S&P Global expects sukuk issuance to touch $100bn in 2020

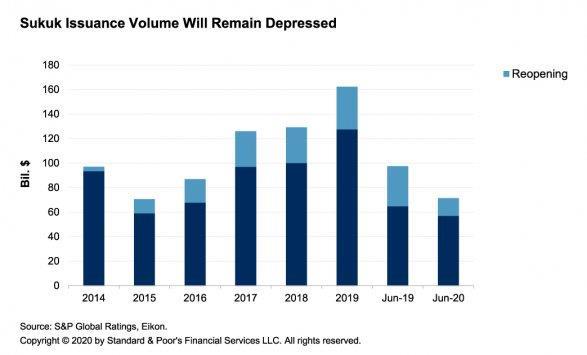

Sukuk issuance volume is expected to total around $100bn for 2020, about 40 percent lower than in 2019.

The issuance volume fell 27 percent in the first six months of this year. The global rating agency S & P noted yesterday that in the current environment, the number of defaults among sukuk issuers with low credit quality will likely increase, which will serve to test the robustness of legal documents for sukuk.

Also, over the next six months, some sukuk may be issued to tackle social issues as economies recover, rather than solely to serve investors' financial interests. Such instruments will likely appeal to investors seeking to support the domestic economy or environment, social, and governance (ESG) goals. S & P Global Ratings believes that investors' risk aversion is subsiding, thanks among other factors to strong global liquidity.

Over the past few weeks, issuers with good credit quality have approached the market, either by reopening sukuk or tapping established programs. Debut issuance remains rare. Despite this glimmer of optimism, total issuance volume for the full year2020 will be lower than in 2019 since corporates are holding on to cash, cutting capital expenditure, and using bank financing.

Central banks have already taken measures to boost banks' liquidity in core Islamic finance countries, so they are unlikely to issue sukuk as liquidity management instruments this year. They want banks' increased liquidity to reach corporates, thereby minimizing the risk of a long-lasting economic downturn resulting from COVID-19 and low oil prices.

The difficult economic environment has led to higher financing needs for sovereigns, but most of them are turning to conventional markets due to the complexity of issuing sukuk. As the spread of the coronavirus moderates in many core Islamic finance countries, policymakers will prioritize restarting the economy and limiting the overall impact of containment measures on productive capacity and employment.

Yet the events of 2020 will still constitute a major economic shock for all core Islamic finance countries, with a significant reduction of economic growth before a mild recovery in 2021. 'Against this backdrop, the volume of sukuk issuance will remain depressed in our view. In the first six months of 2020, the market dropped by27 percent. We expect issuance volume to reach $100bn at best this year compared with $162bn in 2019, which represents an almost 40 percent decline, the rating agency noted.

In response to low oil prices and the pandemic's impact on the economy, several central banks launched liquidity programs to help corporations cope and to preserve the productive capacity of their economies.

As such, local banks are able to meet most of the economies' financing needs. S & P Global expects bank lending to increase by low- to mid-single digits in most core Islamic finance countries in 2020, and for some loans to be at subsidized rates; so there's little incentive for corporates to issue sukuk.

On top of this, corporates' financing needs have reduced, since they are delaying investments and reducing capital expenditure in the uncertain environment. Central banks have also reduced their issuances. So far in 2020, they have been injecting liquidity into the banking systems rather than taking it out; but we foresee some opportunistic issuances in 2020. Market conditions have been extremely volatile over the past few months because of the pandemic.

However, news of several countries' success in containing the virus and the gradual lifting of restrictions brought some stability to global capital markets, and S & P Global sees an uptick in issuance. For example, the Indonesian government issued a $2.5bn global sukuk in June 2020, including a $750m 'green tranche. One of the tranches with a 30-yearmaturity was well received by investors based on its pricing.

The overall sukuk offering was heavily oversubscribed, showing that, even during episodes of volatility, issuers with a sound credit standing can retain access to the market. The volume of foreign-currency-denominated issuance has increased by 11.3 percent, primarily due to higher issuance from the Islamic Development Bank as part of its planned increase in lending, and a Kuwaiti bank's opportunistic launch of a Tier 1 instrument before the capital market instability started.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment