403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Global SpaceTech Industry Profiled for the First Time in Landmark Analysis

(MENAFN- EIN Presswire)

Link to the Special Analytical Case Study:

Link to the Interactive Dashboard:

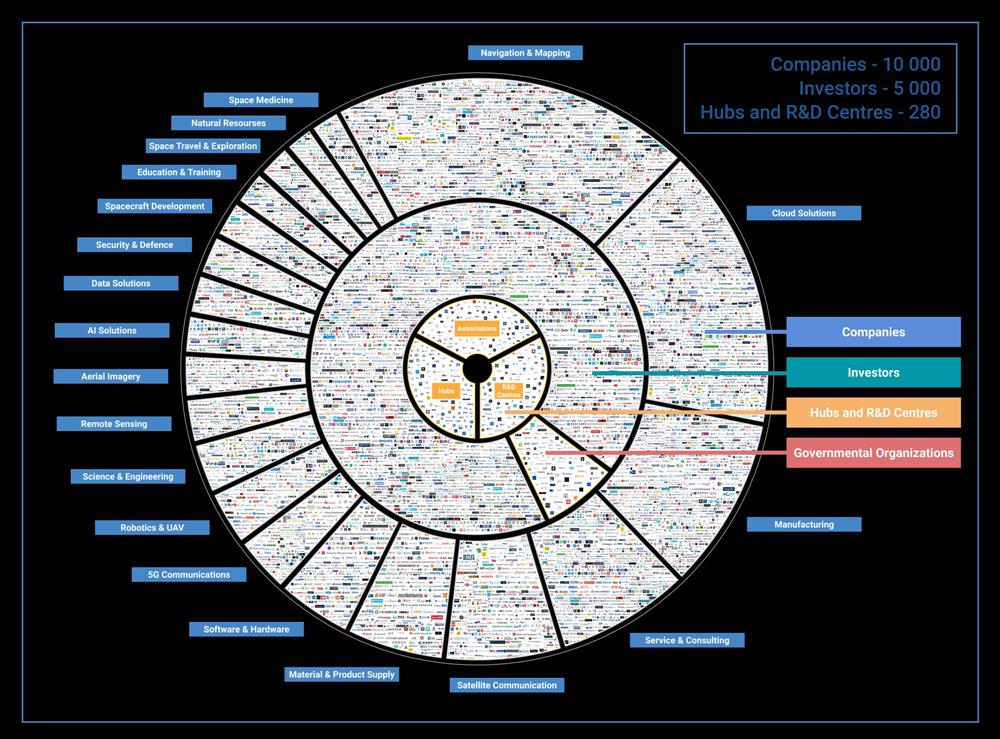

The release delivers information about major industry trends and sector insights on 10 000+ SpaceTech companies, 5 000 investors, 150 R & D hubs and associations, and 130 governmental organizations in the area of space exploration and development. While the special analytical case study, interactive mindmaps and associated IT-Platform distill the major trends and key insights of the project for easy consumption by strategic decision makers, the associated SpaceTech Analytical Dashboard offers additional insights and interactive features that allow key market trends to be identified and analyzed with a higher degree of precision and personalization. The report and associated IT-Platform also forecast future developments in SpaceTech and consolidate the investors, companies, hubs and governmental agencies positioned to make the most progress in terms of growth, diversification and market impact in the coming years.

Based on a comprehensive analysis of key market players and overall industry dynamics, the project has identified a number of key trends and insights about the investment landscape, R & D collaborations, and many other essential aspects in the first iteration. Some of the analysis' takeaways include the following:

- The Space Technology sector continues to consolidate.

- Reusable Launch vehicle companies are competing to reduce the launch-to-orbit cost from $10 000 per kilogram, as it was twenty years ago, to $500 which is estimated for Starship.

- The Small Satellite industry is on the way to becoming the most promising due to their fast manufacturing and launch planning, low vehicle mass budget for propellant, and broad spectrum of specialisation for mass coverage.

- The Earth Observation sector is 'heating up.' The sector is expected to grow from $4.6 billion in 2019 to $8 billion in 2029.

The number of governmental space agencies is increasing. There are 11 new agencies that are expected to emerge in the following years. Some of them are now able to have a number of significant launches on their own in a single year. The analysis revealed a trend of cooperation between various agencies, including private companies (NASA and SpaceX; Artemis and Boeing).

Alongside our research on the governmental space agencies, we also analysed the market of the private SpaceTech companies. The commercial space technology sector grows rapidly. It is now clear that private companies are developing faster than governmental agencies due to the bureaucracy that is slowing down the latter. Most of the SpaceTech companies (5582 companies) are headquartered in the US. However, some of the public companies in the industry are suffering from a decrease in their stock prices, there is a formidable number of private companies to become publicly traded.

Regarding the financial takeaways in the SpaceTech industry, it was managed to gather the following:

-The growing number of IPOs in the SpaceTech industry shows a high level of interest among investors in this sector. The number of IPOs in the SpaceTech industry rose from 2 in 2019 to 5 in 2020. Moreover, the industry expects to accomplish 6 more IPOs in 2021.

-Despite the crisis, publicly traded companies demonstrated rapid growth, as their market capitalization increased from $3.41 trillion in February 2020 to $4.02 trillion in March 2021.

-The declining launch cost and advances in technology can potentially make SpaceTech a $10 trillion industry by 2040.

-The demand for the production and launch of satellites is expected to grow dramatically in the next decade. During the period of 2009-2018, the average number of satellites launched per year was 280. It is expected that this will increase to 990 during the period of 2019-2028.

The special analytical case study pays attention to space-related companies developing AI, DeepTech, and Space Medicine (including Biomarker panels and technologies focused on optimizing the healthspans of astronauts), which constitute activities that have the potential to both further stimulate space exploration and increase the range of applications of SpaceTech products for humanity's needs on Earth.

The data encompassed by SpaceTech Analytics' 'SpaceTech Industry 2021 Landscape Overview' are presented and visualized in such a way as to enable strategic decision-makers to extract insights and other valuable, tangible information more easily, with the ultimate aim of optimizing their investment management strategies, assisting and promoting the accelerated growth of the SpaceTech industry as a whole.

The release marks the inaugural project of SpaceTech Analytics, dedicated to providing deep technical insights, business intelligence, and strategic guidance in the high-growth and significant opportunity areas of the space exploration industry, including satellite technologies, emerging propulsion systems, reusable launch vehicles, space medicine, promising startups, and more.

The company will also be releasing an analytically sophisticated second edition of the report and Dashboard later in 2021 which will incorporate big data analytics, machine learning, AI engine, and investment analytics technologies already developed and validated by SpaceTech Analytics' parent company, Deep Knowledge Group, and its various analytical subsidiaries (including Aging Analytics Agency and Deep Pharma Intelligence).

About SpaceTech Analytics

SpaceTech Analytics is a leading strategic and analytics agency focused on markets in the Space Exploration, Spaceflight, Space Medicine, and Satellite Tech industries. Our range of activity includes research and analysis on major areas of high potential in the SpaceTech industry, maintaining ratings of companies and governments based on their innovation potential and business activity, and providing strategic consulting and analytical services to advance the SpaceTech sector.

About Deep Knowledge Analytics

Deep Knowledge Analytics is a DeepTech focused agency producing advanced analytics on DeepTech and frontier-technology industries using sophisticated multi-dimensional frameworks and algorithmic methods that combine hundreds of specially-designed and specifically-weighted metrics and parameters to deliver insightful market intelligence, pragmatic forecasting, and tangible industry benchmarking.

For press and media inquiries, cooperation, collaboration, and strategic partnership proposals, please contact: al

New Specialized Think Tank SpaceTech Analytics Has Profiled and Analyzed the 2021 Global SpaceTech Industry, Covering 15 000+ Entities

SpaceTech Analytics is a specialized think tank in the area of Space exploration. — SpaceTech AnalyticsLONDON, LONDON, UNITED KINGDOM, May 19, 2021 /EINPresswire.com / -- SpaceTech Analytics, a new spin-off of Deep Knowledge Group's flagship subsidiary, Deep Knowledge Analytics, announces the release of an open-access, 165-page special analytical case study, interactive IT-Platform, and Dashboard designed to provide tangible industry insights, market trends, companies, investors, technologies benchmarking, and forecasting on the Global SpaceTech Industry: 'SpaceTech Industry 2021 Landscape Overview.'Link to the Special Analytical Case Study:

Link to the Interactive Dashboard:

The release delivers information about major industry trends and sector insights on 10 000+ SpaceTech companies, 5 000 investors, 150 R & D hubs and associations, and 130 governmental organizations in the area of space exploration and development. While the special analytical case study, interactive mindmaps and associated IT-Platform distill the major trends and key insights of the project for easy consumption by strategic decision makers, the associated SpaceTech Analytical Dashboard offers additional insights and interactive features that allow key market trends to be identified and analyzed with a higher degree of precision and personalization. The report and associated IT-Platform also forecast future developments in SpaceTech and consolidate the investors, companies, hubs and governmental agencies positioned to make the most progress in terms of growth, diversification and market impact in the coming years.

Based on a comprehensive analysis of key market players and overall industry dynamics, the project has identified a number of key trends and insights about the investment landscape, R & D collaborations, and many other essential aspects in the first iteration. Some of the analysis' takeaways include the following:

- The Space Technology sector continues to consolidate.

- Reusable Launch vehicle companies are competing to reduce the launch-to-orbit cost from $10 000 per kilogram, as it was twenty years ago, to $500 which is estimated for Starship.

- The Small Satellite industry is on the way to becoming the most promising due to their fast manufacturing and launch planning, low vehicle mass budget for propellant, and broad spectrum of specialisation for mass coverage.

- The Earth Observation sector is 'heating up.' The sector is expected to grow from $4.6 billion in 2019 to $8 billion in 2029.

The number of governmental space agencies is increasing. There are 11 new agencies that are expected to emerge in the following years. Some of them are now able to have a number of significant launches on their own in a single year. The analysis revealed a trend of cooperation between various agencies, including private companies (NASA and SpaceX; Artemis and Boeing).

Alongside our research on the governmental space agencies, we also analysed the market of the private SpaceTech companies. The commercial space technology sector grows rapidly. It is now clear that private companies are developing faster than governmental agencies due to the bureaucracy that is slowing down the latter. Most of the SpaceTech companies (5582 companies) are headquartered in the US. However, some of the public companies in the industry are suffering from a decrease in their stock prices, there is a formidable number of private companies to become publicly traded.

Regarding the financial takeaways in the SpaceTech industry, it was managed to gather the following:

-The growing number of IPOs in the SpaceTech industry shows a high level of interest among investors in this sector. The number of IPOs in the SpaceTech industry rose from 2 in 2019 to 5 in 2020. Moreover, the industry expects to accomplish 6 more IPOs in 2021.

-Despite the crisis, publicly traded companies demonstrated rapid growth, as their market capitalization increased from $3.41 trillion in February 2020 to $4.02 trillion in March 2021.

-The declining launch cost and advances in technology can potentially make SpaceTech a $10 trillion industry by 2040.

-The demand for the production and launch of satellites is expected to grow dramatically in the next decade. During the period of 2009-2018, the average number of satellites launched per year was 280. It is expected that this will increase to 990 during the period of 2019-2028.

The special analytical case study pays attention to space-related companies developing AI, DeepTech, and Space Medicine (including Biomarker panels and technologies focused on optimizing the healthspans of astronauts), which constitute activities that have the potential to both further stimulate space exploration and increase the range of applications of SpaceTech products for humanity's needs on Earth.

The data encompassed by SpaceTech Analytics' 'SpaceTech Industry 2021 Landscape Overview' are presented and visualized in such a way as to enable strategic decision-makers to extract insights and other valuable, tangible information more easily, with the ultimate aim of optimizing their investment management strategies, assisting and promoting the accelerated growth of the SpaceTech industry as a whole.

The release marks the inaugural project of SpaceTech Analytics, dedicated to providing deep technical insights, business intelligence, and strategic guidance in the high-growth and significant opportunity areas of the space exploration industry, including satellite technologies, emerging propulsion systems, reusable launch vehicles, space medicine, promising startups, and more.

The company will also be releasing an analytically sophisticated second edition of the report and Dashboard later in 2021 which will incorporate big data analytics, machine learning, AI engine, and investment analytics technologies already developed and validated by SpaceTech Analytics' parent company, Deep Knowledge Group, and its various analytical subsidiaries (including Aging Analytics Agency and Deep Pharma Intelligence).

About SpaceTech Analytics

SpaceTech Analytics is a leading strategic and analytics agency focused on markets in the Space Exploration, Spaceflight, Space Medicine, and Satellite Tech industries. Our range of activity includes research and analysis on major areas of high potential in the SpaceTech industry, maintaining ratings of companies and governments based on their innovation potential and business activity, and providing strategic consulting and analytical services to advance the SpaceTech sector.

About Deep Knowledge Analytics

Deep Knowledge Analytics is a DeepTech focused agency producing advanced analytics on DeepTech and frontier-technology industries using sophisticated multi-dimensional frameworks and algorithmic methods that combine hundreds of specially-designed and specifically-weighted metrics and parameters to deliver insightful market intelligence, pragmatic forecasting, and tangible industry benchmarking.

For press and media inquiries, cooperation, collaboration, and strategic partnership proposals, please contact: al

Alexei Cresniov

SpaceTech Analytics

al

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment