Maldives Set To Roll Out India's UPI Soon As President Muizzu Pushes For Quick Implementation

The decision to take the necessary steps to introduce the UPI in Maldives was made after the recommendation of the Cabinet on Sunday, reported PTI.

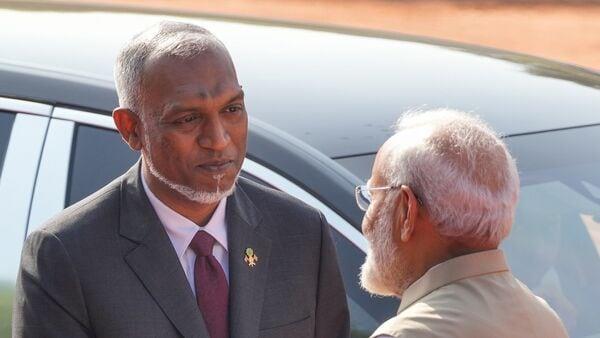

Earlier this month, during Maldives President Mohamed Muizzu's visit to the nation, India and Maldives agreed to exchange expertise in implementing digital and financial services. The two nations also worked on developing the Digital Public Infrastructure (DPI) through the launch of India's Unified Payments Interface (UPI), Unique Digital Identity.

Plans to extend UPI in the Maldives were announced for the first time in August during External Affairs Minister S Jiashankar's visit to the island nation. EAM S Jaishankar said that the move will make it easier for tourists to pay for things, boosting travel to the islands and helping the local economy.

Also Read | Why Maldives President Mohamed Muizzu Changed His Tune On India TradeNet Maldives Corporation Limited to lead the UPI implementation in MaldivesA consortium, set up by President Muizzu, will ensure the introduction of the UPI payment systems in Maldives. The consortium will include multiple stakeholders, including banks, telecom companies, state-owned companies, and fintech companies operating in the country.

Also Read | Rupay card introduced in Maldives after talks between Modi and Muizzu | VideoTradeNet Maldives Corporation Limited, a leading agency with proven expertise, has been appointed as the consortium's leading agency, reported PTI, citing a statement released by President Muizzu's office on Sunday.

The decision by the Maldivian President is expected to bring significant benefits to the Maldivian economy, including increased financial inclusion, improved efficiency in financial transactions, and enhanced digital infrastructure, the statement added.

Also Read | Budget 2024: Aid to Maldives falls, outlay for Bhutan remains highestThe decision to implement UPI in Maldives was made after a thorough review of a report submitted by the Minister of Economic Development and Trade at a cabinet meeting. An interagency coordination team comprising the Ministry of Finance, the Ministry of Homeland Security and Technology and the Maldives Monetary Authority will oversee the establishment of the UPI in the Maldives.

The decision has come nearly a month after India and Maldives sealed the deal for the expansion of UPI in the island nation to enhance ease of payments for Indian tourists in Maldives. The move will also act as a big step for Maldives to strengthen its digital payments infrastructure. Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment