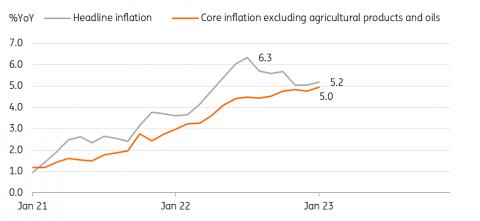

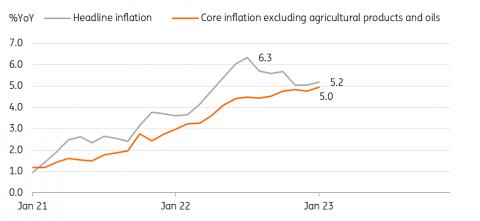

(MENAFN- ING) Headline inflation rose more than expected in January

Upside surprises came mainly from utility prices (electricity, gas, water), which rose the most (28.3% in January vs 23.2% in December). Basic electricity and gas rates have risen

over the past few months, and

the continuing cold weather has resulted in additional rate increases as

the progressive fee system is

applied. Fresh food prices, especially vegetables, also increased quite sharply due to the bad weather. Meanwhile, gasoline prices (-4.3%) continued to drop as oil prices fell significantly, more than offsetting negative tax effects

from the fuel tax cut reduction.

January CPI reaccelerated for the first time in six months

CEIC

Public service-led inflation is a concern In the coming months, several public service prices are set to rise or are planned. For example, taxi fares in Seoul have already risen in early February, and some other public transportation fares are expected to rise soon. This

is also likely to trigger other fare hikes in the Metropolitan Seoul area, like Gyeonggi Province. Public service-led inflation is a major concern for the government and the Bank of Korea because it could push up private service prices as a second-round effect.

The government has urged local governments to refrain from raising public service charges. At the same time, the government plans to expand energy subsidy programmes not only for low-income- households but also for middle-income households.

As weather conditions improve and government support is

dispensed, price pressures on

utilities should

gradually diminish.

The higher-than-expected January CPI results will keep the Bank of Korea in a

hawkish frame of mind, but at this point, the data

is unlikely to trigger a

February rate hike. Aside from utility prices, products and service prices grew at a more moderate pace in January. Also, we see that domestic economic activity has slowed pretty sharply in recent months and external conditions have also worsened. Last night, the federal reserve slowed its tightening pace with

a 25bp hike, thus the BoK will take time to monitor the price trend and examine the impact of earlier rate hikes.

MENAFN02022023000222011065ID1105513808

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment