Rates Spark: A breather on the way up?

Rates have been bouncing back after this week's key events and data. Some are seeing value again, eyeing also geopolitical risks. In the background though lurks the Fed's desire for a steeper curve to provide it with more leeway to ratchet up key rates. The ECB lags behind, but the discussion is already shifting toward more persistent price pressures

In this article- Key events out of the way offer bonds brief relief

- ... but tightening is coming, also for the eurozone

- Today's events and market view

Share

Download article as PDF

NewsletterStay up to date with all of ING's latest economic and financial analysis.

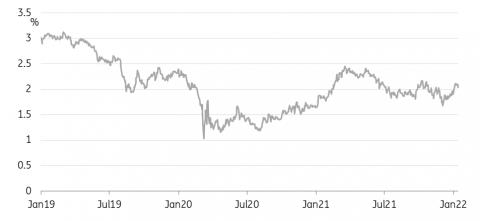

Subscribe to THINK Key events out of the way offer bonds brief reliefThis week's key data and hearings presented the final confirmation that central banks are under pressure to react to inflation staying higher for longer. Markets had been well ahead of the game, yields having risen significantly since mid-December, and are now taking a breather. A decent 30Y US Treasury auction, with strong indirect bids, does indeed suggest some are seeing value again with the 30Y yield handle having risen to 2% again at the start of the year.

Regarding the pandemic, Omicron is still sweeping across the globe and in the US headlines of military support to aid hospital staff shortages sound dramatic. However, there are also early signs of Omicron having peaked at least in parts of the US as well, similar to what is seen in the UK and previously South Africa. In geopolitics the tensions surrounding Russia and Ukraine remain unresolved, fears of escalation and threats of harsh sanctions will have added to the outperformance of Bunds especially with the eurozone more exposed given its energy dependence. At the same time, negotiation channels are not entirely closed and the Russian and German foreign ministers set to meet next week.

A lighter calendar in the week ahead could offer bonds additional respite and may allow markets to broaden their focus for the time being, to geopolitics and the pandemic situation more generally. But hawkish comments by the Fed's Waller and Harker last night came as a reminder that swift and substantial policy tightening lies ahead despite a still raging pandemic. And at the back of it all remains the question whether the Fed will also actively want to engineer a steeper yield curve to provide it with more leeway to ratchet up its main tool, the Fed funds target rate.

30Y US Treasuries: Some may see value again, now back at a 2% handle ...

Refinitiv, ING

... but tightening is coming, also for the eurozone

EUR markets were paring some of their front end ECB hike bets yesterday, coming from elevated levels. And we would agree that hiking expectations for the current year look stretched, but we do see the ECB starting to hike rates early in 2023. The ECB minutes of the December meeting due for release next week may offer more clues of how worried the ECB already was regarding inflation. Comments from Vice President De Guindos yesterday might be seen as attempt to steer the ECB discussion in the direction of greater inflation upside risks. He stressed inflation was less transitory than predicted several months ago and cited the evolution of energy prices as the main risk to the inflation outlook – which also brings us back to geopolitics, but not only.

The EUR curve is still under-pricing medium term ECB tightening in our viewRefinitiv, ING

Eurozone periphery bonds still outperformed yesterday with the first supply wave having been straddled without much of a hiccup. In the week ahead we see Belgium and Austria as the next candidates to launch new 10Y bonds via syndicated deals alongside scheduled auctions from Germany, Finland, France and Spain. As the incentive to front load funding should be even greater with prospects of central bank tightening drawing closer, supply should remain an accompanying theme for longer even as the focus is now shifting away from the periphery issuers.

Today's events and market viewThe bounce back of bonds could find further support in today's data where US retail sales are seen coming in softer being dragged lower by falling auto sales. However, as our economists point out this is a supply-related weakness due to a lack of cars to purchase rather than a weakness in demand.

In the eurozone markets will be watching ECB President Lagarde today and whether there is also greather shift in the ECB's discussion towards inflation upside risks.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment