Sumsub Reveals First Global Fraud Index Showcasing 103 Countries' Susceptibility To Digital Fraud

To assist regulatory bodies, governments and businesses in understanding and preventing digital fraud, Sumsub shares an interactive world map

MIAMI, Nov. 5, 2024 /PRNewswire/ -- Today, Sumsub, a leading full-cycle verification platform, releases the Global Fraud Index , the first-ever in-depth study of 103 countries that offers a complete overview of the risk of digital fraud. The Index reveals the underlying factors that fuel fraud in various parts of the world, aiming to raise public awareness of the root causes rather than mere numbers.

Continue Reading

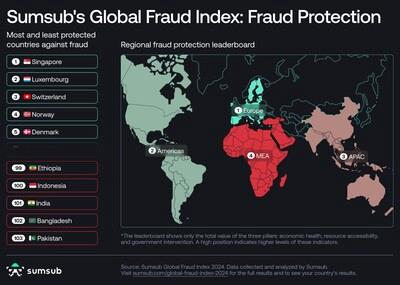

Sumsub's Global Fraud Index: Fraud Protection

Until now, no comprehensive global analysis of the fraud index existed despite digital fraud posing a substantial threat to the financial sector. According to a Juniper Research forecast , global losses from online payment fraud will exceed $362 billion between 2023 to 2028. The Global Fraud Index reveals the underlying factors driving worldwide fraud, and by diving deeper into the reasons and conditions behind online fraud, it aims to provide actionable insights, empowering governments and regulators to implement targeted measures that curb fraud, especially in regions facing elevated risks.

Key highlights of the Global Fraud Index study include:

-

The top 10 countries most protected against digital fraud are Singapore, Luxembourg, Switzerland, Norway, Denmark, the Netherlands, Finland, Sweden, Ireland and Lithuania.

The top 10 countries least protected against digital fraud are Pakistan, Bangladesh, India, Indonesia, Ethiopia, Argentina, Ukraine, Brazil, Algeria and Sri Lanka.

The U.S. has the highest government AI readiness index across the globe.

Singapore takes the highest spot in the Global Fraud Index, holding top-5 positions in economic wealth, resource accessibility and government intervention.

The Nordic countries show the highest e-government services availability.

EMEA (Europe, Middle East and Africa region) has the fastest access to all the necessary KYC/AML services .

Countries with a GDP per Capita of less than US $25,000 are showing higher rates of fraud activity on average when compared with countries with GDP exceeding US $25,000.

You can find data-driven insights, explore interactive maps and infographics as well as build country-specific comparisons here: fraud-index/

Methodology of the research

The Global Fraud Index uses both internal and external data. Sumsub's internal data is based on the volume of over 1 million checks conducted daily on the platform. Most data is from 2023-2024, with a few indicators relying on slightly older data. External sources include The World Bank, The Heritage Foundation, Oxford Insights, Transparency International, Numbeo and other databases.

The Index consists of 4 main pillars of analysis for each country. Those include not only the country's fraud rate itself but also incorporate 'The Fraud Triangle' hypothesis. This widely-used model reflects how certain factors – namely, pressure, opportunity, and rationalization – contribute to higher fraud rates and corruption. In digital fraud, this triangle manifests through lower digital resource accessibility , less efficient government intervention , and higher economic instability scores.

"At Sumsub, we are committed to shaping a people-friendly digital future by raising awareness of fraud and its root causes and by providing advanced solutions to fight digital exclusion," says Andrew Sever, CEO and co-founder of Sumsub . "Building on the recognition of our previous findings by experts at INTERPOL and UNODC, we are launching The Global Fraud Index to further advance the digital fraud awareness agenda. The Index highlights the need for stronger collaboration among businesses, governments, and regulators while addressing the challenge of unnecessary digital exclusion. By helping businesses avoid unintended exclusion through advanced solutions like Non-Doc verification, Sumsub fosters a fairer and more inclusive financial ecosystem."

To inform the tech community and decision-makers about the acute trends in fraud across various sectors–fintech, crypto, iGaming, EdTech, dating, online media and more–Sumsub annually shares expertise and internal study results in a whitepaper. To get a free copy of Sumsub's 2024 Identity Fraud Report, due to be released on November 19, please visit .

Aiming to raise awareness of how unfair digital exclusion impacts the world economy, Sumsub recently launched a campaign featuring Greenflag , a digital nation of 627 million people excluded from online services. Check out the dedicated research results at .

About Sumsub

Sumsub is a full-cycle verification platform that secures the whole user journey. With Sumsub's customizable KYC, KYB, Transaction Monitoring, Fraud Prevention and Travel Rule solutions, you can orchestrate your verification process, welcome more customers worldwide, meet compliance requirements, reduce costs, and protect your business.

Sumsub has over 2,500 clients across the fintech, crypto, transportation, trading, e-commerce and gaming industries, including Bitpanda, Wirex, Avis, Bybit, Huobi, Kaizen Gaming, and TransferGo.

SOURCE Sumsub

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE? 440k+Newsrooms &

Influencers 9k+

Digital Media

Outlets 270k+

Journalists

Opted In GET STARTED

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment