UAE- Adnoc signs Dh4.3b concession deals with China oil giant

Under a 40-year agreement, CNPC, through its majority-owned listed subsidiary PetroChina, was granted a 10 per cent interest in the Umm Shaif and Nasr concession and a 10 per cent interest in the Lower Zakum concession.

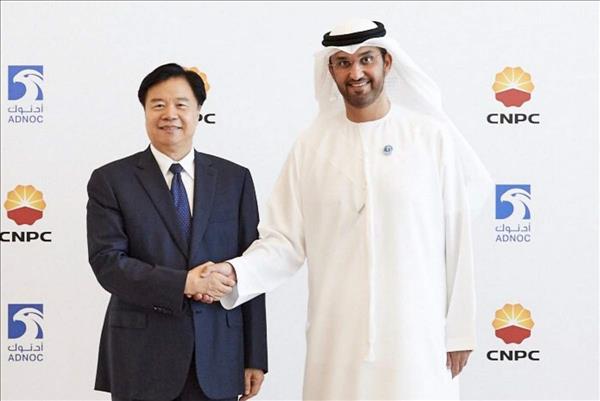

PetroChina paid a participation fee of Dh2.1 billion for the Umm Shaif and Nasr concession and a fee of Dh2.2 billion for the Lower Zakum concession, Adnoc said in a statement. Dr Sultan Ahmed Al Jaber, Adnoc Group CEO, and Wang Yilin, CNPC Chairman, signed the agreements that have a term of 40 years and are backdated to March 9, 2018.

In the Umm Shaif and Nasr concession, PetroChina joins France's Total and Italy's Eni, which were recently awarded a 20 per cent and 10 per cent stake respectively.

In the Lower Zakum concession, CNPC joins an Indian consortium led by ONGC Videsh, Japan's INPEX, Total and Eni.

Adnoc retains a 60 per cent majority share in both concessions.

Dr Al Jaber said the expanded collaboration with CNPC further strengthens and deepens the strategic and economic relationship between the UAE and China, the world's second largest economy.

"Energy cooperation is an increasingly important aspect of the UAE's relations with China, the number one oil importer globally and a major growth market for our products and petrochemicals. These agreements are new milestones in Adnoc's thriving partnership with CNPC and also represent an important platform upon which we can explore opportunities further downstream," he said.

"CNPC's involvement in our offshore concession areas will help to maximise the returns from what are very attractive, stable and long-term opportunities. At the same time these agreements further underline the international energy markets' confidence in Adnoc's 2030 growth strategy as we accelerate delivery of a more profitable upstream business and generate strong returns for the UAE," said Dr Al Jaber.

"These agreements strengthen our growing relationship with Adnoc, and will help to meet China's expanding demand for energy and contribute to asset portfolio optimisation and profitability enhancement of PetroChina," Wang Yilin, who is chairman of both PetroChina and its parent China National Petroleum Corporation (CNPC.

"To promote development of the assets, we will closely collaborate with Adnoc to deploy world class engineering solutions and advanced technology to maximise recovery from these two concessions," said Yilin.

In February 2017, CNPC was awarded an eight per cent interest in Abu Dhabi's onshore concession, operated by Adnoc Onshore. It also has a 40 per cent stake in the Al Yasat concession with Adnoc.

CNPC, through PetroChina, produces 52 per cent of China's crude oil and 71 per cent of its natural gas production, and has exploration and production activities in more than 30 countries in Africa, Central Asia-Russia, America, the Middle East and the Asia-Pacific. In 2016, PetroChina produced 772.9 million barrels of crude oil and 3,464 billion cubic feet of natural gas in China.

China is the world's largest oil importer, with the UAE ranking tenth in supplies to the country. While China grows its domestic refining capacity and fills its strategic inventories, the country continues to secure global crude supplies. By 2020, China's oil consumption is expected to reach 12 million barrels per day.

China and the UAE have made several co-investments in the energy sector in the past year. In February 2017, CNPC was awarded minority stakes in the UAE's onshore oil reserves. And, in November of 2017, Adnoc and CNPC signed a framework agreement covering various areas of potential collaboration, including offshore opportunities and sour gas development projects.

Adnoc is also focusing on downstream expansion in China and Asia, where demand for petrochemicals and plastics, including light-weight automotive components, essential utility piping and cable insulation, is forecast to double by 2040.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment