Czech National Bank Preview: No Change With Limited Liability

With headline inflation at 2.1% in November, the economy expanding by 2.8% annually in the third quarter, and the labour market gradually relaxing, the Czech economy does not seem in need of any monetary policy adjustment at this point.

The outlook is also decent, with our expected real growth of 2.7% for each of the two years ahead and headline inflation below the target for most of next year. In such a setup, we don't expect the rate-setters to rush into change anytime soon, keeping the base rate on hold at 3.5% on 18 December.

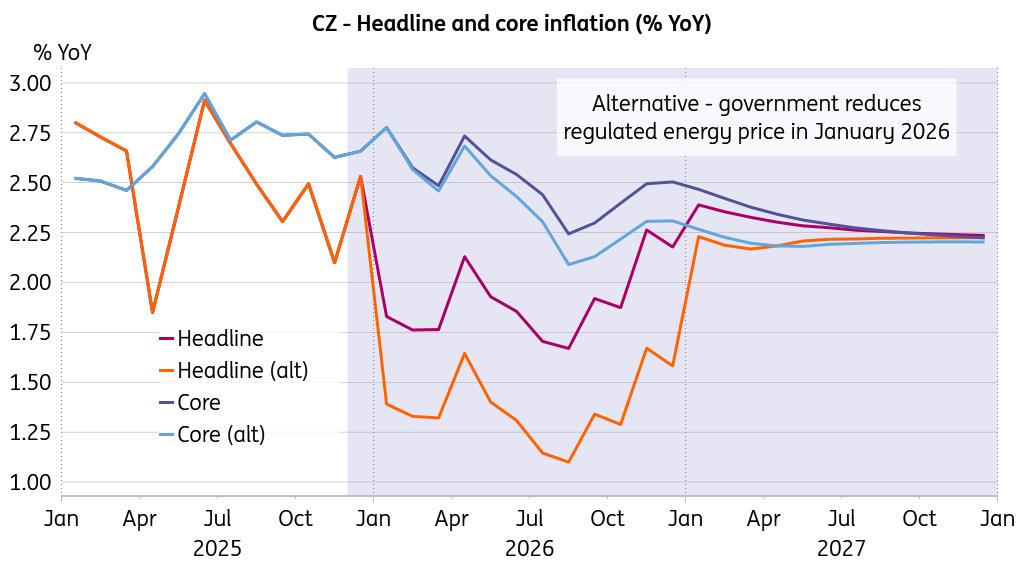

Headline and core inflation about to take different path

Source: CNB, ING, Macrobond

Compared to the latest ING prediction, the CNB forecast assumes weaker economic performance for this and the upcoming year. This is partially on account of a positive GDP surprise in the third quarter, contrasting with subdued CNB anticipation.

At the same time, the CNB's 2026 inflation forecast is above the current ING take, mainly as we have taken on board the relatively recent announcements of energy distributors to lower end prices of electricity and natural gas.

Some of this move was already visible in November's CPI data, while more is likely to come in January. While we will not be served a new economic outlook from CNB this time, we assume its next forecast will paint a stronger 2026 economic growth, along with softer headline inflation throughout the year.

Core rate to drive decisionsThe thing is that two opposing forces will drive the core rate: lower energy prices will trickle down through the economy and will dampen core inflation via secondary effects, while household budgets will be relaxed via lower energy bills, potentially supporting discretionary spending and core inflation. We will have to see which of the forces will take the upper hand. If we were to take a side on which force will dominate, then we would appeal to the output gap turning positive in the second quarter of the year, making the whole conditions more pro-inflationary.

So, if consumers continue to do what they do best, why would vendors not boost their margins? In the words of Oscar Wilde: 'I can resist everything except temptation.' So, core inflation is set to hover around 2.5% over the coming year in our base case scenario, supported by extra discretionary spending and keeping the CNB on hold despite headline inflation marginally below the target. In any case, policymakers will decide in a challenging environment with headline inflation below the target but core inflation likely remaining somewhat elevated.

Government measures could bring inflation to fresh lows

Source: CNB, ING, Macrobond

We work with an alternative scenario in which headline inflation slows even more, should the government proceed with the proposed reduction of the regulated part of energy prices in January. We quantify the direct potential negative impact on headline inflation at between 0.3ppt and 0.4ppt, depending on whether the measure would affect electricity only or natural gas as well.

However, the whole story might differ when it comes to the envisaged government's reduction of the regulated part of energy prices, as this would most likely bring down producer costs as well. A positive supply shock normally implies higher output at lower prices. In such a case, the overall effects on core inflation might turn rather negative indeed.

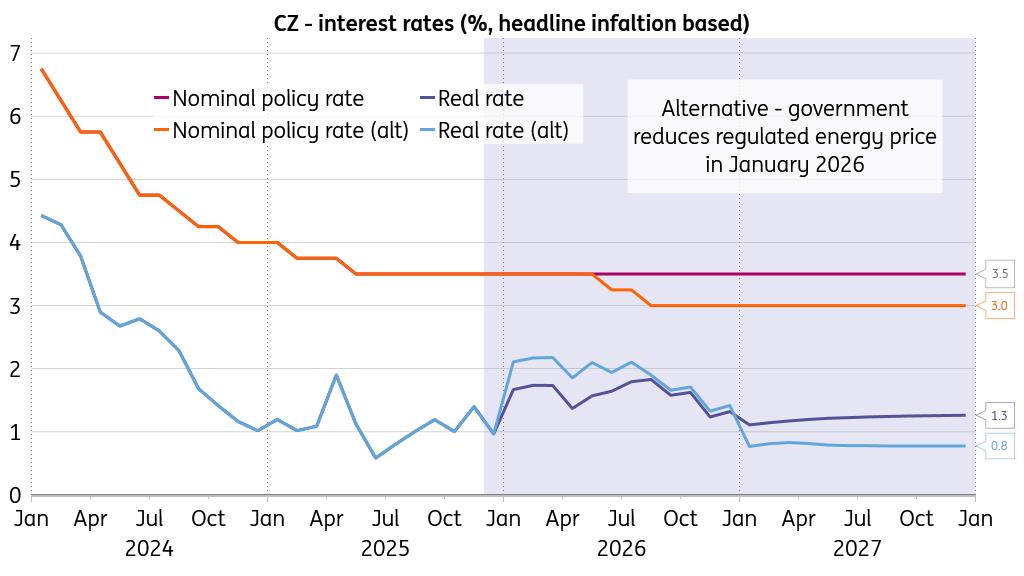

Ample real interest rate to be tamed by lower base rate

Source: CNB, ING, Macrobond

Should core inflation ease decisively below 2.5% over the coming year, insisting on an unchanged rate of 3.5% would become too restrictive, especially given that the real interest rate would crawl up to 2% when measured against headline inflation. So, our alternative scenario opens a window for monetary policy easing around mid-year, supported by headline inflation well below the target and decelerating core inflation.

Our market viewThe Czech koruna has had a great year and we remain bullish for 2026. However, momentum is running out and we cannot expect the same performance as this year. Moreover, the market is rather on the hawkish side at the moment, which, in our opinion, means it is only a matter of time before the market adjusts expectations in line with headline inflation below the CNB target next year.

On the other hand, the performance of the economy and the current account is supportive for the CZK. However, EUR/CZK is the most dependent currency on the interest rate differential within the CEE peers and if our assumption is that the discussion about rate hikes is off the table due to lower energy prices pushing inflation down, the CZK will lose the main engine of this year's gains. Even so, EUR/CZK should gradually grind towards the 24.00 mark.

The rates market has stabilised after a significant sell-off in recent weeks at a price of around 20bp rate hike in the one-year horizon and the long-end remains elevated. The new government indicates that it will keep the public finance deficit“safely” below 3% of GDP and inflation next year may very likely be below the CNB's target. Although core inflation and faster wage growth will prevent the central bank from cutting rates, the chance of additional rate cuts has increased significantly in recent weeks. Together with the resolution of concerns about a deterioration in fiscal policy with the change of government, we expect the entire IRS and bond curve to be lower. At the same time, we see some potential for some minor steepening, but less than elsewhere in the region.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment