403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

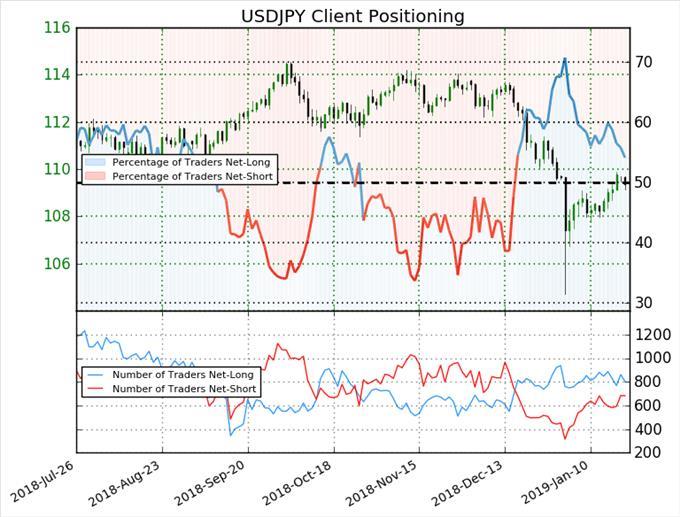

USDJPY: Sentiment Suggests a Mixed Bias

(MENAFN- DailyFX) NET-LONG POSITIONS DECREASE FROM LAST WEEKUSDJPY: Retail trader data shows 54.1% of traders are net-long with the ratio of traders long to short at 1.18 to 1. In fact, traders have remained net-long since Dec 18 when USDJPY traded near 113.568; price has moved 3.7% lower since then. The percentage of traders net-long is now its lowest since Jan 10 when USDJPY traded near 108.288. The number of traders net-long is 7.6% lower than yesterday and 6.0% lower from last week, while the number of traders net-short is 1.2% higher than yesterday and 8.4% higher from last week.

To gain more insight to how we use sentiment to power our trading, join us for our weekly Trading Sentiment webinar .

USDJPY DIRECTION IS UNCLEARWe typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USDJPY price trend may soon reverse higher despite the fact traders remain net-long.--- Written by Nancy Pakbaz, CFA, DailyFX Research

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment