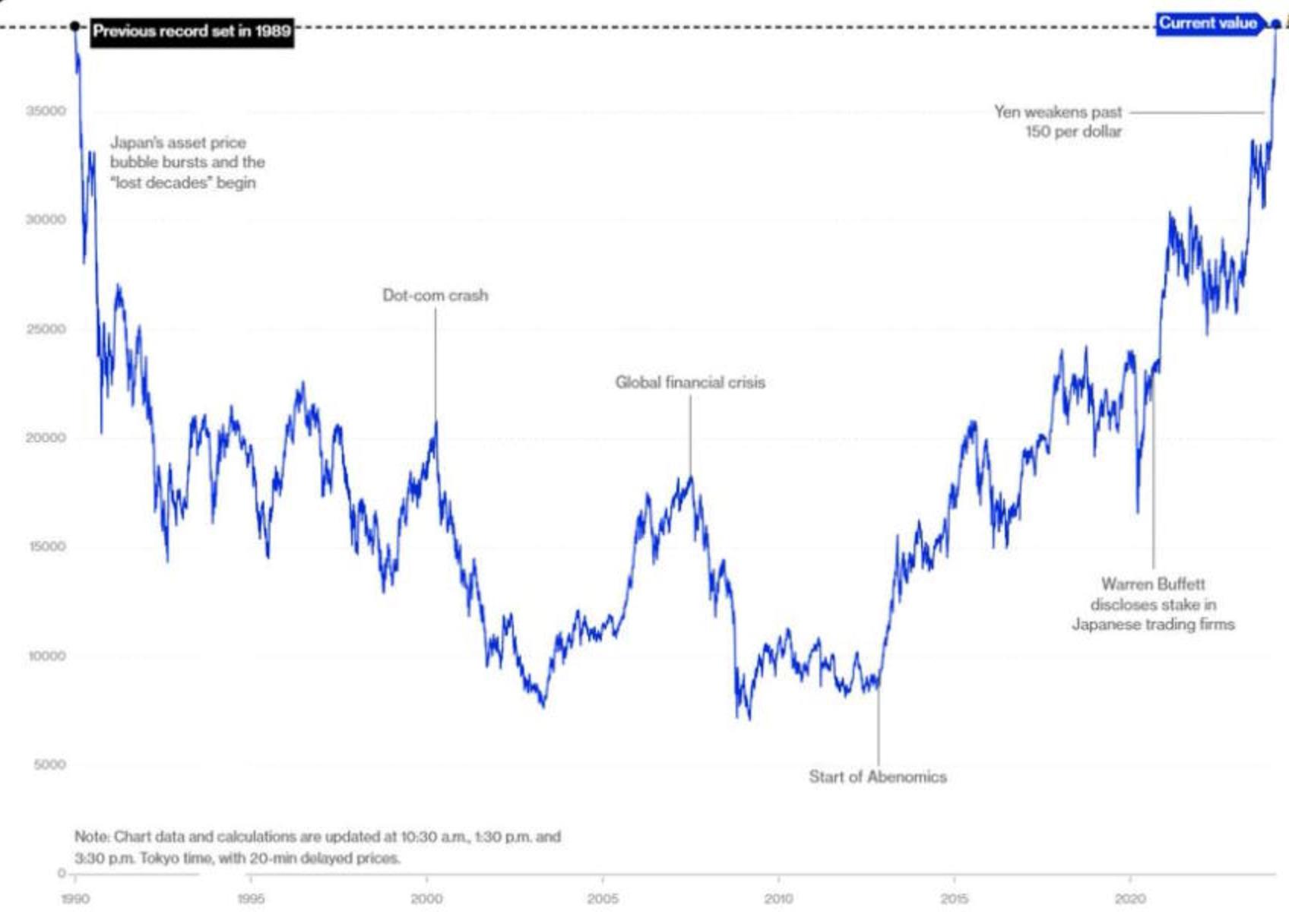

Japan, Not Quite 'Back', Has A New Fighting Chance

finally

reattained its previous peak from 1989:

Graphic: @marikakatanuma

(Note: Technically this isn't adjusted for inflation, but since Japan hasn't actually

had much total inflation

since 1989, that doesn't make much of a difference.)

Bloomberg's detailed breakdown

shows that the rally over the past year has been driven entirely by foreign buyers. But the foreign buyers probably have the right idea - most Japanese companies still look very cheap compared to the value of their assets.

Unfortunately, a country can't eat its stock market; Japan's real economy is looking much more anemic. The country experienced

a surprise recession

in late 2023, with

manufacturing

and

exports

both looking very weak.

The country

lost its spot

as the world's third-biggest economy at market exchange rates, falling behind Germany (whose economy is also pretty weak). Economists are

pessimistic , predicting further economic shrinkage in early 2024.

Still, there are some reasons to be optimistic about Japan's economy in general. First, the country is finally taking its own defense seriously - defense spending surged from 5.4 trillion yen (US$35.9 billion) in 2022 to 7.95 trillion yen ($52.5 billion) in 2024. That's still only about 1.5% of GDP but the rapid increase is pretty stunning.

Defense spending will stimulate manufacturing, but will also give Japan the chance to build its own military-related tech industries. More fundamentally, it demonstrates that Japan's leaders realize the magnitude of the threat China poses, and realize that they need economic growth in order to fund a more robust defense.

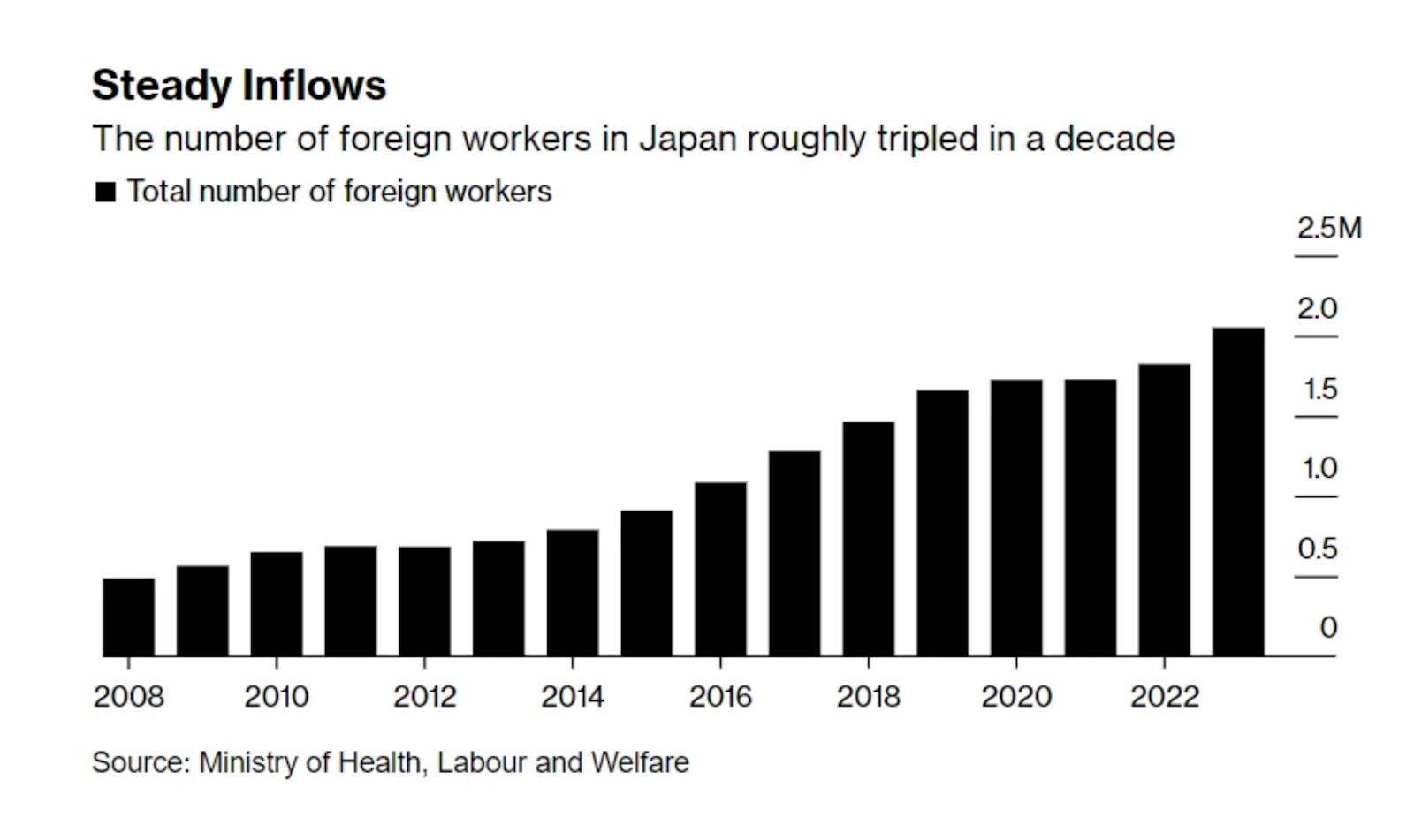

Second, Japan is

bringing in large numbers of foreign workers

to ease its labor shortage:

Now, this could end up causing trouble down the road; unlike the US, Japan is not a nation of immigrants and does not have much experience assimilating large numbers of foreigners.

The Japanese public fears

that immigration will lead to an increase in crime and social disorder, and they're probably right to some extent.

So I do expect an anti-immigration backlash at some point. But for now, the inflow of workers is helping to bolster the economy. Meanwhile, Japan's fertility rate is low, but at around 1.4 it's still much higher than China or other East Asian nations, and the country has

had some modest success

boosting birthrates.

Finally, the big international push to de-risk from China should end up benefitting Japan. Asia isn't going to be displaced as the world's electronics manufacturing mega-cluster, so Asian countries other than China are going to be the biggest beneficiaries of the de-risking trend.

So anyway, Japan is in an interesting place right now - some trends are pointing in the right direction and some in the wrong direction. Japan's policymakers and business leaders need to take action to reinforce the strengths and shore up the weaknesses. Here are some ideas about how to do that.

The first two ideas focus on industrial policy, which was a Japanese strength in the past , and which I think could serve it well again.

Use FDI to reclaim Japan's position in the electronics supply chainIf there's one lesson I've taken from

reading about a bunch

of successfully developing countries, it's that foreign direct investment is better and more important than people give it credit for. Economic research

strongly supports this .

Some small rich economies, like Singapore and Ireland, were basically built by FDI, and their industrial policies are almost entirely focused on courting foreign investors. But even big countries like China managed to learn a huge amount from foreign companies who set up shop there.

Industrialists have often underrated FDI. Japan and South Korea succeeded in autos and electronics by developing their own brands, largely refusing to make things for foreign brands. This allowed their companies to retain the profits, control the intellectual property, and choose to keep the most valuable parts of the supply chain in the country.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment