Recent Strength Has Prompted Us To Raise Our Turkish GDP Forecast For 2025

In the third quarter of 2025, GDP grew by 3.7% year-over-year – below the market consensus of 4.2%, but close to our forecast of 3.8%. This marks a deceleration compared to the previous quarter, which was 4.9% YoY after a revision by the TurkStat, along with the first quarter figure.

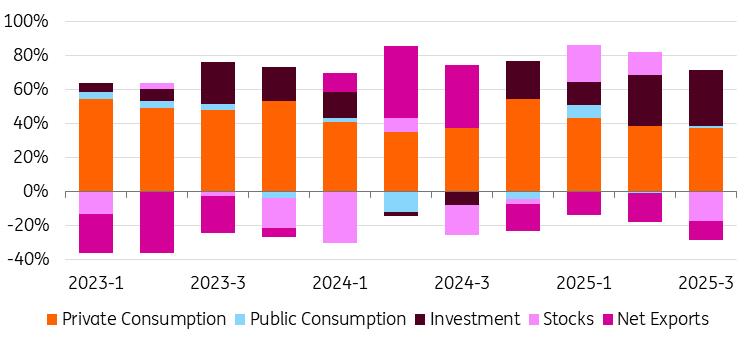

Growth was primarily driven by private consumption and investment activity, while external demand and stock depletion contributed to a reduction in the headline figure. As a result, GDP growth for the first nine months of the year stood at 3.7%.

GDP growth (%, YoY)

Source: TurkStat, ING

After seasonal adjustments, third-quarter GDP corresponds to a quarter-on-quarter growth rate of 1.1%, showing a slowdown in comparison to the previous quarter, which was at 1.6% – the highest quarterly increase of the past two years. However, the pace of slowdown is not as strong as expected, implying persistently strong quarter-to-quarter momentum.

The strong sequential performance stems from private consumption shifting back into a positive contribution (a 1.4ppt impact on the headline reading), further strengthening in investments (1.1ppt) and a positive contribution from net exports (1.6ppt), while stock depletion partially reduced the growth (-3.1ppt).

When we look at the breakdown of expenditures on a year-on-year basis:

-

Private consumption rose by 4.8% YoY, contributing 3.2ppt to headline GDP. This reflects an acceleration from the previous quarter, likely supported by the Central Bank of Turkey's ongoing rate-cutting cycle.

Investments grew by 11.7% YoY, adding 2.8ppt to GDP. This was largely driven by a continued surge in construction investments, which reached 13.3% YoY and a continuing recovery in machinery and equipment investments with an 11.3% YoY increase.

Public consumption rose by 0.8% YoY, adding 0.1ppt from GDP. This modest impact signals intensified efforts to rein in fiscal spending.

Inventory depletion shaved 1.5ppt from growth.

Net exports dragged GDP down by 1.0ppt, continuing the negative trend from the previous two quarters due to rising imports and weakness in exports.

Source: TurkStat, ING

In the sectoral breakdown, the services sector was the largest contributor, adding 1.5ppt to GDP. The industrial sector followed with a 1.1ppt contribution, while agriculture dragged the headline by 1.3ppt, the biggest negative quarterly figure in the current GDP series.

Overall, despite the headline weakness in the third quarter, the seasonally adjusted quarterly pace has remained strong, defying previous expectations of a significant slowdown in momentum. This suggests upside risks to the growth outlook, especially amid ongoing monetary easing.

Leading indicators, including PMI, capacity utilisation, consumer and real sector confidence indices that point to an acceleration in GDP growth in the last quarter also support this view.

Accordingly, we have raised our full-year GDP growth forecast for 2025 to 3.8%, up from the previous estimate of 3.4%. The growth outlook and still-elevated inflation will likely lead the central bank to keep rate cuts measured, with another 100bp in the upcoming MPC meeting.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment