Rising Food Prices Push India's Wholesale Inflation To Four-Month High In Oct

A

Reuters

poll of economists expected wholesale inflation to be around 2.2% in the month, up from 1.84% reported in September.

The WPI, a proxy for producers' prices, has been positive since November 2023. A year ago, it stood at -0.26%.

"Food inflation alone pushed up the headline WPI print by as much as 63 basis points between September and October 2024. The core (non-food manufacturing) WPI inched up mildly by 0.1% on a sequential basis, similar to the uptick seen in the previous month. On a year-on-year basis, the core WPI print rose to 0.3% in October," said Rahul Agrawal, senior economist, Icra Ltd.

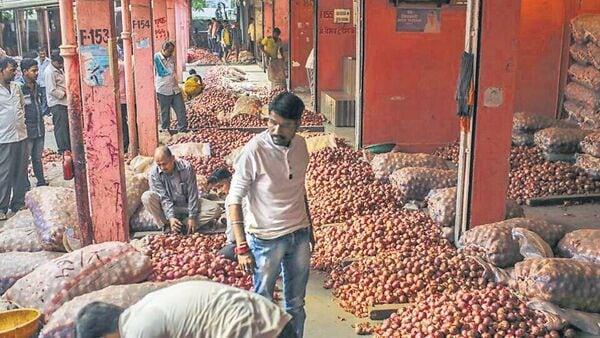

Also Read: Mint Primer All about the inflation spike: how, why whenFood price inflation, a major contributor to the index, rose by 11.59% annually, compared to a 9.47% gain in September and 3.21% in August.

Elevated food prices have also pushed India's retail inflation, based on the consumer price index (CPI), for the month to a 14-month high of 6.21%.

The rise was led by vegetables and fruits, whose prices rose by 63.04% and 13.55% year-on-year, respectively.

In comparison, cereal prices rose 7.9% in the month over last year. In September, they saw a rise of 8.1%.

Prices of non-food articles declined 1.71% annually in the month, compared to a 1.64% decline in September.

Fuel and power prices fell 5.79% annually in October, compared to a 4.05% annual decline in September.

Crude petroleum and natural gas prices fell by 12.16% annually in October, against the 13.04% annual contraction reported last month.

Manufactured products' prices rose 1.5% annually in October, compared to a 1% rise in the previous month.

Will the WPI rise further?Agarwal said the outlook for headline WPI inflation remains vulnerable to movements in global commodity and crude oil prices, as well as food prices.

To be sure, headline retail inflation, a key indicator for the Reserve Bank of India's policy decisions, has averaged 5% over the past 12 months, with food inflation remaining high in the first half of 2024-25, driven by weather-related disruptions that pushed up prices of vegetables, cereals, and other essential food items.

Also Read: Mint Quick Edit Inflation above 6%: There goes a December rate cutAs a result, economists expect a rate cut by the central bank to get pushed to the March quarter.

The RBI has not cut the repo rate since February 2023.

Economists are, however, optimistic about food inflation in the coming months, with the good monsoon seen this year and a better rabi harvest expected to result in lower food price volatility in the March quarter.

"Given the arrival of the Kharif crop and a favourable outlook on rabi sowing, food inflation is likely to trend its way down and, along with soft commodity prices, should keep the WPI inflation print within 3% in the current fiscal," said Suman Chowdhury, executive director and chief economist, Acuite Ratings & Research.

Also Read: Inflation hump: Will it continue beyond October? "However, we have revised our forecast for headline retail inflation to 4.8%, given the stickiness in food inflation observed in October-November 2024. This not only is likely to lead to a postponement of a rate cut by the RBI in December but also creates uncertainty on the decision in February 2025," he added. Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment