Weekly Fundamental Forecast:Trade Wars are Heating Up, Brexit Faces a Fork, Fed Intent Blurs

nother batch of lackluster U.S. data prints may spur a further depreciation in USD/JPY as it pushes the Fed to adopt a less-hawkish forward-guidance for monetary policy.

Crude may still finish the year in the red, but OPEC helped to stop the bleeding with a production cut agreement that exceeded market expectations.

The Canadian Dollar looks to rebound with major event risk in the rearview mirror and shifting bullish sentiment.

It would be easier to solve a Rubik's cube wearing a blindfold than it would be to work out the UK's position on Brexit which seemingly shifts every day. And that is hitting Sterling, making it increasingly difficult to trade with any confidence.

The US Dollar may find fuel to push higher as CPI data boosts Fed rate hike bets while shaky European politics stoke haven demand.

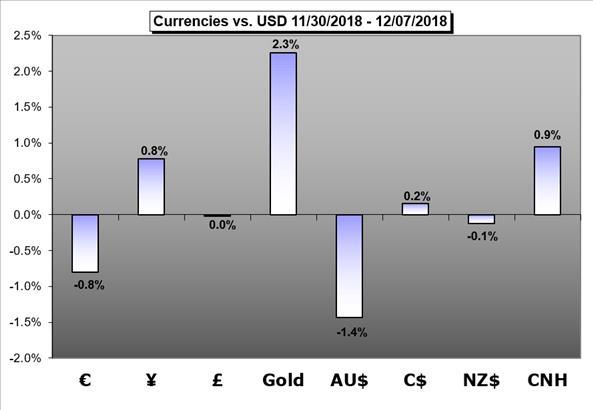

Gold Forecast -Can Gold Prices Keep Gains After Brexit Draft Vote, US CPI, ECB?Gold gained amidst a weaker US Dollar, lower government bond yields on market-wide pessimism. Next week contain numerous uncertainties for gold: Brexit draft vote, US CPI and ECB.

Equities Forecast - S & P 500, DAX, FTSE Look to Brexit Vote. Trade Wars Remain a FactorBrexit will be the headline event to watch in the week ahead for equities, but trade wars are ongoing and pose a constant threat.

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the .See how retail traders are positioning in the majors using the

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment