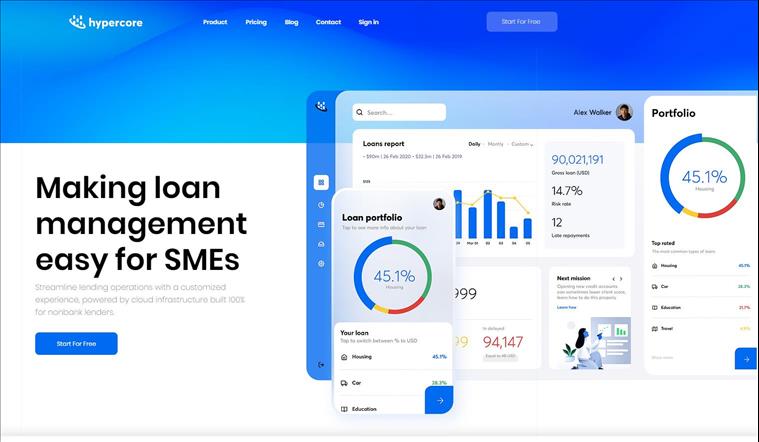

Fintech Startup Hypercore.ai brings simplicity, security and transparency to property loan management

Hypercore property loan management platform for SMEs

Hypercore.ai is a new Israeli FinTech SaaS solution for non-bank SME property lenders.

What I love about this platform is the ease and simplicity of the onboarding. Unlike some platforms, which can take up to 6 months to integrate, we were up and running in under thirty minutes. — Paul SullivanLONDON, ENGLAND, UNITED KINGDOM, May 4, 2021 /EINPresswire.com / -- Hypercore.ai is a new Israeli FinTech SaaS solution for non-bank SME property lenders. The founders are all deeply experienced developers from the Fintech space. Their driving ambition is to provide a secure cloud-based solution for the processing and ongoing management of property developer loans. They are making it easy for SME businesses to move from Excel to a more suitable business platform.

Hypercore uses cloud-based technology to automate the otherwise time-consuming property loan management process. They are focusing on real estate and other SME lenders. These include consumer and retail lending, mortgage servicing providers, invoice factoring and eCommerce.

The platform's services include but are not limited to loan origination, KYC/AML compliance, credit scoring, repayment schedules, documentation and other automated processes. In addition to their array of services, they enable easy to manage self-service onboarding.

Hypercore's experience and research showed that many SME finance companies still rely on old-school or outdated solutions when managing property loan portfolios, for example, Excel. With the rapid growth of cloud-based technology and data, solutions like Excel are inefficient and prone to human error and susceptible to data breaches.

That experience led them to see that SME property lenders in particular are still using Excel spreadsheets to manage their property loans. Due to Excel being static and non-intuitive, and utterly reliant on humans, the slightest mistake in the data will produce spurious results in reporting.

Another problem that loan companies face is lengthy onboarding processes with the incumbent software players. Hypercores speedy onboarding reduces friction which increases adoption and ensures same-day value for its customers.

Digital transformation for property lenders

Digital transformation for real estate lenders is achieved through adopting cloud-based SaaS platforms. This solves security concerns and makes loan portfolio management simple. It also removes the need for human management of tedious and repetitive administrative tasks, saving time for more productive efforts in the workplace.

Errors can be difficult to spot and time-consuming to analyse and rectify, potentially causing brand reputation and financial damages; this is why Hypercore.ai offers property finance loan services a customisable, accessible and modern replacement of Excel spreadsheets.

Hypercore, In addition to being a cost-effective cloud-based solution, has your organisation up and running in under ten minutes. This SaaS platform automatically covers areas that otherwise require hours of manual work. In particular, risk management, loan lifecycle, KPI monitoring, reporting and customer experience.

Hypercore's software allows you to 'Focus on growing your business while they make sure you're running the latest systems, security and infrastructure'.

By offering a free full access trial of the software, users can capitalise on the platform right after signing up.

There are three plans available for different sizes of businesses: Basic, Standard and Professional, for a free 30 days trial for each. For more information on Hypercore.ai, visit their website. For further inquiries, please contact

Daniel Liechenstein

Hypercore

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment