TIN Number Mandatory For Over 18S : How To Get It?

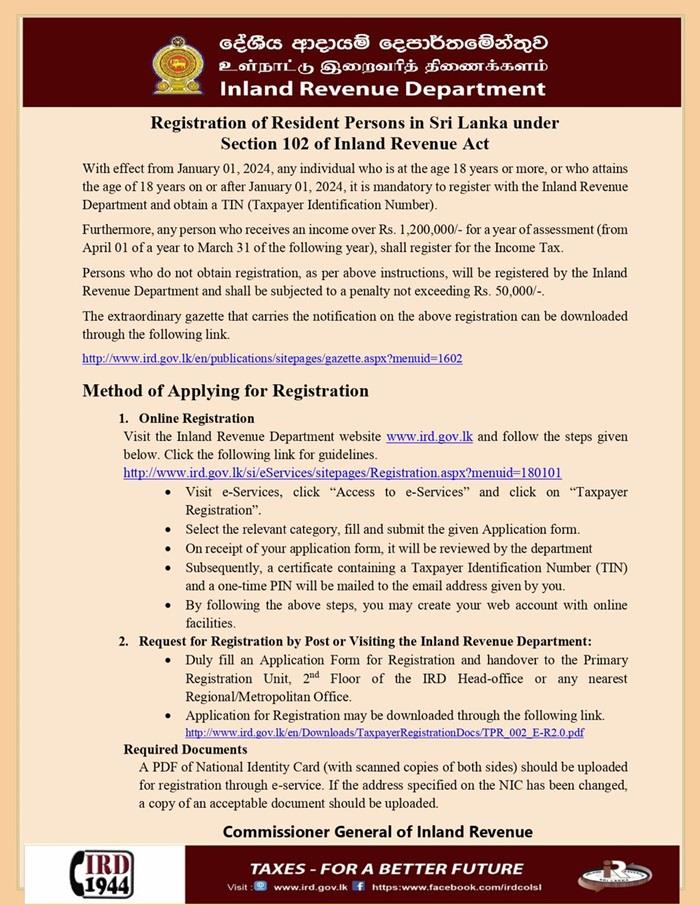

In a notice to the public, the Inland Revenue Department (IRD) reiterated it is mandatory for persons at the age of 18 or more, or who turn 18 years on or after 1 January, to register and obtain a TIN.

For similar articles, join our Telegram channel for the latest updates. – click here

ADVERTISEMENTFurther, any persons receiving an income exceeding Rs. 1,200,000 for a year of assessment (from 1 April of a year to 31 March of the following year) must register for income tax.

The general public has the option of registering online at , requesting registration by post, or registering in person at the IRD.

The department has also urged the eligible persons to ensure to register as required, adding that the registration can be done by adhering to the steps outlined on its official website;

Subscribe to our Telegram channel for the latest updates from around the world

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Kintsu Launches Shype On Hyperliquid

- Barunson, Studio Behind Parasite, To Launch Nplug IP Remixing Platform On Story And Bring Flagship IP Onchain

- Moonbirds And Azuki IP Coming To Verse8 As AI-Native Game Platform Integrates With Story

- Leverage Shares Launches First 3X Single-Stock Etps On HOOD, HIMS, UNH And Others

- Alchemy Markets Launches Tradingview Integration For Direct Chart-Based Trading

- Dexari Unveils $1M Cash Prize Trading Competition

Comments

No comment