Bank Of Japan Rate Hike Odds Rise With Strong Export Performance

| 6.1% |

Exports (%YoY)

Imports 1.3% YoY |

| Higher than expected |

Japan's exports rose 6.1% year on year in November (vs 3.6% in October, 5.0% market consensus). We believe that finalising the US trade deal and robust global semiconductor demand mainly drove the sharp increase in Japanese exports.

By destination, exports to Asia increased by 4.5%, with notable growth in Taiwan (16.8%), Malaysia (14.3%), and Vietnam (14%), while exports to China fell by 2.4%. Exports to the US and EU also increased sharply by 8.8% and 19.6%, respectively.

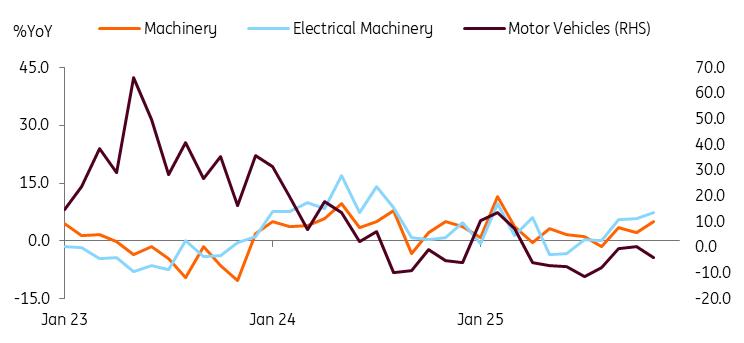

By export item, machinery exports increased by 5.1% and electrical machinery by 7.4%. Semiconductor exports rose 13%, mirroring growth seen in other major Asian chipmakers. Semiconductor exports throughout Asia remained robust. Motor vehicle exports fell by 4.1%. Yet shipments to the US increased slightly (1.5%), while exports to the EU remained strong (25.7%).

Japanese exports are on the recovery thanks to solid demand in machinery

Source: CEIC The effects of trade tensions between Japan and China remain uncertain

It's still unclear whether recent tensions between China and Japan are affecting trade. Exports to China declined (-2.4%) across most categories, except for electrical machinery. Significant declines were seen in organic chemicals (-23.6%) and nonferrous metals (-26.8%). But these exports have been sluggish throughout the year, partly due to unfavourable price effects and global oversupply. Regarding imports, raw material imports rose by 1.8%; imports of chemicals and machinery also remained positive. However, starting in December, we should monitor how geopolitical tensions may begin to affect trade between the two countries.

Meanwhile, imports rose more slowly than exports, by 1.3% YoY in November (vs 0.7% in October, 3.0% market consensus), so the trade balance turned to a surplus of 322.3 billion JPY in November. Seasonally adjusted, the balance recorded a small surplus for two months. This is expected to support growth positively this quarter.

| 7.0% |

Core Machinery Orders (%MoM, sa)

12.5% YoY |

| Higher than expected |

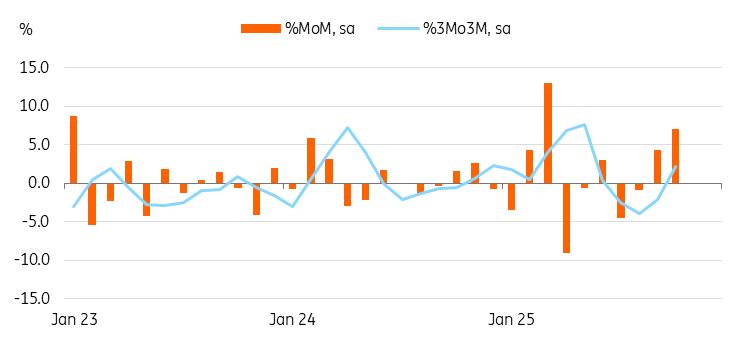

In a separate report, core machinery orders rose sharply -- 7.0% month on month, seasonally adjusted, in October, following a 4.2% gain in September. Currently, overseas demand is stronger than domestic demand. This is likely to boost export growth in the coming months. However, weak non-manufacturing demand suggests the expected recovery in CAPEX investment may be softer than anticipated.

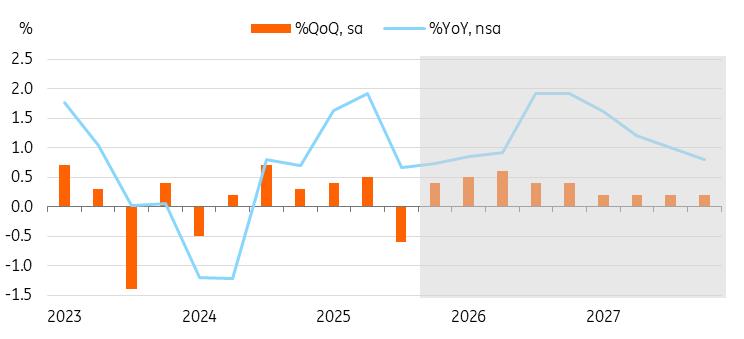

Recent releases of industrial production, retail sales, trade figures, and survey results reinforce our expectation that growth will recover in the fourth quarter of 2025. We anticipate a 0.4% quarter-on-quarter increase for 4Q25, with full-year GDP projected to rise by 1.2% YoY in 2025 and 1.4% in 2026.

Core machinery orders rose solidly for two months in a row

Source: CEIC BoJ preview

A 25 bp hike is almost fully priced by market participants. The markets' focus will be on Governor Ueda's comments. We don't expect Ueda to send any hawkish-titled messages to the market at the presser, given growing concerns about rising market rates. The BoJ expects real rates to remain negative after the rate hike later this week, leaving room for further hikes.

Current market expectations point to an additional rate hike in June or July. However, our assessment indicates that October is more likely. We anticipate that BoJ will maintain its existing neutral rate estimate within the 1-2.5% range for the foreseeable future. Recent market reactions to Ueda's remarks on reassessing the neutral rate appear to be a bit exaggerated. It's important to note that the neutral rate is a conceptual range rather than a fixed point. The BoJ doesn't attempt to spell it out it precisely. Looking ahead, the BoJ will closely evaluate the impact of higher interest rates on the economy such as corporate borrowing, bank lending, private consumption, and capital expenditures. Key indicators to monitor in the near term include the Spring wage negotiations and the JPY exchange rate.

Recent upbeat data releases suggest the rebound of GDP in 4Q25

Source: CEIC and ING estimates

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment