Bank Of Japan Rate Hike Case Backed By Strong Exports And Elevated Inflation

| 3.0% |

Consumer price inflation

%YoY |

| As expected |

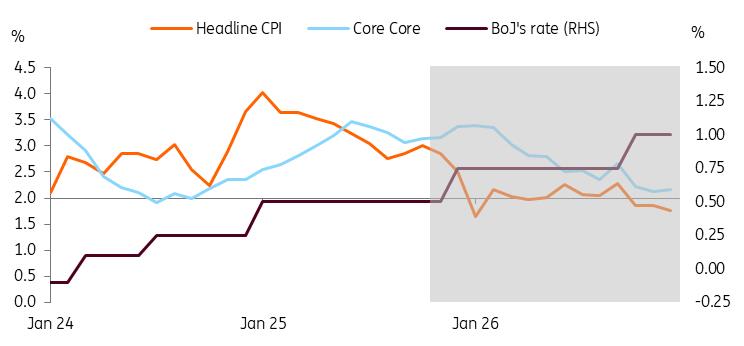

Both headline and core inflation Japanese rose to 3.0% year-on-year in October (vs 2.9% in September, 3.0% market consensus). Food prices rose the most, 6.4%, while entertainment and transportation/communication also rose solidly by 2.6% and 3.6%, respectively. Utilities continued to rise as the government subsidy program ended.

On a monthly basis, inflation rose by 0.4% month-on-month, seasonally adjusted, driven by goods and services rising 0.3% and 0.4% each. Typically, companies adjust final prices in October, and they are clearly passing increased input costs on to consumers. This development is likely welcomed by the BoJ, which seeks a virtuous cycle between solid wage growth and sustained inflation.

Above 2% inflation is likely to support the BoJ's rate hike

Source: CEIC, ING estimates

| 3.6% |

Exports

%YoY |

| Higher than expected |

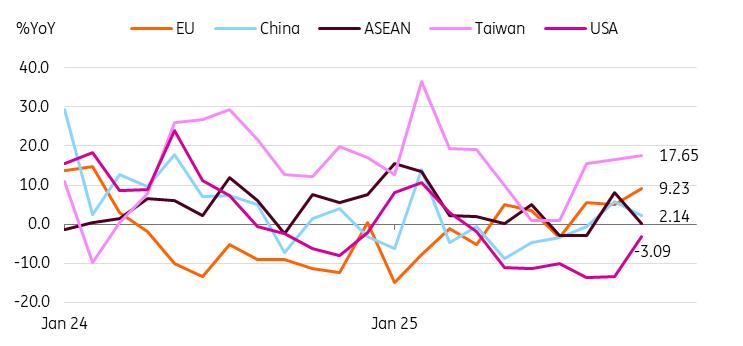

Exports rose 3.6% YoY in October (vs 4.2% in September, 1.1% market consensus). Although Japan reached a trade deal with the US, exports to the US were still down 3.1%. However, the contraction has moderated compared to the previous quarter. The most notable drop came from car exports (-7.1%) and iron and steel (-14.5%).

Exports to other regions rose, more than offsetting weak US exports. Exports to the EU were up sharply by 9.2% with transport equipment up 5.7% and machinery up 18.5%. Exports to China and Asia increased by 2.1% and 4.2%, driven by strong demand for electrical machinery (including semiconductors). We believe that solid global semiconductor demand and AI investment support intra-regional trade.

Exports to the US remained sluggish but exports to other regions gained

Source: CEIC

| 52 | Flash PMI Composite |

The composite purchasing managers' index (PMI) increased to 52 from 51.5. Most gains were in manufacturing (up to 48.8 from 48.2), while services remained at 53.1. Easing global trade tensions may have helped boost the manufacturing PMI, but it is still below 50, indicating ongoing caution among companies.

BoJ watchInflation remains elevated, and stronger signals of economic recovery in the current quarter should keep the BoJ's rate hike in the near future. Although we believe that recent data supports a rate hike as early as December, government pressure for accommodative monetary policy could postpone it until next year. Additionally, markets appear to favour a January hike.

We anticipate that more board members will support a rate hike in December, with at least three board members likely to vote in favor. This would mark an increase from the two who supported hikes in the previous two meetings. However, it remains unclear whether the rest of the board will agree.

If the Japanese yen remains weak and forthcoming data confirm both economic recovery and increasing inflation, we think the BoJ will act, basing its decision on data and maintaining independence from political influence.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment