Real Estate € Supply Outlook 2025

Real estate bond supply has exceeded our expectations so far in 2024, with total €-denominated real estate issuance at c€19bn as of October 2024. We had initially forecasted supply of €15bn for the year, which was already a large increase compared to 2023 (€8bn). However, supply has been even stronger than expected, with many companies having taken advantage of improving capital markets and substantial demand in 2024.

We expect supply to pick up meaningfully again in 2025, pencilling in €30bn for real estate. While €30bn is significantly higher than recent years, it is still a lot lower than 2020 and 2021, and more in line with 2018 and 2019. We see five main reasons for the 2025 increase:

Redemptions start to pick up Transaction volumes likely to improve Bond market conditions improve for more issuers Real estate turns the corner Green bond supply remains strongFor 2024, redemptions and supply are set to be broadly similar, with the potential for net supply to be marginally positive. This follows the -€11bn of net negative supply in 2023, a real outlier as the chart below shows. For 2025, we think net positive supply is c€6bn, which is still low in a historical context.

We expect supply to pick up meaningfully again in 2025, pencilling in €30bn for real estate

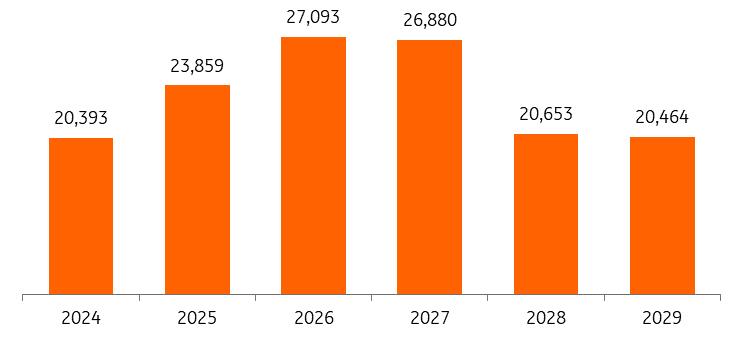

Five reasons why real estate bond supply will be higher in 2025 Redemptions start to pick up€-denominated real estate redemptions totalled €20.4bn in 2024, up from €18.7bn in 2023. For 2025, redemptions are set to increase further to €23.9bn, partly due to a sizable portion of the large primary volumes in 2019-2021 now set to mature. This will mean that refinancing will remain a key theme for the sector in 2025.

€-denominated bond redemptions (€m)

Source: Dealogic, ING

Furthermore, redemptions pick up again in 2026, to €27bn. We expect many issuers to start looking at 2026 maturities and beyond, early in the year, as current funding conditions and market demand dynamics remain favourable. As shown below, January 2026 has a significant level of redemptions at €5.3bn, which really stands out from the rest. Total 1H26 redemptions account for 65% of total 2026 redemptions; thus we think this will lead to issuers looking to prefinance part of these maturities in 2025.

Monthly €-denominated redemptions (€m) Source: Dealogic, ING Transaction volumes likely to increaseTransaction volumes have increased so far in 2024 relative to 2023, albeit the overall market remains sluggish. According to data from CBRE and Savills, 1H24 investment volumes were up by 10% and 1% respectively. Full year investment volumes are forecast to increase by roughly 10% compared to 2023. For 2025, we do expect a further recovery in transactions, as yields and valuations stabilise and investors will seek to take advantage of opportunities, while 'Fear of missing out' (FOMO) will likely also play a key factor. With increased transaction levels, including an uptick in M&A, this should spur further bond issuance as the market moves from“have we reached the bottom yet” to“cautiously optimistic”. In addition, price expectations of buyers and sellers have become more similar recently. However, we also note that the volume of distressed or insolvency sales may pick up, as we saw with the CBRE Germany Investment Volumes for 9M24, with insolvency volumes of €2.6bn accounting for nearly 12% of total volumes.

European real estate investment volumes (% change) Source: ERIX (CBRE) Bond market conditions should improve for more issuersFunding conditions improved materially in 2024, with policy rate cuts from major central banks resulting in lower yields and swap rates. In addition, spreads have declined significantly for the sector and for most issuers. We have seen a lot of issuance in recent months, including September, with issuance of c€6bn (see below). This was the single largest volume of supply since January 2022, while the average oversubscription rate remains strong at around 4.5x.

Monthly bond supply (€m) Source: Dealogic, INGDue to relatively tight spread levels (as shown in the chart below) and an expectation of a further decline in rates, we expect this to encourage other issuers that have been on the sidelines since early 2022. Many issuers have sought alternative funding options in recent years, including through the bank lending market, raising equity, or through asset sales and divestments where possible. We expect a partial reversion of this trend, with more issuers coming back to the bond market – putting upward pressure on supply volumes.

Real estate bond spreads compared to Corporate BBB'sReal Estate Index = EJRE / Corporate BBB Index = EN40 / asw = asset swap spread Source: ICE Indices, ING Real estate sector turning the corner?

For 2025, we think that bond markets will continue to improve for real estate companies, as the sector is set to recover further, with rate cuts and valuations appear to be stabilising. Furthermore, credit metrics should not deteriorate much further and credit risk is now more limited to certain subsectors (i.e. Offices) or idiosyncratic cases. In addition, many investors have had an underweight exposure to the sector for a while – this may drive additional demand for real estate primary as a decent way to grow exposure at attractive coupon levels.

That being said, real estate is clearly not out of the woods just yet, as a slowing economy in Europe and lower consumer spending could lower demand, while office fundamentals remain challenged as vacancies continue to pick up in certain geographies or markets. Furthermore, investors will remain wary about parts of the sector, with some companies still needing to deleverage and focus on upcoming debt maturities. On the whole, we do think that 2025 will be a year where real estate does finally turn the corner however, and we are increasingly optimistic for the outlook.

Can't get enough of the green stuffSo far in 2024, green bond supply has surpassed“vanilla” bond supply for the first time, with €10.4bn and €8.4bn issued year-to-date, respectively. In previous years, green supply has trended below 50% of total supply but we do not think that 2024 is an outlier, as the shift towards green financing is likely to remain over the longer term.

Green bond supply (€bn) Source: Dealogic, INGSustainability continues to grow as a key consideration for real estate financing, as environmental concerns and regulatory pressure boosts demand for sustainable development practices and funding. Furthermore, an increasing share of capex will be directed towards sustainability and ESG-related practices, as real estate companies need to invest heavily in energy efficiency and to reduce carbon footprints of buildings. We think the growing sector focus for sustainability, as well as the growing demand for green bonds, will lead to higher green bond issuance in 2025. Overall, we pencil in around €16bn of green issuance for next year.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment