Budget 2024-25: New Credit Guarantee Scheme To Offer Significant Relief To Small Units In UP

To support this, a self-financed guarantee fund will be established, providing guarantee coverage of up to Rs 100 crore for each borrower. This initiative will also benefit small units in Uttar Pradesh that struggle to repay loans on time due to unavoidable reasons, preventing their accounts from becoming NPAs.

Chief Minister Yogi Adityanath-led government has been consistently encouraging MSME units in the state, and the new budget provisions will invigorate the MSME sector.

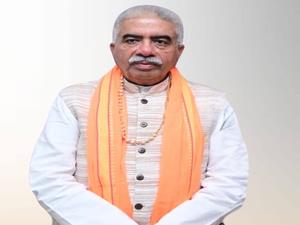

Uttar Pradesh Micro, Small and Medium Enterprises, Khadi and Village Industries, Silk Industry, Handloom and Textiles Minister Rakesh Sachan described the Budget 2024-25 as an all-inclusive and development-oriented one.

He noted that MSME units currently face significant challenges in obtaining loans from various banks, which impacts their economic stability.

"To address this issue, a new credit assessment model will be introduced in the budget, which will simplify the process of approval of loans based on digital footprints. This will make it easier for MSME units to secure loans. Unlike the traditional system that relies on assets and turnover, this new system will streamline access to bank loans," he said.

Sachan also mentioned that the budget includes an increase in the loan limit under the Pradhan Mantri Mudra Yojana, raising it from Rs 10 lakh to Rs 20 lakh. This facility will be available to units that have repaid their previous loans within the stipulated time frame.

Artisans will be able to easily sell their products in the international market.

In the next three years, 24 new SIDBI branches will be established in MSME clusters to assist MSME units in obtaining loans. Additionally, the registration limit on the TReDS (Trade Receivables Discounting System) platform has been reduced from Rs 500 crore to Rs 250 crore, enabling more MSME units to register and access credit easily.

E-commerce export hubs under the PPE model will support MSMEs and traditional artisans by facilitating the sale of their products in both national and international markets.

Additionally, 100 NAB-accredited food testing labs will offer high-quality testing services to food processing units. Over the next five years, training will be provided to 1 crore youth at 500 large companies across the country, equipping them to start their own enterprises. These measures will significantly contribute to empowering the MSME sector and driving economic growth.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment