US Moving To Revive Small And Community Banks: Bessent

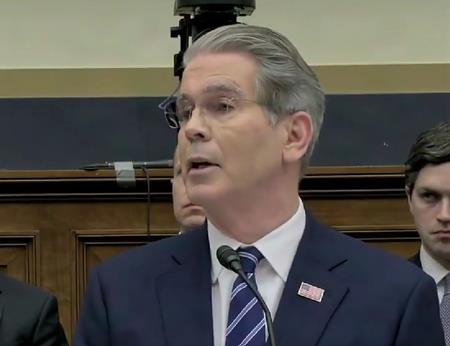

Testifying before the House Financial Services Committee on Wednesday (local time), Bessent said community banks are critical to small businesses, agriculture, and housing, but have steadily disappeared since the global financial crisis.

“More than 50 per cent of community banks have disappeared since the great financial crisis,” Bessent said, noting that the decline continued long after the crisis ended.

He blamed what he called one-size-fits-all regulation for squeezing smaller lenders and pushing credit toward large institutions. Bessent said regulators often treated small banks as if they posed the same risks as the biggest banks in the country.

Bessent told lawmakers that under previous regulatory regimes, community banks were burdened with compliance costs that reduced their ability to lend. He said the administration is now pushing for“tailored regulation” that matches rules to each institution's size and risk profile.

Republican lawmakers backed that approach. They argued that small banks know their communities best and play a central role in financing local housing, farms, and small businesses.

Bessent said community banks provide much of the credit for agriculture, small commercial real estate, and local enterprises. He warned that continued consolidation would weaken competition and limit access to credit outside major financial centres.

He said reviving local banks would help expand housing supply and support economic growth beyond large cities.“It's Main Street's turn,” Bessent told the committee.

Democratic lawmakers expressed concern that loosening rules could increase financial risk. They warned that past deregulation had contributed to financial instability and said safeguards were needed to prevent a repeat of earlier crises.

Bessent rejected comparisons to the period before the 2008 collapse. He said excessive regulation can itself threaten stability by choking growth and reducing lending capacity.

He said the Financial Stability Oversight Council is working with banking regulators to modernise supervision and reduce unnecessary burdens, especially for small and mid-sized institutions.

The administration's push includes encouraging the formation of new banks, which Bessent said has been rare in recent years. Before the financial crisis, he noted, dozens of new banks were formed each year.

Bessent said restoring a diverse banking system with strong community lenders would make the US financial system more resilient over time.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment