Crude Oil Prices Remain Bid as Iraq Hints at More OPEC Measures

- Struggles to Test Monthly-High Ahead of , NZ GDP.

- Crude Oil Prices Remain Bid as Iraq Hints at More OPEC Measures.- Sign Up for the for an opportunity to discuss potential trade setups.

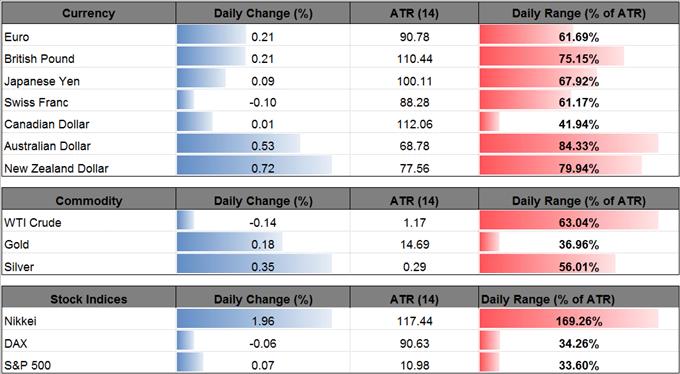

NZD/USD outperforms its major counterparts ahead of the Federal Open Market Committee (FOMC) interest rate decision, but mixed developments coming out of New Zealand may drag on the exchange rate as the economy is expected to grow at the slowest pace since 2015.Market participants will pay close attention to the fresh updates from Chair Janet Yellen and Co. as the ‘Committee expects to begin implementing its balance sheet normalization program relatively soon,' but the central bank may merely attempt to buy more time as inflation continues to run below the 2% target. In turn, NZD/USD traders may put increased emphasis on New Zealand's 2Q Gross Domestic Product (GDP) report as the growth rate is expected to hold steady at an annualized 2.5%. A lackluster GDP reading may produce headwinds for kiwi it encourages the Reserve Bank of New Zealand (RBNZ) to retain the record-low cash rate throughout 2017, and the central bank may continue to toughen the verbal intervention on the local currency as ‘a lower is needed to increase tradables inflation and help deliver more balanced growth.'

NZD/USD Daily ChartBroader outlook for NZD/USD remains mired by a head-and-shoulders formation, with the pair at risk for a key reversal as long as it remains capped by the Fibonacci overlap around 0.7330 (38.2% retracement) to 0.7350 (23.6% expansion). Need a break/close below the near-term support zone around 0.7190 (50% retracement) to 0.7200 (38.2% retracement) to open up the downside targets, with 200-Day SMA (0.7140) on the radar as it lines up with the August-low (0.7132); next area of interest coming in around 0.7100 (38.2% retracement) to 0.7110 (38.2% expansion) followed by the 0.7040 (50% retracement) region. Crude remain bid as the Organization of the Petroleum Exporting Countries (OPEC) appear to be on course to further reduce supply, and prices may continue to trade higher over the near-term as U.S. refiners recover from Hurricane Harvey.

Iraqi Oil Minister Jabbar al-Luaibi suggested OPEC will boost its efforts to rebalance the energy market as ‘some, like Ecuador and other countries, even Iraq, think there should be another cut of 1 percent,' while others ‘think that cuts should be extended beyond March, three or four months, or six months, or maybe till the end of 2018.' At the same time, the International Energy Agency (IEA) warned that ‘there is at least a possibility of going back to the situation we had 10 years ago where oil prices were very, very high at a time when demand was growing' as the group raises its outlook for global consumption.As a result, concerns surrounding Hurricane Maria may keep crude prices afloat as the storm gathers pace, but the recent disruption in field production may end up being short-lived as outputs approach the record-high (9,610 b/d).

USOIL Daily Chart

Chart - Created UsingBroader outlook for USOIL has perked up as it clears the August-high ($50.40) and appears to be making a more meaningful attempt to break out of the downward trend from earlier this year, which raises the threat for an inverse head-and-shoulders formation; next topside area of interest comes in around $52.00 (50% expansion) to $52.10 (23.6% retracement), which lines up with the May-high ($51.97). However, the string of failed attempts to close above the $50.20 (38.2% retracement) hurdle may trigger a near-term pullback in crude, with the first downside region of interest coming in around $48.60 (38.2% retracement) to $49.30 (23.6% retracement) followed by the $47.70 (38.2% expansion) region. Retail Sentiment

Retail trader data shows 55.1% of traders are net-long NZD/USD with the ratio of traders long to short at 1.23 to 1. The number of traders net-long is 10.9% higher than yesterday and 14.1% higher from last week, while the number of traders net-short is 7.4% lower than yesterday and 16.7% lower from last week. Click Here for the

--- Written by David Song, Currency AnalystTo contact David, e-mail . Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment