This Tampa Man Nearly Lost $15K In A Sophisticated 'Cash Bag' Scam - Until 1 Dead Giveaway Stopped Him Cold. Learn How To Spot This Fraud Yourself

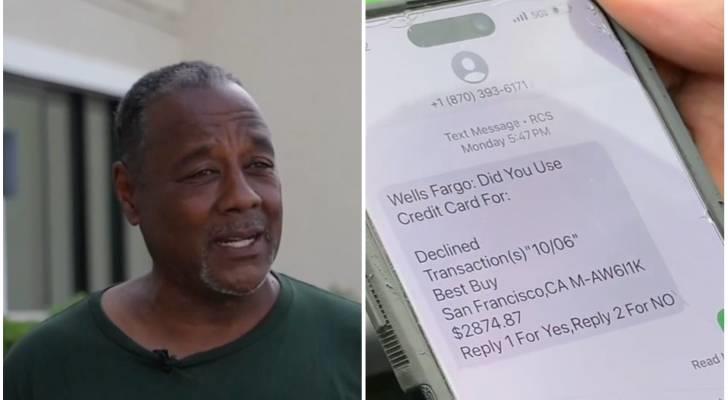

Impostors posing as Wells Fargo reps over the phone were so convincing that Tampa resident Moses Harmon almost fell for their scam, ready to withdraw $15,000 and hand it over.

In fact Harmon, who runs a landscaping business, had reached the point that he was standing in front of a teller at his local Wells Fargo branch.

But as he shared with Tampa Bay 28's investigative team, something didn't feel right.

Must Read-

Thanks to Jeff Bezos, you can now become a landlord for as little as $100 - and no, you don't have to deal with tenants or fix freezers. Here's how

Robert Kiyosaki says this 1 asset will surge 400% in a year - and he begs investors not to miss its 'explosion'

Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake - here's what it is and 3 simple steps to fix it ASAP

The scammers he'd been speaking with on the phone told him to keep his phone turned on so they could hear what he said when he was inside the bank. (1)

Harmon did as he was told, but when the teller passed him a withdrawal slip, he did something the scammers couldn't hear. He turned the slip over and wrote:“I think I'm being scammed.”

The teller called for the bank manager, who instructed Harmon to turn off his phone immediately.

Harmon had a narrow escape and empathizes with anyone who gets taken in. That's why he's sharing his story.

“I just think we need to be sharing information because there's so much crazy stuff going on right now,” he said.

Here's how he got hooked in the first place and how to protect yourself from cash bag scams.

How the 'cash bag scam' worksIt starts with a text or notification, typically asking you to confirm or deny an unusual charge to your bank account. In Harmon's case, the con artists sent a text asking if he had made a $2,800 charge at Best Buy. That's the bait.

If you reply (whether your reply is 'yes' or 'no'), they've already hooked you.

Trending: Approaching retirement with no savings? Don't panic, you're not alone. Here are 6 easy ways you can catch up (and fast)

They follow up with a phone call, claiming to be a bank rep - as they did in Harmon's case. To reinforce their cover story, they read you a list of your actual financial transactions.

How do they know? Scammers can use your SIN number (acquired on the Dark Web) and hack into phone-based bank systems to pull a list of your transactions, as they did with Harmon.

“Never before has a scammer been able to tell me exactly what my banking history was,” Harmon said.

This adds a sense of legitimacy to the criminals' storyline.

“I was 100% sure it was them,” Harmon said.

Once scammers gain a target's trust, they create a false sense of urgency and fear.

They will tell a victim that their bank account is compromised and the bank needs their help to protect it.

Sadly, the“protection” is actually where victims endanger their savings, as they are told to withdraw thousands of their hard-earned dollars in cash and hand it over to scammers or send it to fraudsters via prepaid cards or a cryptocurrency. After the money is sent out, recovery is unlikely.

Falling for such a con job is more common than you might think. Roger Grimes, who works for the cybersecurity company KnowBe4, said his own bank manager recently informed him that their branch bank stopped two to three scams a day.

Florida Bankers Association president Kathy Kraninger told Tampa Bay 28 that banks are doing all they can to teach customers and staff how to recognize increasingly sophisticated scams nationwide.

As of July 2025, 73% of U.S. adults had experienced some kind of online scam or attack, according to the Pew Research Center. (2)

“This is organized crime now,” Kraninger said.“This is not individual, one-off scammers.”

It's a multi-billion dollar criminal enterprise.

In 2024, Americans lost $12.5 billion to fraud, a 25% increase over 2023, according to the Federal Trade Commission (FTC ).

How to protect yourself from this common scamDon't share any financial details with people you don't know.

If you receive a text about a fraudulent or questionable charge, don't respond to the text directly - even if the number looks legitimate, it can be spoofed so that it looks real.

Confirm the facts by calling your bank directly, using the number on the back of your debit or credit card or the contact number listed on your bank's official website.

The Federal Deposit Insurance Corporation (FDIC) advises being on guard if anyone asks you to withdraw or transfer money, particularly via a text, email or online notification. If they ask you to buy cryptocurrency or gift cards, that's a big red flag.

If you feel rushed to perform an unexpected financial action, share your concerns with someone you trust or a bank manager. Depending on the situation, a second set of eyes might help you avoid a scam - as the bank teller and bank manager helped Harmon.

Whether or not you actually fall victim to the scam, it's good to report it to your bank and FTC so they can investigate, build a case against the scammer and educate the public on the latest scams out there.

And trust your gut, like Harmon did, as he contemplated the reality of handing $15,000 over to a stranger.

“It was too hard to get the money in there to just walk in there and get it and bring it out and give it to somebody,” he said.

Article sourcesWe rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

Tampa Bay 28 (1 ); Pew Research Center (2 )

What to read next-

Here's why wealthy investors are pouring millions into this 1 US asset class - and how to quickly copy the move while there's still time

Warren Buffett used 8 solid, repeatable money rules to turn $9,800 into a $150B fortune. Start using them today to get rich (and stay rich)

Dave Ramsey says this 7-step plan 'works every single time' to kill debt, get rich - and 'anyone' can do it

22 US states are already in a recession - protect your savings with these 10 essential money moves ASAP

Join 200,000+ readers and get Moneywise's best stories and exclusive interviews first - clear insights curated and delivered weekly. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment