403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Mastercard New Payments Index 2022: UAE Consumers Embrace Digital Payments

(MENAFN- Weber Shandwick)

Dubai, UAE; 2 August 2022: Adoption of a broader range of digital payment methodsis accelerating in the UAE andthe technology fueling the future of payments is already here, according to Mastercard’s New Payments Index 2022. In addition to being aware of solutions like cryptocurrency, digital cards, biometric payments, BNPL (Buy Now Pay Later) and open banking, consumers in the UAE are increasingly and actively using these solutions in their everyday lives.

Mastercard’s New Payments Index 2022 found that 88% of people in the UAE have used at least one emerging payment method in the last year. Of these, 39% used a tappable smartphone mobile wallet, 29% used BNPL, 20% used cryptocurrency and 18% used a payment-enabled wearable tech device. Consumers are also making purchases in increasingly diverse ways, including through voice assistantsand social media apps.

Usage of digital payments increasing, use of cash declining

While traditional payment methods still have traction, 29% of consumers in the UAEindicated they used less cash in the past year.By contrast, 66% of UAE users(compared to 61% globally) increased their use of at least one digital payment method in the last year, including digital cards, SMS payments, digital money transfer apps and instant payment services. While crypto use was low, 40% of cryptocurrency users in the UAE say they have used it more in the last year. These behaviors are expected to continue, with comfort and security key to growing adoption.

The Index confirmed security istop of mind when deciding what payment methods to use, globally and in the UAE (36%). In the country, security and rewards are main considerations, followed by promotions and ease of use. Highlighting sustainability as a key driver in the region, 36% of UAEconsumers said they also consider social and environmental benefits.

“It is exciting to see theincreased adoption of emerging payment methods and consumers’ eagerness to reap the benefits of the digital economy in the UAE and across the region. Mastercard is committed to understanding the needs and preferences of the people in the markets we serve, and we will continue partnering with the public and private sectors to develop market-relevant solutions as we buildaninclusiveand connected digital future that works for everyone,” said J.K. Khalil, Cluster General Manager, MENA East, Mastercard.

The Mastercard New Payments Index 2022 further shows:

High awareness of Buy Now, Pay Later (BNPL) Installmentsas a budgeting tool

The majority of UAEconsumers have heard of BNPL with 87% saying they are familiar with the concept, and almost half (46%) arealready comfortable using it today.Consumers want the flexibility and convenience of BNPL, but with the sense of security associated with a trusted provider like a bank or payment network.

Those that have used BNPL find it useful for emergency and big-ticket purchases, as well as increased purchasing power. Consumers also find BNPL useful for unique use cases, including as a budgeting and financial planning tool.

Deeperunderstanding of blockchain technology key to expanding cryptocurrency and NFT use

Broad mainstream awarenessof cryptocurrency (95%) and NFTs (non-fungible tokens) (86%) exist, though depth of understanding about both currencies and the underlying technology is lacking, with three in four (74%) UAE consumers agreeing they would use cryptocurrency more if they understood it better. Consumers are looking for more education, security, and flexibility to manage crypto assets.Still, about two thirds (66%) of consumers in UAEagree NFTs and other digital assets could be good investments.Two in three UAE consumers (67%) have undertakenat least one crypto-related activity in the past year, such as opening a crypto wallet, buying, trading or holding crypto as an investment.

Most consumers are open to future cryptocurrency engagement, with potential opportunities ranging from holding an investment to redeeming rewards, using crypto as means of payment, topurchasing an NFT using a credit or debit card. Stability in the industry is lacking, with those familiar with crypto feeling especially strongly about the need for regulation. Banks are presently the most trusted entity to drive digital currencies.

Receptiveness to more direct Account-to-Account (A2A) payments

The majority of consumers are seeking greater agility to optimize bill payments, prioritizing control, flexibility, convenience, and integrated payment technologies.Mostconsumers are open to direct account-to-account payment options, by linking their account to a merchant site for future purchases. 83%of UAEconsumers using account-to-account paymentshave maintained or increased their usage in the last year.

Seven in ten consumers (70%) agree they are interested in a bill payment option that allows them to change the date they pay their monthly bills, mostly due to an irregular income. Bill payment options that allow them to pay over a period using a buy now, pay later solution (71%) was also of interest, as well as automatic payments for their household bills (70%).

Consumers turning to fintech, and indirectly open banking, to accomplish everyday finance needs

Consumers are relying on digital finance options for their everyday financial tasks, with the benefits of open banking like speed, convenience, and transparency.Eight in ten (81%) know about open banking, and are using it to pay their bills, do their banking, secure or refinance loans, and make BNPL payments.

Over half (55%) of UAE consumers feel safe using apps to send money to people or businesses from their phone. Five in ten (50%) are willing to share financial data information with apps to have access to payment tools that help them manage their money.

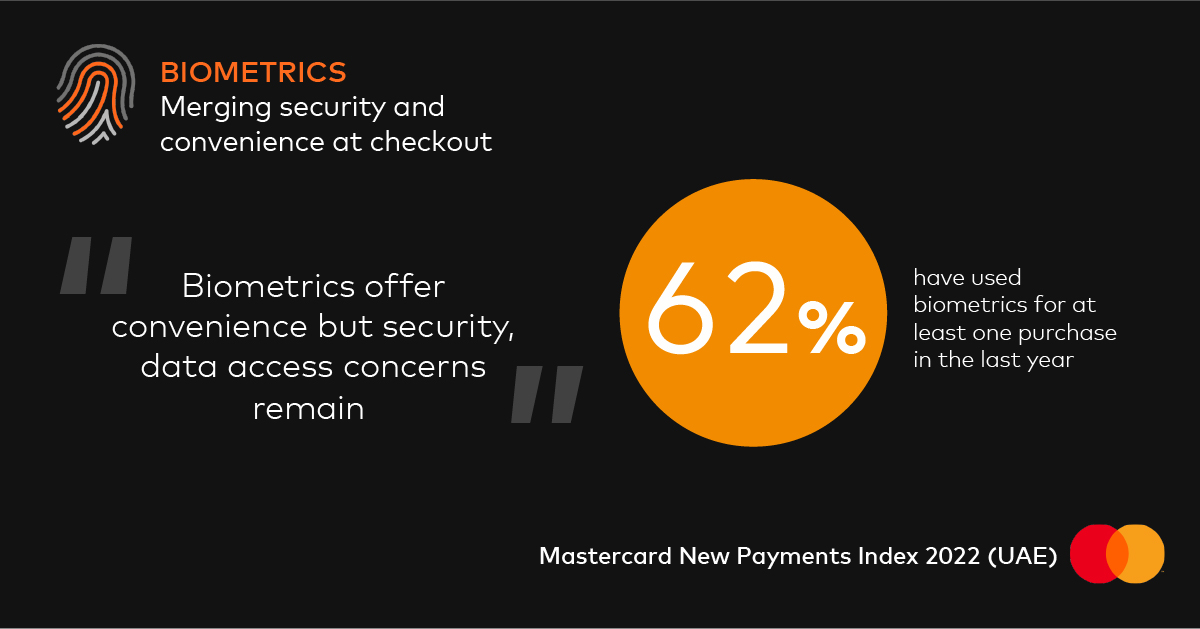

Biometrics offer convenience and security at checkout, though data access concerns remain

Consumers recognize the convenience that biometrics can offer, with 71%agreeing it is easier to make payments using biometrics than a card or device.The potential for security optimization is also evident to consumers, with seven in ten agreeing biometrics tech for payments is more secure than two factor authentication.

While consumers do have some concerns about what entities have access to their biometric data, they are still open to using it given the time it saves, and nearly two thirds (62%) have usedbiometrics for at least one purchase in the last year.Five in six (87%) consumers have used or plan to use their fingerprint to make a payment, which was followed by other biometric methods like facial recognition, palm or hand, retina scans, and voice recognition.

Emerging payments have strongest traction among more digitally native generations

Younger generations have gone more digital in their purchasing and payments behavior, and their engagement in and usage of emerging digital payments engagement is accelerating at a faster rate than older audiences. They are also more open to exploring emerging payment approaches like crypto, or buying virtual products in the metaverse. While security and data privacy remain a concern for them, it is less heightened than for older audiences, and they are more likely to perceive digital tools as secure.

Across the UAE, Gen Z is least likely to use cashor make in-person purchases and payments. They are proactively seeking out new payment methods, andnearly two thirds of Gen Z (64%) in the UAE are likely to have obtained a new digital payment alternative (e.g. digital wallet, click-to-pay account) compared to only 22% of Boomers.

As consumers shop, bank and transact digitally more than ever before, Mastercard continues to strengthen its digital payment capabilities in the UAE and wider EEMEA region. Its trusted technology solutions are being used for new use cases, brought to market through various partnerships with fintechs, governments, financial institutions, digital giants and telecom operators. By tapping into multi-rail capabilities to create competitive localized solutions, Mastercard is accelerating the transfer of value in new ways, on multiple rails, thereby advancinga bright future for inclusive commerce.

Dubai, UAE; 2 August 2022: Adoption of a broader range of digital payment methodsis accelerating in the UAE andthe technology fueling the future of payments is already here, according to Mastercard’s New Payments Index 2022. In addition to being aware of solutions like cryptocurrency, digital cards, biometric payments, BNPL (Buy Now Pay Later) and open banking, consumers in the UAE are increasingly and actively using these solutions in their everyday lives.

Mastercard’s New Payments Index 2022 found that 88% of people in the UAE have used at least one emerging payment method in the last year. Of these, 39% used a tappable smartphone mobile wallet, 29% used BNPL, 20% used cryptocurrency and 18% used a payment-enabled wearable tech device. Consumers are also making purchases in increasingly diverse ways, including through voice assistantsand social media apps.

Usage of digital payments increasing, use of cash declining

While traditional payment methods still have traction, 29% of consumers in the UAEindicated they used less cash in the past year.By contrast, 66% of UAE users(compared to 61% globally) increased their use of at least one digital payment method in the last year, including digital cards, SMS payments, digital money transfer apps and instant payment services. While crypto use was low, 40% of cryptocurrency users in the UAE say they have used it more in the last year. These behaviors are expected to continue, with comfort and security key to growing adoption.

The Index confirmed security istop of mind when deciding what payment methods to use, globally and in the UAE (36%). In the country, security and rewards are main considerations, followed by promotions and ease of use. Highlighting sustainability as a key driver in the region, 36% of UAEconsumers said they also consider social and environmental benefits.

“It is exciting to see theincreased adoption of emerging payment methods and consumers’ eagerness to reap the benefits of the digital economy in the UAE and across the region. Mastercard is committed to understanding the needs and preferences of the people in the markets we serve, and we will continue partnering with the public and private sectors to develop market-relevant solutions as we buildaninclusiveand connected digital future that works for everyone,” said J.K. Khalil, Cluster General Manager, MENA East, Mastercard.

The Mastercard New Payments Index 2022 further shows:

High awareness of Buy Now, Pay Later (BNPL) Installmentsas a budgeting tool

The majority of UAEconsumers have heard of BNPL with 87% saying they are familiar with the concept, and almost half (46%) arealready comfortable using it today.Consumers want the flexibility and convenience of BNPL, but with the sense of security associated with a trusted provider like a bank or payment network.

Those that have used BNPL find it useful for emergency and big-ticket purchases, as well as increased purchasing power. Consumers also find BNPL useful for unique use cases, including as a budgeting and financial planning tool.

Deeperunderstanding of blockchain technology key to expanding cryptocurrency and NFT use

Broad mainstream awarenessof cryptocurrency (95%) and NFTs (non-fungible tokens) (86%) exist, though depth of understanding about both currencies and the underlying technology is lacking, with three in four (74%) UAE consumers agreeing they would use cryptocurrency more if they understood it better. Consumers are looking for more education, security, and flexibility to manage crypto assets.Still, about two thirds (66%) of consumers in UAEagree NFTs and other digital assets could be good investments.Two in three UAE consumers (67%) have undertakenat least one crypto-related activity in the past year, such as opening a crypto wallet, buying, trading or holding crypto as an investment.

Most consumers are open to future cryptocurrency engagement, with potential opportunities ranging from holding an investment to redeeming rewards, using crypto as means of payment, topurchasing an NFT using a credit or debit card. Stability in the industry is lacking, with those familiar with crypto feeling especially strongly about the need for regulation. Banks are presently the most trusted entity to drive digital currencies.

Receptiveness to more direct Account-to-Account (A2A) payments

The majority of consumers are seeking greater agility to optimize bill payments, prioritizing control, flexibility, convenience, and integrated payment technologies.Mostconsumers are open to direct account-to-account payment options, by linking their account to a merchant site for future purchases. 83%of UAEconsumers using account-to-account paymentshave maintained or increased their usage in the last year.

Seven in ten consumers (70%) agree they are interested in a bill payment option that allows them to change the date they pay their monthly bills, mostly due to an irregular income. Bill payment options that allow them to pay over a period using a buy now, pay later solution (71%) was also of interest, as well as automatic payments for their household bills (70%).

Consumers turning to fintech, and indirectly open banking, to accomplish everyday finance needs

Consumers are relying on digital finance options for their everyday financial tasks, with the benefits of open banking like speed, convenience, and transparency.Eight in ten (81%) know about open banking, and are using it to pay their bills, do their banking, secure or refinance loans, and make BNPL payments.

Over half (55%) of UAE consumers feel safe using apps to send money to people or businesses from their phone. Five in ten (50%) are willing to share financial data information with apps to have access to payment tools that help them manage their money.

Biometrics offer convenience and security at checkout, though data access concerns remain

Consumers recognize the convenience that biometrics can offer, with 71%agreeing it is easier to make payments using biometrics than a card or device.The potential for security optimization is also evident to consumers, with seven in ten agreeing biometrics tech for payments is more secure than two factor authentication.

While consumers do have some concerns about what entities have access to their biometric data, they are still open to using it given the time it saves, and nearly two thirds (62%) have usedbiometrics for at least one purchase in the last year.Five in six (87%) consumers have used or plan to use their fingerprint to make a payment, which was followed by other biometric methods like facial recognition, palm or hand, retina scans, and voice recognition.

Emerging payments have strongest traction among more digitally native generations

Younger generations have gone more digital in their purchasing and payments behavior, and their engagement in and usage of emerging digital payments engagement is accelerating at a faster rate than older audiences. They are also more open to exploring emerging payment approaches like crypto, or buying virtual products in the metaverse. While security and data privacy remain a concern for them, it is less heightened than for older audiences, and they are more likely to perceive digital tools as secure.

Across the UAE, Gen Z is least likely to use cashor make in-person purchases and payments. They are proactively seeking out new payment methods, andnearly two thirds of Gen Z (64%) in the UAE are likely to have obtained a new digital payment alternative (e.g. digital wallet, click-to-pay account) compared to only 22% of Boomers.

As consumers shop, bank and transact digitally more than ever before, Mastercard continues to strengthen its digital payment capabilities in the UAE and wider EEMEA region. Its trusted technology solutions are being used for new use cases, brought to market through various partnerships with fintechs, governments, financial institutions, digital giants and telecom operators. By tapping into multi-rail capabilities to create competitive localized solutions, Mastercard is accelerating the transfer of value in new ways, on multiple rails, thereby advancinga bright future for inclusive commerce.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment