USDJPY Rate Defends Monthly Low Despite Growing Bets for Fed Rate Cut

USDJPY Rate Defends Monthly Low Despite Growing Bets for Fed Rate Cut USD/JPY may stage a larger rebound going into the final days of May as U.S. Treasury yields bounce back from fresh yearly lows, and developments coming out of the world's largest economy may continue to influence risk sentiment as President Donald Trump tweets that there's 'great progress being made in our trade negotiations with Japan.'

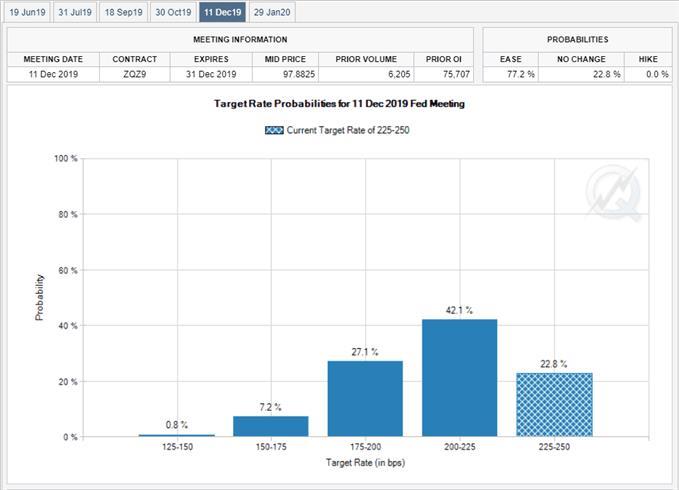

It remains to be seen how carry trade interest will fare going into the second-half of the year as the Trump administration struggles to reach an agreement with China, and the Federal Reserve may come under increased pressure to respond to the shift in U.S. trade policy especially as theInternational Monetary Fund (IMF)warns that 'consumers in the US and China are unequivocally the losers from trade tensions.'  In turn, Fed Fund Futures now show a greater than 70% probability for a December rate-cut, but the Federal Open Market Committee (FOMC) may find it difficult to abandon the rate hiking cycle as higher tariffs are seen feeding into consumer prices. In fact, Chairman Jerome Powell & Co. may continue to project a longer-run interest rate of 2.50% to 2.75% at the next quarterly interest rate decision on June 19 as 'many participants viewed the recent dip in PCE inflation as likely to be transitory.'

In turn, Fed Fund Futures now show a greater than 70% probability for a December rate-cut, but the Federal Open Market Committee (FOMC) may find it difficult to abandon the rate hiking cycle as higher tariffs are seen feeding into consumer prices. In fact, Chairman Jerome Powell & Co. may continue to project a longer-run interest rate of 2.50% to 2.75% at the next quarterly interest rate decision on June 19 as 'many participants viewed the recent dip in PCE inflation as likely to be transitory.'

Keep in mind, the recent pickup in USD/JPY volatility has shaken up market participation, with retail sentiment holding near an extreme reading.

TheIG Client Sentiment Reportshows 66.5% of traders are net-long with the ratio of traders long to short at 1.99 to 1. In fact, traders have remained net-long since May 03 whenUSD / JPYtraded near 111.40 even though price has moved 1.9% lower since then. The number of traders net-long is 6.5% higher than yesterday and 7.0% lower from last week, while the number of traders net-short is 1.3% lower than yesterday and 6.0% higher from last week.

TheIG Client Sentiment Reportshows 66.5% of traders are net-long with the ratio of traders long to short at 1.99 to 1. In fact, traders have remained net-long since May 03 whenUSD / JPYtraded near 111.40 even though price has moved 1.9% lower since then. The number of traders net-long is 6.5% higher than yesterday and 7.0% lower from last week, while the number of traders net-short is 1.3% lower than yesterday and 6.0% higher from last week. Despite the small pickup in net-short position, the tilted in retail interest offers a contrarian view to crowd sentiment especially as USD/JPY fails to fill the gap from earlier this month. As a result, the Dollar Yen exchange rate may continue to give back the rebound following the currency market flash-crash as it carves a series of lower highs & lows.

Sign up and join DailyFX Currency Strategist David Song LIVEfor an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.USD/JPY Rate Daily Chart The USD/JPY correction following the currency market flash-crash may continue to unravel as price and the RSI snap the bullish trends from earlier this year, with the recent series of lower highs & lows keeping the 108.30 (61.8% retracement) to 108.40 (100% expansion) zone on the radar. Next downside area of interest comes in around 106.70 (38.2% retracement) to 107.20 (61.8% retracement) followed by the 105.40 (50% retracement) region. However, recent developments in the RSI suggest USD/JPY has marked a failed attempt to test the monthly-low (109.02) as the oscillator holds above oversold territory, with a move back above the 109.40 (50% retracement) to 110.00 (78.6% expansion) area opening up the Fibonacci overlap around 111.10 (61.8% expansion) to 111.80 (23.6% expansion). For more in-depth analysis, check out theQ2 2019 Forecast for the Japanese Yen

The USD/JPY correction following the currency market flash-crash may continue to unravel as price and the RSI snap the bullish trends from earlier this year, with the recent series of lower highs & lows keeping the 108.30 (61.8% retracement) to 108.40 (100% expansion) zone on the radar. Next downside area of interest comes in around 106.70 (38.2% retracement) to 107.20 (61.8% retracement) followed by the 105.40 (50% retracement) region. However, recent developments in the RSI suggest USD/JPY has marked a failed attempt to test the monthly-low (109.02) as the oscillator holds above oversold territory, with a move back above the 109.40 (50% retracement) to 110.00 (78.6% expansion) area opening up the Fibonacci overlap around 111.10 (61.8% expansion) to 111.80 (23.6% expansion). For more in-depth analysis, check out theQ2 2019 Forecast for the Japanese Yen

Want to know what other currency pairs the DailyFX team is watching? Download and review theTop Trading Opportunitiesfor 2019.

--- Written by David Song, Currency StrategistFollow me on Twitter at @DavidJSong.

DailyFX

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment