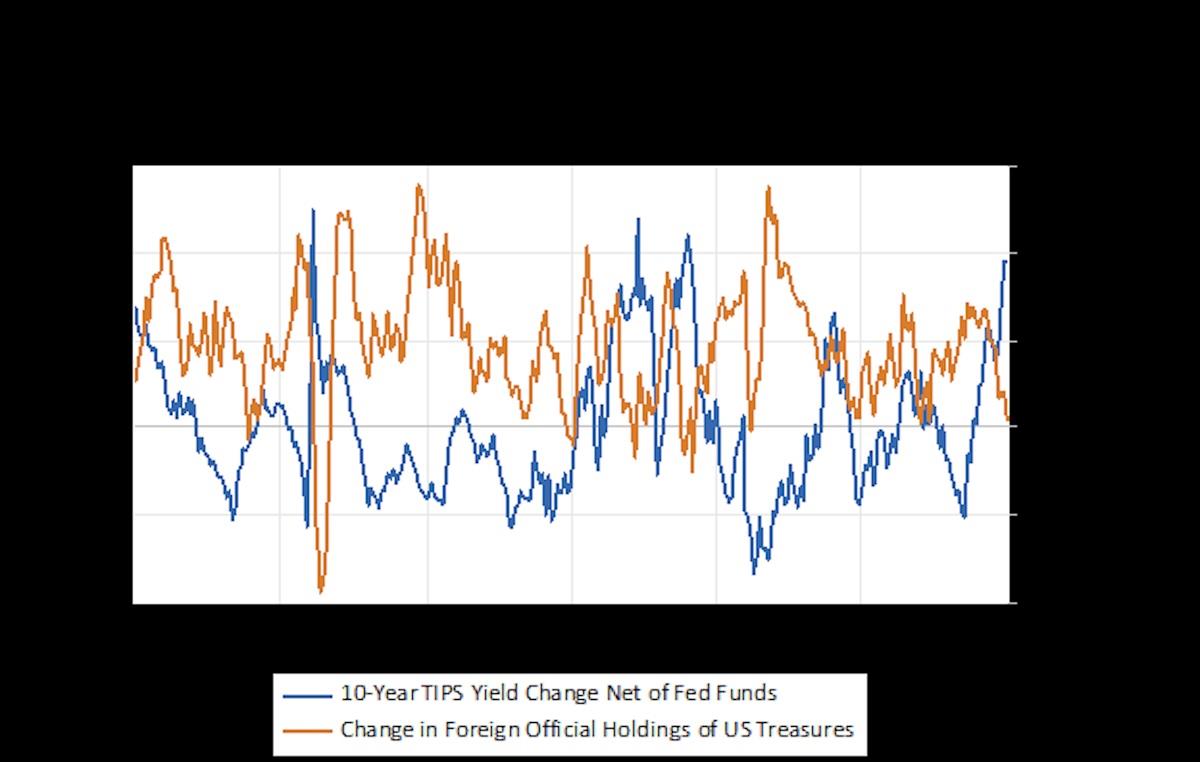

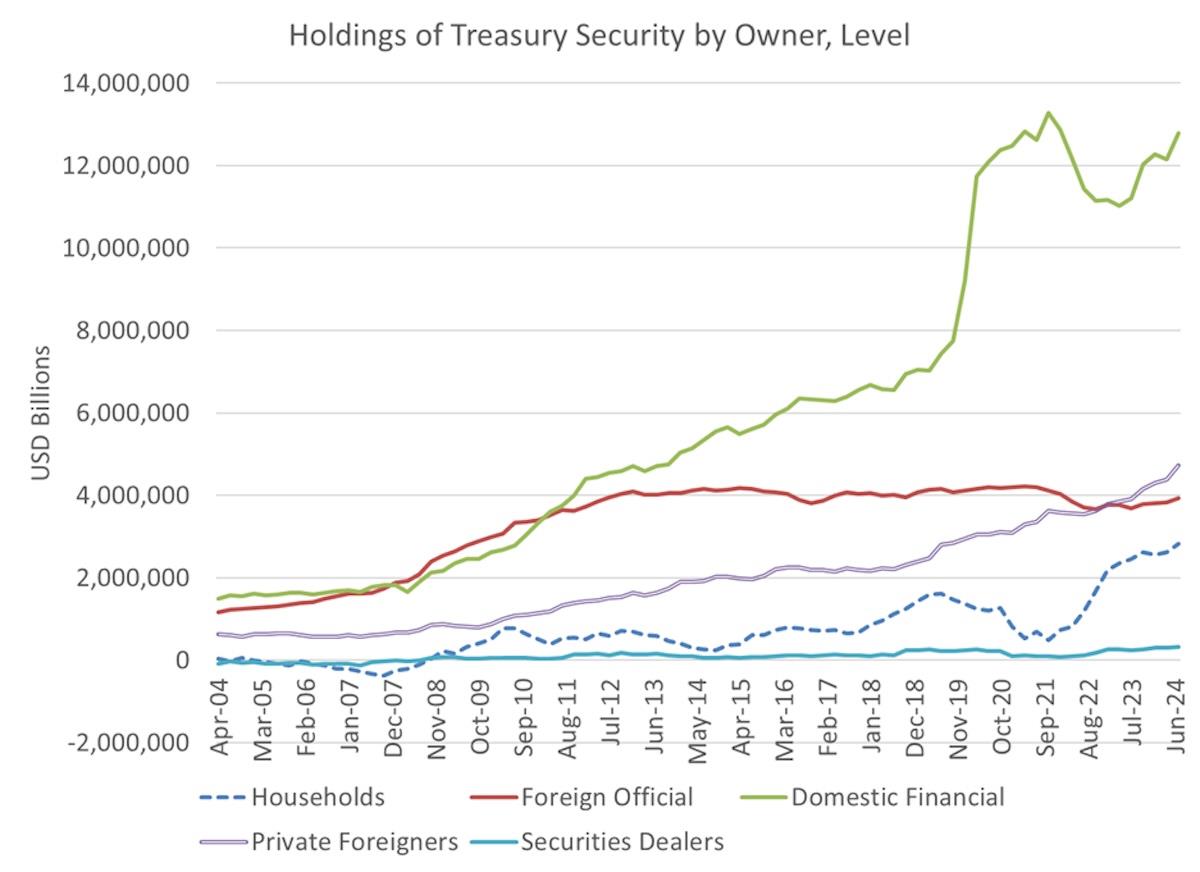

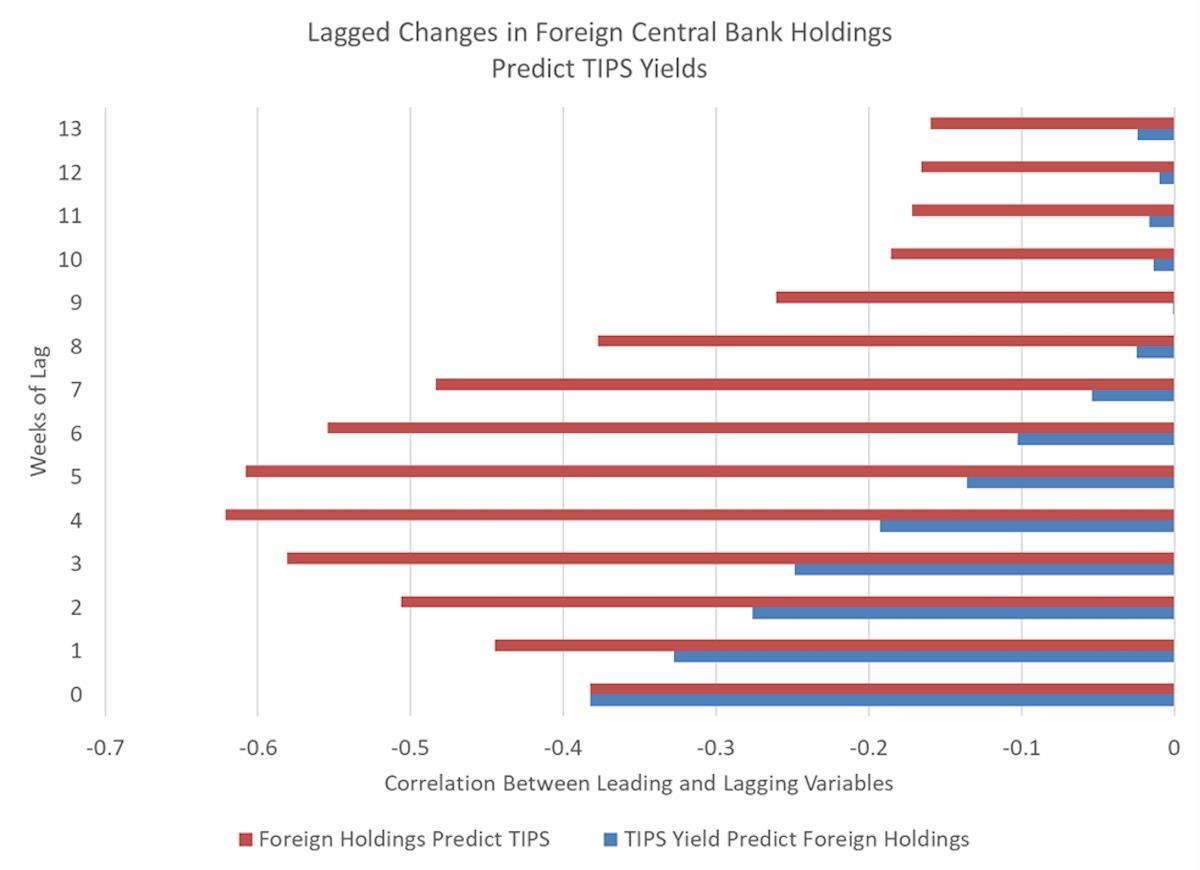

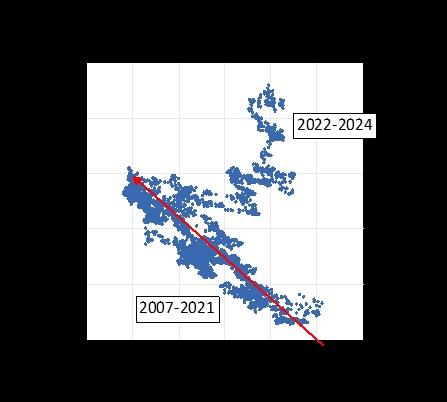

Foreign central banks meanwhile have cut their holdings of US government debt, adding to upward pressure on yields – by a painful 0.8 percentage points, according to my calculation. The seizure of Russian foreign exchange reserves in 2022 led central banks to shift out of dollar assets. The reserve seizure probably did more damage to the US economy than to Russia's.

The Federal Reserve caused most of the rate surge by raising the rate at which it charges banks for overnight money, to be sure. But a significant increment in the so-called real yield of Treasury bonds – in this case, the interest rate on inflation-indexed Treasuries (TIPS) – is due to reduced purchases of US debt by foreign central banks. Roughly 80 basis points (8/10ths of a percentage point) are explained by reduced foreign central bank holdings of US government debt.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment