403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

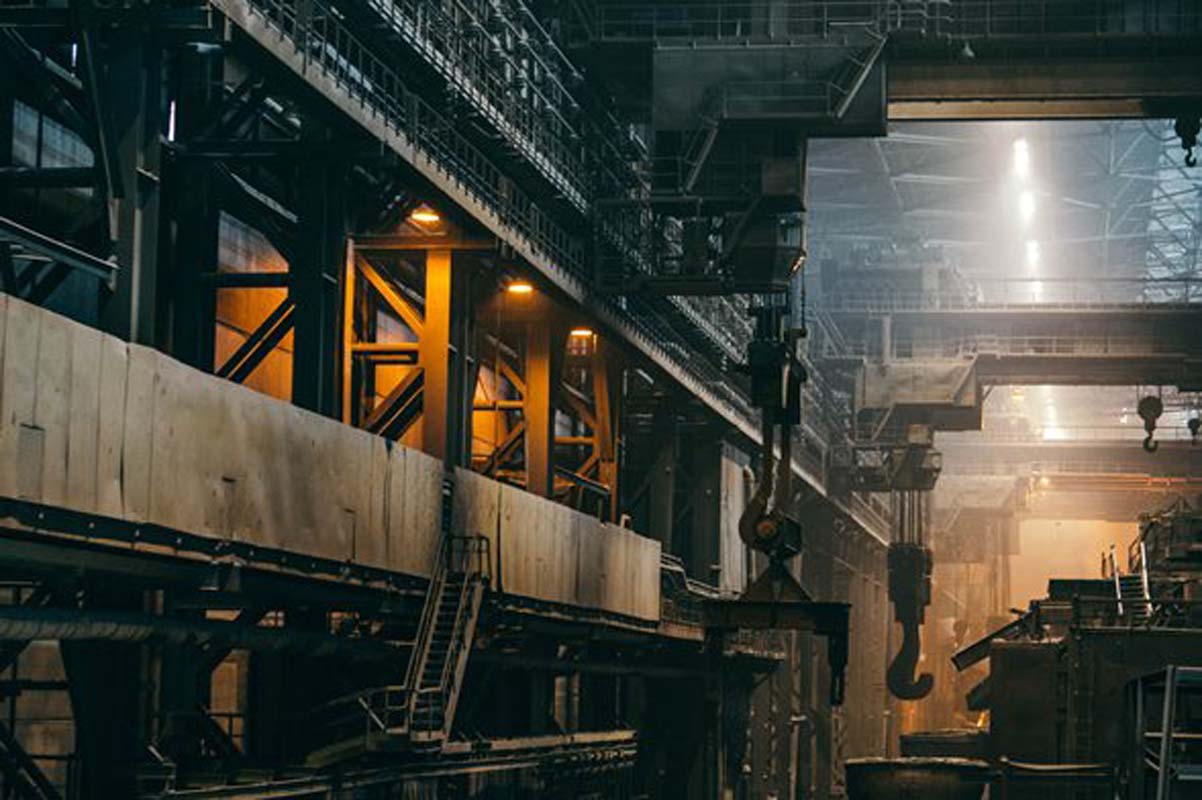

US Sees Return in Manufacturing Growth After Year-Long Slump

(MENAFN) American manufacturing activity jolted back into expansion territory last month, snapping a year-long slump, fresh data revealed Monday.

The Institute for Supply Management (ISM) reported its manufacturing purchasing managers' index (PMI) rocketed to 52.6% in January—a dramatic 4.7 percentage point leap from December's 47.9%. Readings exceeding 50 signal growth, while figures below that threshold indicate contraction.

The result crushed analyst expectations of 48.5%.

"Economic activity in the manufacturing sector expanded in January for the first time in 12 months, preceded by 26 straight months of contraction," an ISM statement said.

New orders demonstrated particularly robust momentum, with the New Orders Index climbing to 57.1%—a 9.7 percentage point surge from December's 47.4% and the strongest performance since February 2022, when it hit 59.7%. The measure hadn't registered expansion since August 2025.

Production metrics similarly strengthened, advancing 5.2 percentage points to 55.9% from the prior month's 50.7%—the highest level recorded since February 2022's 58.1%.

Price pressures persisted in expansion mode, ticking up to 59% from December's 58.5%.

The Backlog of Orders Index jumped to 51.6% from 45.8% the previous month, marking the strongest reading since August 2022's 53%.

ISM Chair Susan Spence acknowledged the turnaround while noting lingering weaknesses.

"In January, U.S. manufacturing activity returned to expansion territory, with improvements in all five subindexes that make up the PMI® (New Orders, Production, Employment, Supplier Deliveries, and Inventories), though the Employment and Inventories indexes still remain in contraction," Spence said.

The Institute for Supply Management (ISM) reported its manufacturing purchasing managers' index (PMI) rocketed to 52.6% in January—a dramatic 4.7 percentage point leap from December's 47.9%. Readings exceeding 50 signal growth, while figures below that threshold indicate contraction.

The result crushed analyst expectations of 48.5%.

"Economic activity in the manufacturing sector expanded in January for the first time in 12 months, preceded by 26 straight months of contraction," an ISM statement said.

New orders demonstrated particularly robust momentum, with the New Orders Index climbing to 57.1%—a 9.7 percentage point surge from December's 47.4% and the strongest performance since February 2022, when it hit 59.7%. The measure hadn't registered expansion since August 2025.

Production metrics similarly strengthened, advancing 5.2 percentage points to 55.9% from the prior month's 50.7%—the highest level recorded since February 2022's 58.1%.

Price pressures persisted in expansion mode, ticking up to 59% from December's 58.5%.

The Backlog of Orders Index jumped to 51.6% from 45.8% the previous month, marking the strongest reading since August 2022's 53%.

ISM Chair Susan Spence acknowledged the turnaround while noting lingering weaknesses.

"In January, U.S. manufacturing activity returned to expansion territory, with improvements in all five subindexes that make up the PMI® (New Orders, Production, Employment, Supplier Deliveries, and Inventories), though the Employment and Inventories indexes still remain in contraction," Spence said.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment