21Shares Updates Dogecoin ETF Filing As DOGE Extends Daily Rally

- New filing sets a 0.50% DOGE-paid fee and updates custodians to BNY Mellon, Anchorage, BitGo

- Dogecoin jumps 8.79% as trading volume surges nearly 46%, signaling stronger market demand

21Shares has submitted new revisions to its spot Dogecoin exchange-traded fund, marking one of the final procedural steps before the product enters the U.S. market. The latest amendment, filed with the U.S. Securities and Exchange Commission, outlines the fund's fee structure, operational roles, and custodial arrangements, while confirming additional administrative details that position the ETF for launch.

21Shares Discloses Fee Structure and Custodian Changes

The updated filing amounts to the fifth amendment to the issuer's S-1. According to the document, the Dogecoin (CRYPTO: $DOGE) fund will incur a 0.50% management fee, which will accrue daily and be paid in Dogecoin on a weekly basis. The filing also shows that the issuer has not introduced any fee waiver at this stage, though such adjustments could be announced later. A delaying amendment remains in place, and the ETF will become effective upon submission of an 8(a) application.

The amendment also replaces earlier custodian information. The Bank of New York Mellon is listed as the administrator, cash custodian, and transfer agent, while Anchorage Digital Bank and BitGo will serve as additional custodians for the trust. Previous disclosures identified Coinbase Custody Trust Company as the custodian and 21Shares US LLC as the seed capital investor. The trust intends to use $1.5 million in seed capital to acquire Dogecoin before the product begins trading.

Additional service providers named in the filing include Wilmington Trust NA as trustee, Foreside Global Services as marketing agent, and Cohen & Company for accounting oversight. The ETF will trade on Nasdaq under the ticker TDOG and track the CF Dogecoin-Dollar U.S. Settlement Price Index.

Dogecoin Advances as Market Activity Strengthens

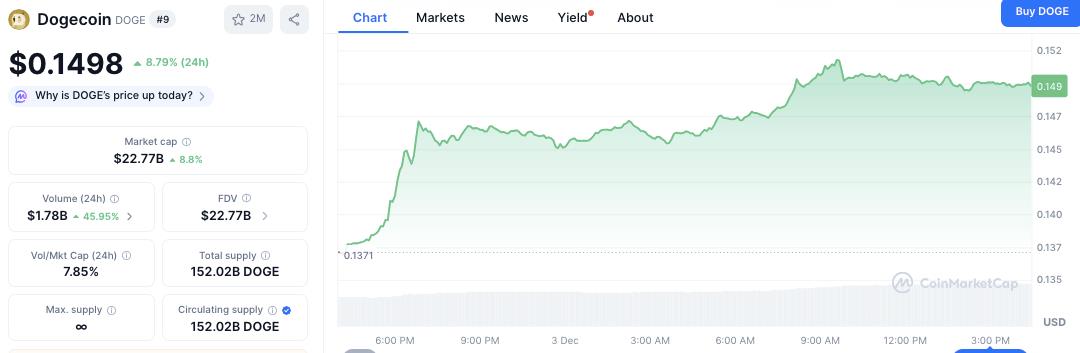

Dogecoin's market performance strengthened over the past 24 hours, rising by 8.79% to $0.1498, with its market capitalization increasing to $22.77 billion. The token moved higher from the $0.137 range late yesterday, breaking above $0.147 before stabilizing near $0.149 in early U.S. trading.

Source: CoinMarketCap

Trading conditions reflect heightened activity. DOGE's 24-hour volume climbed by 45.95% to $1.78 billion, while its volume-to-market cap ratio reached 7.85%. The circulating supply stands at 152.02 billion DOGE.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment