403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Meta Platforms Stock Signal 07/01: Trading $2 Billion AI

(MENAFN- Daily Forex) Long Trade IdeaEnter your long position between $643.50 (Friday's intra-day low) and $664.54 (Monday's intra-day high).Market Index Analysis

- Meta Platforms (META) is a member of the NASDAQ 100, the S&P 100, and the S&P 500. The NASDAQ 100, S&P 100, and S&P 500 all pushed cautiously higher to start 2026, with AI stocks surging on renewed euphoria following strong Micron and Nvidia earnings, even as broader market breadth deteriorated and trading volumes declined, signalling that gains are increasingly concentrated in mega-cap tech names. The Bull Bear Power Indicator of the NASDAQ 100 is bullish but remains structurally below its descending trendline, suggesting that while early-year strength persists, the reliability of the rally is questionable as volume divergences widen and retail participation lags.

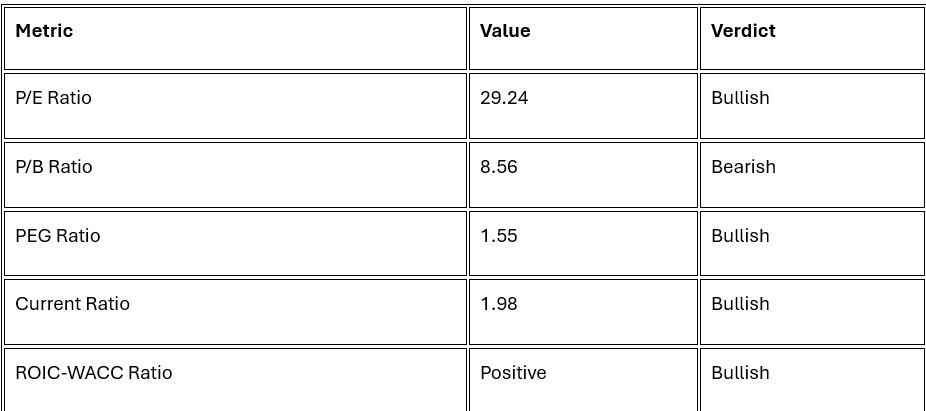

- The META D1 chart shows price action consolidating just above the $660.00 psychological level after a sharp intra-week rally, with buyers defending the $643.50–$650.00 support zone aggressively, confirming that institutional accumulation remains intact despite the recent pause in momentum. META now trades above its 20-day and 50-day moving averages with rising volume on the recent bounce, indicating that the pullback that preceded the Manus announcement was a healthy consolidation rather than a trend reversal, and dip-buyers continue to emerge on weakness. The Bull Bear Power Indicator on the META daily chart has turned bullish with an ascending trendline, signalling strengthening buyer dominance and suggesting that recent dips continue to attract institutional accumulation rather than capitulation selling. Average trading volumes on the recent breakout above $658.00 are above the 20-day average, a constructive sign that suggests the stock's rally is supported by real money flows rather than retail euphoria alone. META has begun to materially outperform the broader NASDAQ 100 and S&P 500 indices on a relative strength basis, a constructive signal that underscores the stock's preferred positioning within the AI and mega-cap technology rotation, supporting continued strength as the January 28th earnings report approaches.

- META Entry Level: Between $643.50 and $664.54 META Take Profit: Between $796.25 and $837.15 META Stop Loss: Between $581.25 and $601.20 Risk/Reward Ratio: 2.45

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment