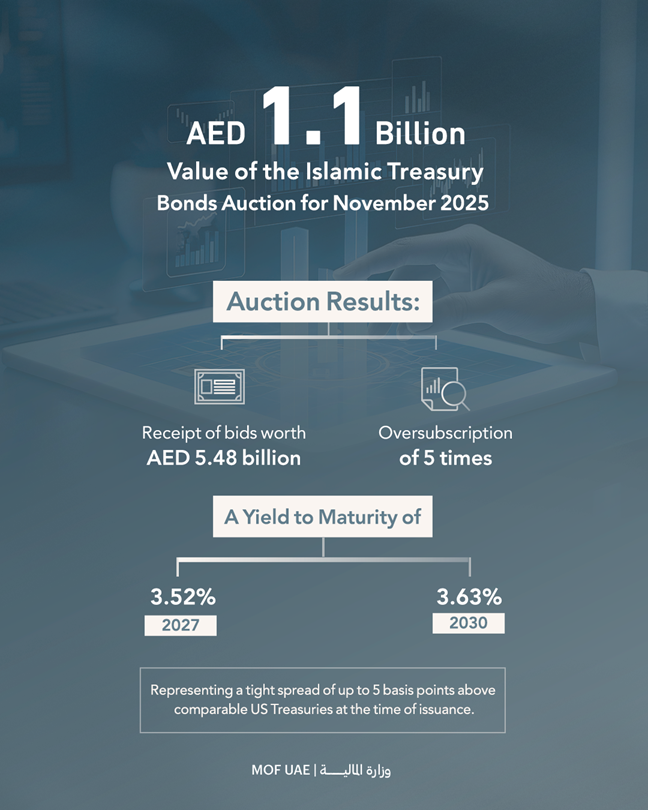

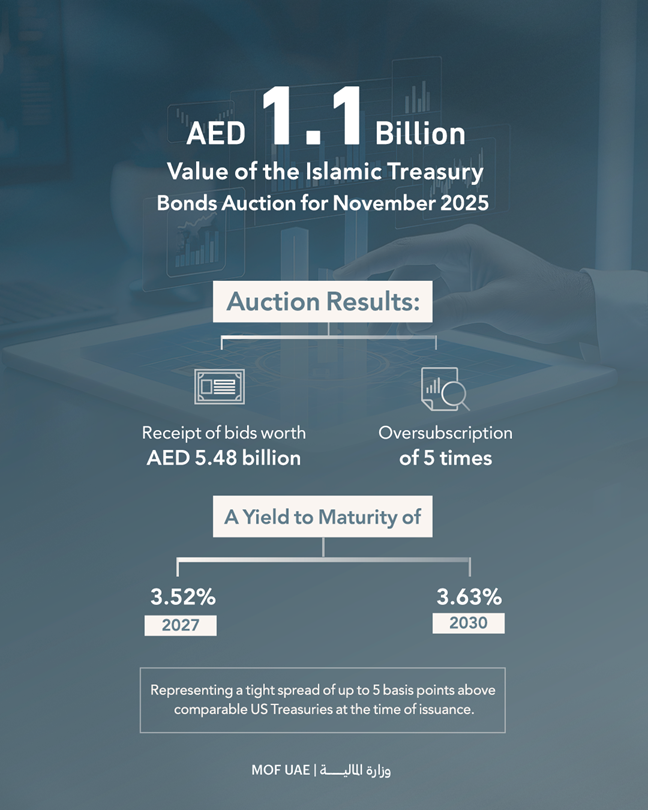

Sovereign Sukuk Auction Closes 2025 With AED 1.1 Billion Issue

The Ministry of Finance, acting as issuer alongside Central Bank of the UAE as the issuing and payment agent, has completed the November 2025 auction of dirham-denominated Islamic Treasury Sukuk with a total issuance of AED 1.1 billion. This marks the final scheduled T-Sukuk auction under the 2025 issuance programme.

Demand outpaced supply sharply: bids submitted for the auction totalled AED 5.48 billion, implying an oversubscription of roughly five times. Yields to maturity were set at 3.52% for the tranche maturing in October 2027 and 3.63% for the tranche maturing in May 2030. This yield spread was reported to lie just a few basis points above comparable US Treasury yields.

The auction drew participation from the eight primary dealers, who subscribed across both the 2027 and 2030 tranches. The size and quality of demand are viewed as reaffirmation of investor confidence in the UAE's sovereign credit profile and its Islamic finance framework. Observers point out that the tight yield spread underscores strong appetite for Sharia-compliant, dirham-denominated debt from both regional and international investors.

The T-Sukuk are listed under the UAE Treasury Islamic Sukuk Programme on Nasdaq Dubai, offering investors enhanced access and liquidity in the secondary market. The broader programme has been instrumental in shaping the dirham-denominated yield curve, strengthening the domestic debt capital market, and deepening the reach of fixed-income investment options denominated in local currency.

Over 2025, the MoF carried out nine auctions under the T-Sukuk issuance programme, culminating in a total of AED 9.9 billion in issuance volume. The strong oversubscription rates observed across the year reflect sustained investor confidence and growing recognition of the stability and appeal of UAE sovereign Sukuk.

See also Crescent Enterprises Unveils AED 1 Billion Investment PlanNotice an issue? Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don't hesitate to contact our editorial team at editor[at]thearabianpost[dot]com. We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment