Is Lebanon Headed For A Second Civil War?

Perhaps the approach to the Middle-East crisis is for the Saudis to first strike at Lebanon, considered a satellite state of Iran, rather than drop the gloves with the budding nuclear power itself. As the Saudis appear to have 'declared war' on Lebanon, to one Hezbollah leader in the region, does the path to a Saudi Iranian War start with its satellite states? Some of the lessons of Lebanon can be learned through history, says a Nomura report, which cites knee-jerk reactions as paving the way for a change in financial outcomes in the region. The trick for analysts is to watch for the point tensions spill over into developed world equity markets.

Move in crude reflects Saudi Iranian War possibilities

Since bottoming in January 2016 near $29, the price of oil has been , with the August move in WTI Crude from $47.47 to today's price above $57. With all the potential hostility around the world keeping a lid on volatility, this is one market that appears sensitive to recent movements in the region. The undercurrent has been the long-awaited Saudi Iranian war. With Iran on the cusp of obtaining nuclear weapons, a fate Saudi Arabia will not allow, and Western diplomats and local royalty lining up behind a recently anointed prince, the battle lines appear drawn.

Capital Econ opines:

the latest leg-up in oil prices since mid-October, which had been triggered by a crackdown on corruption by Saudi Crown Prince Mohammed bin Salman and the harder line he has taken on Iran and its allies, is likely to be reversed in due course. We agree, assuming that hostilities between Saudi Arabia and Iran are avoided. Indeed, we still forecast that oil prices will end this year and next a little lower than they are now.

But could the first shot in this Saudi Iranian War not be aimed at Iran, but rather Lebanon?

'In the , the market concerns about Lebanon turning into a battleground for the Saudi – Iran conflict materialize and sectarian clashes erupt, possibly dragging Israel into a military conflict within Lebanese territory,' Nomura's Inan Demir wrote in a November 9 research piece.

Southern Lebanon is considered by Israel a staging ground for Iranian backed Hezbollah terrorists who have issued a death vow to wipe the Jewish nation off the face of the earth. The concern is that by attacking Lebanon, it could unleash a wider conflict. Rather than being an Arab affair, bringing Israel into the mix muddies the sectarian waters.

Indeed, Capital Econmics noted in a different report this week that while a Saudi Iranian War is unlikely, proxy wars will heat up:

Equity markets elsewhere in the region have generally fared worse than those in Saudi Arabia. (See Chart 5.) We suspect that this reflects concerns that the Kingdom's increasingly aggressive tone towards Iran will stoke regional tensions that could ultimately morph into a military confrontation. A direct conflict between Saudi Arabia and Iran seems unlikely but the threat of a proxy war unfolding, most probably in Lebanon, is building. On the back of this, Lebanon's benchmark equity index has dropped by 3% since the weekend.

• Such a scenario would clearly have a devastating social impact on Lebanon and hit the country's economy hard. A period of capital flight would quickly erode the country's foreign exchange reserves and probably force the authorities to abandon the dollar peg.

Markets starting to react to a Saudi Iranian War heavyweight fight

Markets around the world could be reacting to the conflict potential. The most immediate impact is felt in Lebanese , which have risen to highs not seen since the 2008 financial crisis. While US market tensions have been tied to the weakening chances of a corporate-friendly tax-reform bill passing, a widening conflict in the gulf region that appeared to go over the top with a missile being fired into the capital of Riyadh.

Capital Economics, for its part, notes that 'Saudi saber-rattling' is hitting markets not just in the region, but beyond as well.

'We suspect (regional market weakness) reflects concerns that the Kingdom's increasingly aggressive tone towards Iran will stoke regional tensions that could ultimately morph into a military confrontation,' Capital Economics analyst Jason Tuvey wrote in a November 9 report.

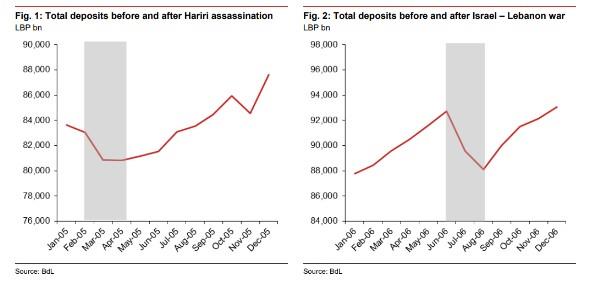

He doesn't see a direct conflict between Saudi Arabia and Iran , but rather the likely probability path is a proxy war, with Lebanon being a prime target. 'Such a scenario would clearly have a devastating social impact on Lebanon and hit the country's economy hard,' he wrote. 'A period of capital flight would quickly erode the country's foreign exchange reserves and probably force the authorities to abandon the dollar peg.' There are issues of Lebanese bank deposit flight and general financial weakness that will result from what could be a financial as well as physical war in the region.

Watching for contagion will be the key, however.

'CDS premia and dollar bond spreads over US Treasuries have risen in the Gulf too,' Turvey noted. 'Investors seem to be building in an additional risk premium to take account of the heightened political uncertainty.'

Benchmarking when that uncertainty hits developed market shores will be the next step in the crisis.

Meanwhile, Kuwaitand Saudi have told their citiens to leave Lebanon immediately - that usually is a sign of a threat of Saudi Iranian war, at least. If a war does take place though with Lebanon's complex multi ethnic makeup it seems unlikely that Saudi would invade. Aided by hundreds of thousands of mostly Sunni refugees from Syria (who are likely to be more sympathetic to Saudi than Iran), Saudi can fight a more agressive proxy war against the shia controlled (sort of) Lebanese Government.

It seems unlikely that Saudi will send tanks into Lebanon but a savage civil war like 1975 cannot be ruled out. Of course, whether there is a Saudi Iranian War war or not, Iran would also share at least equal if not more of the blame especially after its likely involvement in the .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment